A wedding is one of the most significant events in a person’s lifetime. It brings changes, anticipations, and concerns about the interwoven future. Finances are an important part of this future. It is important to pay attention to managing finances so that the new journey you have embarked on together is fulfilling. This Article is taking you through Financial Planning for Newly Married Couples in an easy way.

Must Read- Financial Planning For NRI

What Needs to be Consider Financial Planning for Newly-Wed NRI Couples

It is highly recommended that both partners engage in financial planning and review their plans regularly. A qualified financial adviser can provide invaluable assistance when discussing one’s financial outlook, objectives, and strategies to reach them.

An adviser can assist you in reconciling conflicting approaches so that you can accomplish your individual objectives without compromising on shared long-term objectives such as children’s education or retirement. Let us look at our tips for the Top 7 Financial Planning for Newly Married Couples.

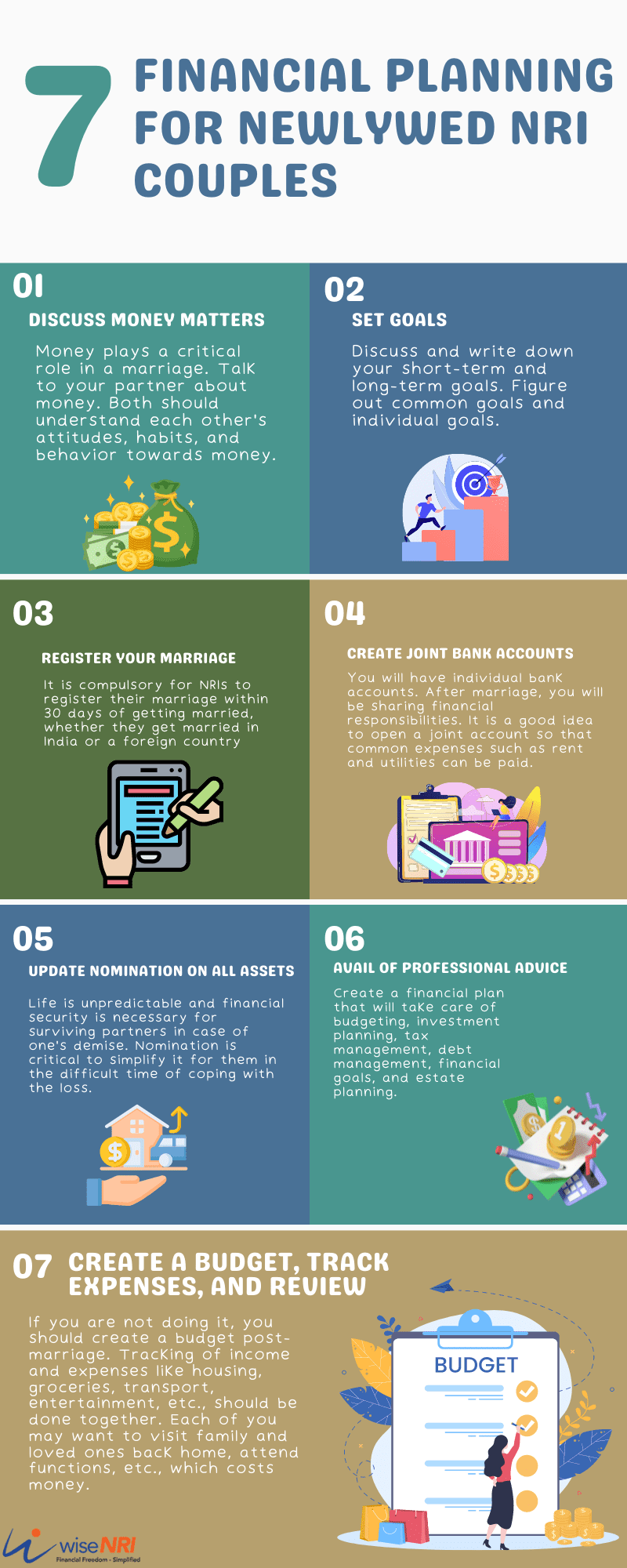

1. Discuss Money Matters

Money plays a critical role in a marriage. Talk to your partner about money. Both should understand each other’s attitudes, habits, and behavior towards money. You should be aware of each other’s current financial situation, which means savings, spending, assets, and liabilities. You should also discuss the way forward to manage finances as a couple. For example, talk about how you will spend your money as a couple. How will you manage if your approaches to money are different? Supporting financial dependents is also a point on which you will have to agree. It is best, to be honest, and transparent in these initial discussions to plan your finances appropriately

Must Check- 9 Benefits of Early Financial Planning for NRIs

2. Set Goals

Every person has their own money goals. Some might want to own a dream house, and others may wish to have a holiday abroad every year. As NRIs, you might have some plans regarding where you want to live in the future. Discuss and write down your short-term and long-term goals. Figure out common goals and individual goals. They must be included in your financial plan so that both can work towards achieving them. You should also review the goals periodically together.

3. Register your Marriage

It is compulsory for NRIs to register their marriage within 30 days of getting married, whether they get married in India or a foreign country. Non-registration could result in the passport authority seizing the passport of the NRI individuals and also summoning them for legal proceedings.

4. Create a Budget, Track Expenses, and Review

If you are not doing it, you should create a budget post-marriage. Tracking of income and expenses like housing, groceries, transport, entertainment, etc., should be done together. Each of you may want to visit family and loved ones back home, attend functions, etc., which costs money. Without planning, these visits can throw your finances in disarray. You can then discuss openly and figure out and analyze each one’s money habits so that you can be in sync on money matters. Budgeting can be done on paper, a spreadsheet, or budgeting software.

5. Create joint Bank Accounts

You will have individual bank accounts. After marriage, you will be sharing financial responsibilities. It is a good idea to open a joint account so that common expenses such as rent and utilities can be paid. It can be an account to save money for mutual goals. It can also be used to park emergency funds. If both partners are from the same country and continue to live there post-marriage, they will have individual bank accounts. If one of the partners is going abroad post-marriage, then the person needs to have access to money, and a joint account can help here. When both partners are working, both can contribute a portion of their income to the account. A joint bank account provides transparency on finances and builds trust, and the couple can grow to become a financially strong team.

Must Check – 6 Financial Resolutions for NRI

6. Update Nomination on all Assets

Life is unpredictable and financial security is necessary for surviving partners in case of one’s demise. Nomination is critical to simplify it for them in the difficult time of coping with the loss. Updating nomination details on all financial assets – bank accounts, Demat accounts, FDs, insurance, and other investments is imperative, and it should be done for assets in India and abroad. Else, the process of transferring assets to their name and settling claims can be long-drawn and arduous, which may be even more overwhelming in the already emotionally painful situation.

7. Avail of Professional Advice

Create a financial plan that will take care of budgeting, investment planning, tax management, debt management, financial goals, and estate planning. You can take the help of a professional financial planner who can provide an unbiased view and advise on all financial matters such that the attitude, risk profile, and financial situation of both are considered. As NRIs, you might have assets and liabilities in multiple countries. Financial planning requires relevant knowledge and skills, and you will have to take time out of your busy schedules. Moreover, as NRIs, you will need updated information regarding investments, taxation, and other financial matters in multiple countries. It may be challenging. Therefore, the advice of a professional who understands India and foreign markets will be valuable.

Money plays a significant role in a happy and healthy marriage. Financial Planning for Newly-Wed NRI Couples is essential if they are not want to avoid any money problems.