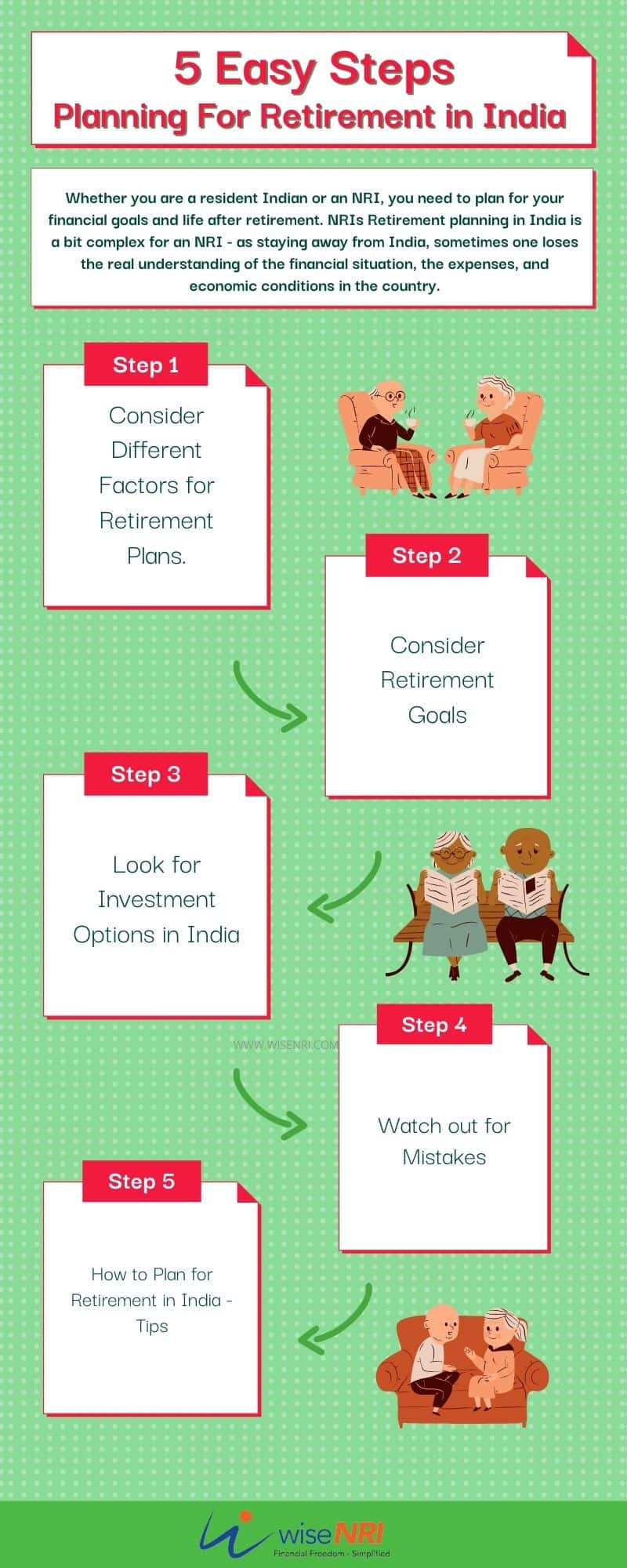

Whether you are a resident Indian or an NRI, you need to plan for your financial goals and life after retirement. NRIs Retirement planning in India is a bit complex for an NRI – as staying away from India, sometimes one loses the real understanding of the financial situation, the expenses, and economic conditions in the country.

Check – NRI retire early using the FIRE Method

Retirement Planning in India

Here are some steps that NRIs can take to achieve retirement goals easily –

1) Consider different factors for retirement plans

NRIs answering the questions – When, Where, and How will make a phase smoothly into retirement.

When are you going to retire?

Some NRIs take up a job or assignment for a few years and not necessarily until retirement age. Others may have made enough money and consider retiring early.

NRIs have to decide their plans after retirement regarding their return to India and their family’s return to India.

If you are an NRI and your children are studying in the US or UK, you might want to save more for their education as compared to education expenses in India.

Check – Mr. NRI – How Much Retirement Corpus Is Enough

Where are you going to live post-retirement?

An NRI may want to live in a metropolis such as Mumbai or Bangalore or live in a Tier II city or may want to retire in his village. Depending on the choice, the amount for retirement varies. The cost of living in Mumbai is higher compared to a village. But the medical amenities and other modern comforts may be easily accessible as compared to a village.

How are you going to spend time post-retirement?

If you plan to do some part-time work after retirement or engage in social building activities, you might want to live in a particular place. Some may want to stay with old-age parents to take care of them.

“Finalize your plans before retirement and then decide the place to retire in.” wiseNRI

NRIs have to plan their retirement considering these factors so that finances can be planned accordingly.

Must Read- What should (budding) NRIs do with their Indian EPF accounts?

2) Consider Retirement Goals

What are your retirement goals?

Do you want to live a life of luxury in a palatial house with servants at your beck and call?

Do you want to live a simple life spending your time reading and doing yoga?

As an NRI, it will be easy to achieve retirement goals if you have planned for them. Depending on the goals, you can save and invest in a variety of instruments to get the necessary returns and build wealth.

Check – Should NRIs Retire In Dubai

3) Look for Investment Options in India

There are many investment options for NRIs in India. An NRI can check out the various investment alternatives and select the best ones as per investment requirements. NRIs can invest in –

Mutual Funds – NRIs from all countries except the US and Canada can invest in equity funds, balanced funds, debt funds, liquid funds, and MIPs. NRIs from U.S and Canada can invest in selected Mutual Fund Schemes.

Equity – An NRI can invest in direct equity through a Demat account which is linked to the NRE account or NRO account

NRIs who do not want research or to take risk of investing in direct equities should use the MF route. They are managed by professional fund managers.

In retirement planning India, one thing people must consider is that retirement savings in financial assets are very important – in the long term equity is a good asset class but we should be prepared for volatility.

Fixed Deposits – NRIs can invest in fixed deposits in NRE and FCNR accounts to get tax-free interest.

NPS – The government has allowed NRIs to invest in National Pension Scheme (NPS).

Real Estate – NRIs can invest in Residential and Commercial properties but not in farms, agricultural land, and plantations. As an NRI, one should be watchful while investing in real estate as it is not easy to be away and be involved in maintenance and management matters. You can give power of attorney to someone you trust to manage matters.

When I talk to NRIs few of them feel they don’t have to do Retirement Planning in India as they have the property that can generate rent. I think this is one of the biggest misconceptions of personal finance – rents will not beat the inflation rate.

NRIs can invest in different asset classes to get returns. NRIs can work with a financial planner to make things smooth and transparent.

Must Read- NRI Save For Early Retirement

4) Watch out for mistakes

- Saving and Investing late in life – Some NRIs wait for the annual bonus or a target amount to start investing! Do not wait to get a big bank balance and then invest. Keep saving and investing at every opportunity you get. The more you save and invest, the more your wealth becomes. The earlier you save and invest, the longer and harder your money works.

- Forget to Factor in Inflation – You have to consider the inflation rate of the place you will be staying after retirement while planning your finances. Inflation rates and the way they move vary from country to country and you have to plan as per the inflation movements in the country you want to retire in.

- Improper assessment of Investment Risk – India still has a lot of scope for economic growth. The stock markets are doing very well. But NRIs who are smart will understand currency risk, growth risks, and risk of the impact of global factors on the Indian economy. It is important to build a diversified portfolio to protect yourself from risks.

Must Check – Importance of pension plan for NRIs

5) How to Planning for Retirement India – Tips

- Estimate the retirement budget as accurately as possible. You think you will spend less compared to your expenses now. But that may not be the case. There are many expenses that you will undertake as a retired person which you may not incur now so do not underestimate the amount of retirement kitty you need.

- Keep your documentation updated. Know Your Customer (KYC), bank account, and Portfolio Investment Scheme (PIS) account, along with Demat and trading accounts are required for hassle-free investing.

- Do not depend overtly on the bank where all your accounts are present. You can talk to a wealth management firm or financial planner to understand investment opportunities and have an unbiased view.

Whether you are an NRI or a Resident Indian resident, Financial Planning is Important.

“NRIs have to pay attention to factors such as currency movements, legal aspects of investing in India and abroad, taxation matters in India and country of residence to have a smooth transition to retirement and achieve retirement goals.”

Please share how NRIs planning for retirement in India. If you have any questions feel free to add them in the comment section.

If I live about 9 months in India do I have to file tax returns in India or my home country filing (Canada) is good enough?

Can an NRI open a new saving account in India if he already has an NRI acct ?

Very useful content….pls keep sharing…

Thanks Satish Ji

I have an EPF which is not having any Credit for last 5 years and it may be in dormant status. I would like to withdraw it and need some assitance

what are process / steps to become NRE to PNOR to maintain the NRE FDS status quo

i have become an RNOR three weeks ago. i have NRE FDs. 1.can i continue to hold them – for how long. 2. is the interest on thesse from date of RNOR taxable?

Hi Sangameswar . Can you write me the process / steps to become RNOR ?

I retired in Nov’2020. I might move abroad permanently this year, unless I don’t get a visa. I am 54 years old. The interest is good, should I try and get the interest or should I withdraw and close the account. Can I start the withdrawal process after I get the visa, since it is said that it takes 2 weeks to get the amout transferred?

Taxation in USA for Indian recently moved from India

can an nri kyc be done online

Hi Rohan,

Check this https://www.wisenri.com/nri-kyc-for-mutual-fund/

I am regular reader of your articles. It is very informative and useful. I am doing my financial planning personally but I am not very much satisfied. I think that financial planning by professionals are better but may not be cost effective.

Thanks Dr Anil for appreciating our effort.

Don’t you think the same cost applies to any other profession – be it architect to doctor? It’s important to see cost Vs Value.

Very informative

Thanks Radhika

Great article, specially understanding RNOR status. Shall get back to you later for retirement planning.

Thanks for appreciating 🙂

Hi Dipankar,

In my suggestion, you need to keep balance allocation of equity and debt and reallocate it when reaches retirement. You must consult your financial planner regarding this.

I am an NRI from Middle East. I am already 51 . What is the best investment ( low risk and guaranteed ) instruments and how much needs to be invested to get 1 lakh per month as return after 9 years ? I have my own house at Vadodara after retirement. Thanks

Dear Hemant,

Thank you so much for your highly balanced article on NRI retirement and investment. I truly appreciate you / wisenri for the efforts to bring in quality information when in need. I am a NRI living in Middle East, never planned finance properly, now decided to return to India. With my family of 5, I believe I need at least 50k per month to manage, apart from other medical, education expenses. Any specific govt bonds where i can invest or any other suggestions ? It would be nice if there is an app or calculator to find out best way to generate this monthly income and lead a peaceful life. I am not going to work anymore. Just FYI, Thanks.

It is highly suggested to consult a financial planner regarding your retirement planning.

Can NRI with OCI card open pension account/pension policy in India .aged 59 and 60

Hi kuldeep,

Yes you are eligible to open an account in National Pension Scheme(NPS). Account opening age is 18 to 65yrs

Thanks . Can you mention relevant link / details for NPS

Dear Kuldeep,

I will soon write a post on that.

I am 44. Currently I don’t have any job but will surely get into it. How much should I have to invest to get 50000 rs per month (in my retirement) in next 7 yrs ..

You must contact financial planner regarding your retirement plan.

You can add one useful section, with links for details on:

RETIREENT HOUSING PLANS. SOCITIES, ETC. May collaborate with some NGO or real estate association (NOT individual company, though!)

Dear Seetharama,

It’s a good idea – will explore.

1. Thank you for your invitational statement:

Please share how you are planning for retirement in India. If you have any questions feel free to add in the comment section”.

2. You may like to keep in mind a section of people who are now/or in near future will be NRIs (such as need to live with Children & grandchildren), BUT HAVE NOT YET DECIDED WHERE THEY WILL SETTLE FINALLY! This is the group that needs maximum advise, and planning (though dynamic!)

Regards

Dear Seetharama,

Can you share more details on the 2nd point?

Mutual Funds – NRIs from all countries except US and Canada can invest in equity funds, balanced funds, debt funds, liquid funds and MIPs. NRIs from U.S and Canada can invest in selected Mutual Fund Schemes.

Incomplete or misleading, so suggest> rewritten below:

NRIs from all most all countries can invest in equity funds, balanced funds, debt funds, liquid funds, MIPs and NPS. They need to be fully aware of tax rules in their country of residence. Refer to FATCA here….. NRIs are not allowed to contribute to PPF and certain saving schemes of GOI where interest rates are fixed by the govt (such as Sr. Citizen Saving Certificate, VVY, post office schemes, etc). NRIs cannot also take the benefit of ELSS, and many tax-saving provisions are also denied to them. (Produce a table somewhere else…) Only few Mutual fund houses entertain investments from NRIs based in USA and Canada; in many cases, they can only subscribe to selected schemes only when NRIs visit India (ICICI Pru, Motilal Oswal), and in fewer cases certain fund houses insist on paper applications whilst in India (Motilal). Generally investment in LLPs is not allowed. One needs to declare all Indian assets and income on yearly basis to resident country (such as the USA).

Dear Mr Seetharama,

I would like to thank you from bottom of my heart for your comments, suggestion & feedback in last few days.

I can clearly sense that you have good knowledge about NRI issues – your comments will definitely help other readers.

I am not making any change in the post right now as I will cover these points in future posts – but I have pinned this comment to the top so others can read this important information. 🙂

Thanks a lot for sharing.