Nilesh has spent three decades building a successful life with an accomplished tech career in San Francisco, financial security, a well-settled family, and a close circle of friends. He loved his work and had a good work-life balance, spending his weekends with people he loved and pursuing hobbies he enjoyed. By all measures, life was good.

Yet as he thought about retirement, his thoughts drifted back to his childhood days in Ahmedabad, India, his school friends and family back home. He yearned to spend more time with his parents and celebrate festivals with his extended family. The question, “Should I return to India after retirement or continue staying in San Francisco?” replayed in his mind constantly, but he was unable to decide.

Nilesh’s dilemma is shared by countless NRIs. Deciding where to retire is deeply personal, but we highlight the emotional, practical, and lifestyle factors of retiring in India that matter for planning your next chapter.

Why are NRIs Returning to India After Retirement?

Cost of Living: Retiring in India vs Abroad

The cost of living in India for NRIs retiring in India after living abroad is much lower than in other developed countries like the UK or Singapore. If you have a good financial corpus built over the years and invested your money efficiently, it can stretch further in many Indian cities and towns compared to many developed countries. By making the right choices, you can live a comfortable life whether you retire in India or abroad. For instance, based on some cost-of-living calculators available online, the cost of living in Singapore for a family can be anywhere from 3 to 7.5 times that of a tier 1 city in India, depending on the area of stay, schooling, and healthcare options. Similarly, the cost of living is 3 to 5 times more expensive in London compared to living in a tier 1 city in India, which is a major factor for NRIs considering returning to India after retirement.

Healthcare Options for NRIs Retiring in India

It is another important dimension to consider as one gets older. India offers far more accessible and affordable medical care compared to many Western countries. It’s easy to see a general physician, get blood tests done at home, or secure specialist appointments in India. For instance, it takes anywhere from one to four weeks to get a routine appointment under the National Health Service (NHS). The trade-off is that the quality and consistency of healthcare can vary across regions. Developed countries usually have more structured systems and predictable standards. In some cases, advanced treatment is more accessible in developed countries.

Lifestyle Comforts for NRIs Returning to India

Many returning NRIs appreciate the ease of having household support—cooks, drivers —and access to maintenance staff, such as plumbers and electricians. With advances in technology, many tasks can be accomplished in India with a few taps on a phone, unlike in many other countries.

Quality of Life: India vs Developed Countries

Countries like Singapore, the UK, and those in Europe usually offer better air quality, more open public spaces, better traffic management, and efficient public transportation, which improve the quality of life. As a developing country, there is work to be done in these matters in India, and it might take time to adjust to it if you have lived abroad. There are more opportunities to explore hobbies and take up sports abroad. That said, residential communities in India are rapidly evolving. The newer ones are designed with modern amenities, sports facilities, and green spaces that match the expectations of Indians who have lived abroad and are accustomed to such facilities.

Investment Opportunities After Returning to India

Your post-retirement comfort will also depend on where you invest and the returns you can expect. As an NRI, you can invest in most investment products in India. You can also invest in real estate, except for some restrictions (e.g. agricultural land). You also have the opportunity to invest in global markets, allowing you to build a diversified portfolio and tap into opportunities across geographies. As a resident Indian, you may have fewer opportunities to invest in global markets. But this is evolving.

With the launch of GIFT City, India’s first International Financial Services Centre (IFSC), investors can now access global markets from India, with fewer compliance requirements and potential tax advantages.

Starting a business is another consideration. While doing so abroad may depend on your residency status and local regulations, it might be easier to set up a business in India as a resident. However, it comes with its own learning curve. You will need to build local networks, understand regulatory frameworks, and navigate processes that can sometimes be less streamlined, requiring patience and persistence.

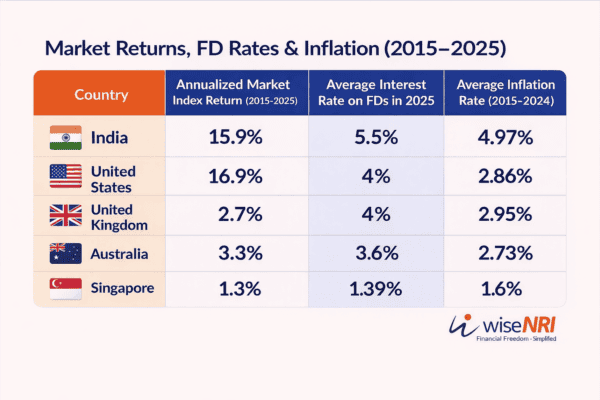

Here are the overall stock market returns, average FD interest rates, and average inflation rates of some countries. This comparison can give you an idea of how much your investments might grow and how your expenses may vary depending on where you choose to live.

Should You Retire in India or Abroad? Final Thoughts

The choice between retiring in India or remaining abroad is deeply personal. It is shaped by a blend of emotional ties, financial realities, and lifestyle priorities that matter most to you. India has transformed quite a bit in the last decade, offering ample opportunities to live a comfortable life. At the same time, after building a life abroad for decades, uprooting yourself and your family is no small feat. Establishing social networks, adapting to various systems in India, creating routines, and finding stability in a new environment will take time, money, and effort.

Reflecting on these questions will help you get closer to your decision:

- What does your ideal retirement look like?

- Where do your deepest connections lie?

- What trade-offs are you willing to make?

Your answers will guide you far more effectively than any comparison of costs, conveniences, or investment returns.