We love getting gifts. Gifts might involve a lot of emotion and tradition. But we have to consider practical and mundane things like rules and taxation when it comes to gifts in terms of cash or assets.

NRIs can give and receive gifts in cash or kind (jewelry, antiques, property) to and from relatives and non-relatives in India. Check tax on gift in India & exemption limits…

You can also get NRI Gift Deed Format from the end of this post

Must Read – NRI Tax in India new rule

NRI Gift Tax In India

Let us look at the tax implications of gifting for NRIs but first check basic definitions which will help you in understanding the rules & other issues.

Definition

The Income Tax Act defines a gift as any asset received without consideration like money or money’s worth. It can include cash, movable property, immovable property, jewelry, etc.

Check – Tax Residency Certificate for NRIs

Relatives and Non-relatives

The treatment of Gift Tax In India is different when given to relatives and when given to non-relatives. The following people are considered relatives –

| Father | Child’s Spouse |

| Mother | Grandchildren |

| Stepmother | Grandchild’s spouse |

| Spouse | Siblings |

| Children | Stepsister and Stepbrother |

| Stepchildren | Siblings’ spouse. |

| Grandparents |

All other persons are considered non-relatives.

Must Read – NRI Resident Savings Account

NRI Gift Taxes Rules In India

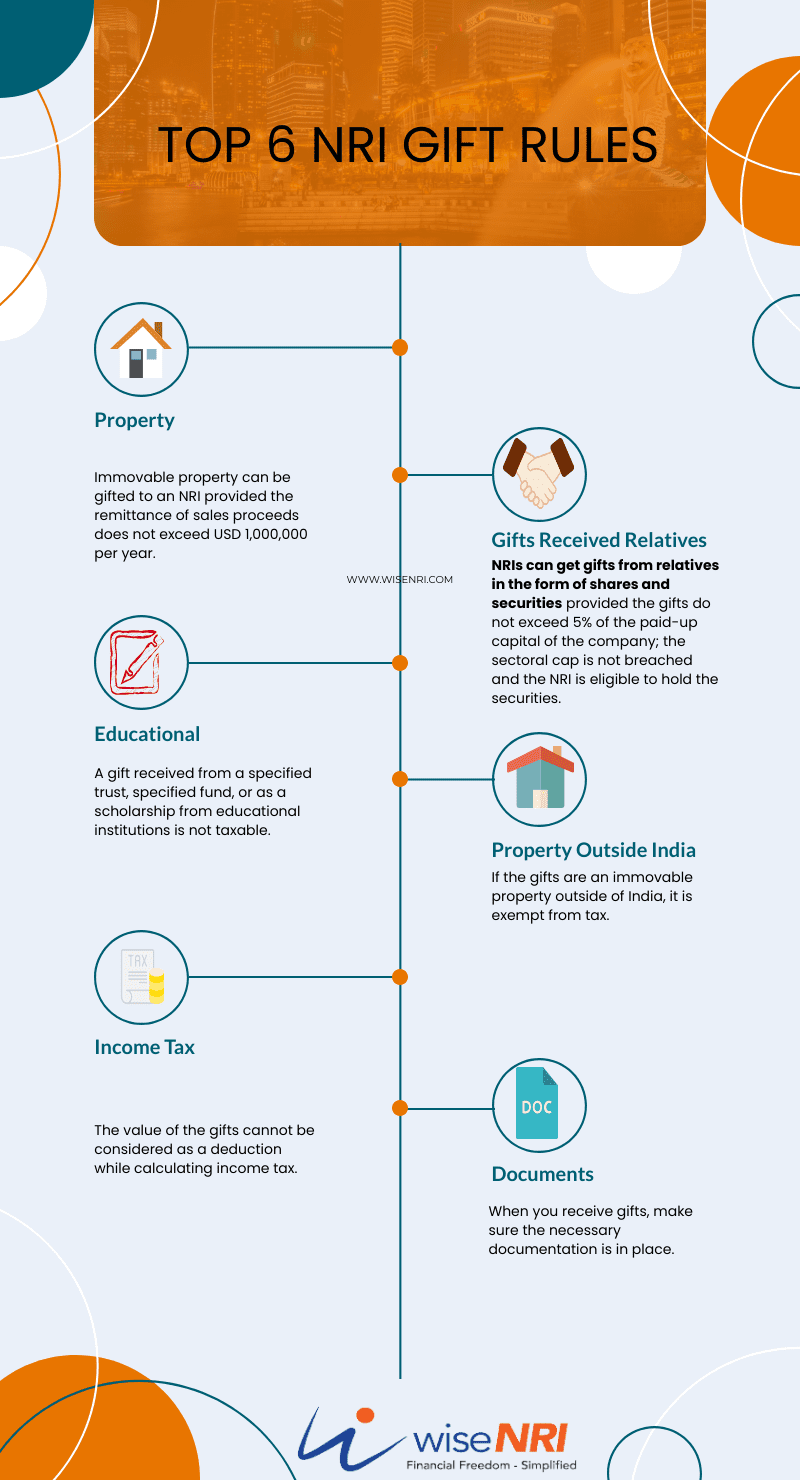

- Immovable property can be gifted to an NRI provided the remittance of sales proceeds does not exceed USD 1,000,000 per year.

- NRIs can get gifts from relatives in the form of shares and securities provided the gifts do not exceed 5% of the paid-up capital of the company; the sectoral cap is not breached and the NRI is eligible to hold the securities.

- A gift received from a specified trust, specified fund, or as a scholarship from educational institutions is not taxable.

- If the gifts are an immovable property outside of India, it is exempt from tax.

- The value of the gifts cannot be considered as a deduction while calculating income tax.

- Income received from a gift in India is taxable in India whether the receiver and giver are Resident Indians or NRIs.

- When you receive gifts, make sure the necessary documentation is in place.

- Cash gifts that exceed Rs. 2,00,000 can be subject to penalty. Ensure that you get the relevant gift through cheques or bank account transfers.

Must Check – NRIs should consider before buying a gadget abroad

Gift by NRI to Resident Indian

NRI gifts to Resident Indian – Let us look at the different scenarios when an NRI gifts to Resident Indian –

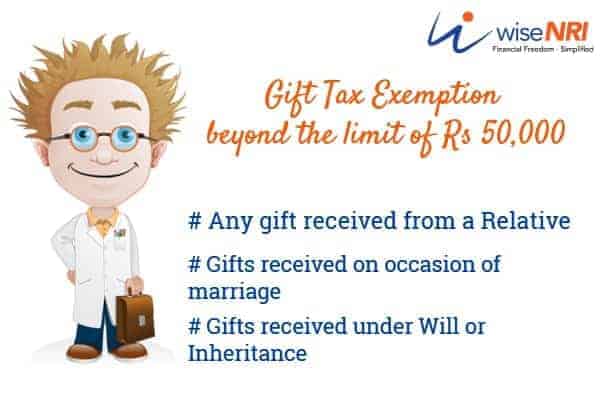

- Gifts from NRI Relative are exempted from tax – When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

- When an NRI gives gifts in the form of cash, cheque, items, or property that is within the value of Rs. 50,000 to a Resident Indian who is not a relative, both giver and receiver are exempt from tax in India.

- When an NRI gives gifts in the form of cash, cheque, items, or property that exceeds the value of Rs. 50,000 to a Resident Indian who is a non-relative, the NRI gift taxes India is payable by the receiver. The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver.

- When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian for marriage or through will, both giver and receiver are exempt from tax in India irrespective of the ‘relative’ status.

Must Read –Power of Attorney for NRI

Gift to NRI by Resident Indian

Resident Indian gives a gift to an NRI – Let us look at the different scenarios when an NRI receives a gift from a Resident Indian –

- A gifts to NRI Relative is exempted from tax – When a resident Indian gives a gift in the form of cash, cheque, items, or property to an NRI who is a relative, both giver and receiver are exempt from Gift tax in India.

- When a resident Indian gives a gift in the form of cash, cheque, items, or property that is within the value of Rs. 50,000 to an NRI who is not a relative, both giver and receiver are exempt from tax in India.

- When a resident Indian gives gifts in the form of cash, cheque, items, or property that exceeds the value of Rs. 50,000 to an NRI, who is a non-relative, the India gift tax NRIis payable by the receiver. The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver. The maximum limit for such a gift is USD 250,000 in one financial year. [This limit is defined under LRS (Liberalised Remittance Scheme) – the total amount of foreign exchange purchased from or remitted through, all sources in India.]

- When a resident Indian gives gifts in the form of cash, cheque, items, or property to an NRI for marriage or through will, both giver and receiver are exempt from tax in India irrespective of the ‘relative’ status.

- When a resident Indian gives a gift in the form of shares or securities of an Indian company, the total value cannot exceed USD 50,000 in one financial year. The gift should follow the regulations of RBI regarding NRIs holding stock in Indian companies.

When you give a gift or get a gift, make sure you understand the rules regarding gifts and the tax implications and act accordingly. wiseNRI

The information that I shared in the above post is one part of the story – issues can be complex based on your resident status. If we talk about the USA – you can gift up to $15,000 in a year. This is not that simple but just an example. So check the rules in countries where you are staying.

NRI Gift Deed Format

It’s important to sign-gift deeds & keep them safe to avoid issues in the future. Many readers were asking for sample NRI gifts deeds that they can copy. So I have added ready to use gift deed format for immovable property & even movable property.

Please share any additional information or experience that you have about a gift to NRI or gift from NRI – that will really help all readers. If you have any questions related to NRI gifts taxability in India – feel free to add them in the comment section.

I am an overseas citizen of India OCI. I want to gift Rs three lakhs to my mother’s brother’s son residing in India from my NRE account to his Savings account in India. Is there any tax implications?

I am a US Citizen. Should I create an NRE account or NRO account in India? I want to transfer the amount (40Lakhs Rupees) from my dad who passed away to my account in India and subsequently move it to US. Is that allowed?

If I take 1crore loan from my brother of America.Later how shud I give bk the amount in dollers

My son is an NRI settled in US. Wish to give him 2 Lakhs as Deepavali gift. Is there need for him to file Income tax return in India?

Can NRI individual gift a cheque to father-in-law?

I am an NRI, can I send money to my parent’s account and can I invest in equity investment with my parent’s Demat account?

What are the compliances for a gift of £200000 to be given to me by my mum? Can she transfer it directly to my UK account?

My son who is NRI London wants property to be a gift to his mother what is the tax implication in London and India? The price of property is about 1crore.

Gift received from father’s brother NRI plus US citizen in foreign currency taxable or not

I need money order for Indian Rupees 25,000 to give as gift

I am NRI and wish to transfer shares worth 50 lakhs to my resident mother. I need to know the tax implications.

No tax implications.

i have a property in india as an nri can i give this land to my sister as a gift in case if she sells it do i need to pay 20% tds please advice

I am an NRI living in middle east. my mother wisher to gift me shares from her resident DEMAT account to my NRO account and my queries: one, is there a tax implication for her or me. two, is there a limit for value of shares ?

I am NRI in UK and I want to sell a property in India and gift the entire earning to my sister who will buy her house from this property… Do i need to pay tax

Hey Tushar,

As an NRI selling property in India, you may be subject to taxes on the capital gains earned from the sale. However, gifting the proceeds to your sister does not exempt you from potential tax liabilities. Both you, as the seller, and your sister, as the recipient, may have tax implications based on Indian tax laws.

can a NRI money gifted to his son who is also NRI

Hey Amar,

Yes, an NRI can gift money to their son, who is also an NRI, without any restrictions. However, it’s essential to consider the tax implications and regulations of both the home country and the country where the funds are received

I am nri and trasnfer money from my nri account via internet banking around 20 lakh during last FY20220-2023 to mother in law.How do i make gift deed and ensure as a proof as gift

Hey Jagannath,

To create a gift deed, you can consult a lawyer or a notary public. Include details like the amount gifted, purpose, both parties’ details, and intent. Ensure the deed is duly signed, stamped, and registered as per legal requirements. Keep transaction records, including bank statements, to serve as proof of the gift transfer and its purpose.

How much money NRI gift to relative without tac

Hey Sudhakar,

In India, there’s no specific limit on the amount an NRI can gift to a relative without tax implications. However, tax implications can arise based on the recipient’s relationship and other factors.

My daughter in us wants to gift me to pay her education loan.Will there be any tax if u receive the money in my bank account.?

Hello Natarajan,

In the United States, gifts between family members are generally not subject to tax. If your daughter gifts you money to pay her education loan, it’s typically not taxable income for you. However, ensure it’s documented as a gift with a clear purpose to avoid any confusion, and consider consulting a tax advisor for personalized guidance.

If I receive 40000 inr + 45000 inr as gift from a non relative in my NRO account will it be taxable

Hey Gaurang,

Gifts received from non-relatives in an NRO (Non-Resident Ordinary) account in India can be subject to taxation. The combined sum of 85,000 INR may be considered taxable as it exceeds the tax-free limit for gifts from non-relatives in India, which is currently 50,000 INR per year. It’s advisable to consult with a tax expert for accurate advice on the tax implications.

Can nri donate a property in india

Hello Bharath,

Yes, an NRI can donate a property in India. However, certain legal and tax implications need consideration. Donating a property might involve complying with Indian laws, such as the Transfer of Property Act, and could have tax consequences.

Can i make payment from my NRE account to purchase a residentail property in india but it will be registered under the name of my wife and mother? is it possible without any issues regarding ITR rules?

Hello Bharat ,

In India, using funds from your NRE (Non-Resident External) account to buy a property registered in your wife and mother’s names might not pose immediate issues concerning ITR (Income Tax Return) rules. However, it’s essential to establish the legal ownership structure clearly to avoid potential income tax complications or scrutiny.

I am an OCI living in Australia. I send money to my mother in India. Does she need to show that remittances in her ITR? If yes then under what head? Further, she do trading with that money and have only losses. Does she need to show those losses also in her ITR? Please assist.

Hey Nishant,

If your mother in India receives remittances from you, it’s not necessary for her to show the money in her ITR (Income Tax Return) as it’s considered a non-taxable gift. However, if she engages in trading activities with that money and incurs losses, she should declare those losses under the ‘Capital Gains’ or ‘Income from Other Sources’ section while filing her ITR to reflect the financial transactions and losses accurately.

Can gift deed of property from Indian parent to US Citizen/OCI child be executed when both are currently in the USA?What is the process and how much time it would take?

Hey Jaya,

Yes, a gift deed for a property from an Indian parent to a US Citizen/OCI child can be executed when both are in the USA. The process involves drafting the deed, getting it signed and notarized, and then attested at the nearest Indian consulate. The time taken can vary depending on consulate procedures, but it generally takes a few weeks to complete the process.

Can I make payment from my NRE account direct to the seller to buy a residential property in india, but it will documented in the name of my wife and mother who are resident indian, is there a problem or violation of nay ite law?

Hi BBS,

Yes, you can make a payment directly from your NRE account to the seller to buy a residential property in India. NRE accounts are designed to facilitate easy repatriation of foreign income and are meant for NRIs to manage their income earned abroad and in India.

How much money can a citizen of India gift a Friend who is an American citizen? and is there any tax involved.

Hi Angela,

The limit for non-taxable gifts from non-relatives was set at Rs. 50,000 annually. Gift tax is typically the responsibility of the recipient. However, if the recipient is a non-resident, they may not have any tax liability in India, depending on their tax status.

What is the tax implication for NRI for receiving stocks from Indian parents?

Hi Ajit,

As an NRI, receive stocks from your Indian parents, there is typically no gift tax liability in India.

NRI wants to gift transfer his flat to mothers sister. The flat which he was inherted by will from grandfather (mothers father)

Hi Advocate Dattatraya Mallikarjun Kore,

The NRI will need to execute a gift deed to transfer the flat to the mother’s sister. The gift deed should be drafted in accordance with Indian laws and should include all necessary details of the property, donor, and recipient.

Can Son who is resident Indian can buy a property in uae in his name with the help of parents

Hi Varun,

Yes, a resident Indian, including a son, can purchase a property in the UAE in their name with the help of their parents. but they need to maintain their resident status in India as well.

Can multiple people send money to me in Australia as gifts including family members, relatives and friends?

Hi Pradeep,

Yes, multiple people, including family members, relatives, and friends, can send you money as gifts in Australia. There are generally no restrictions on receiving gifts from individuals, and gift transactions are not subject to income tax in Australia for the recipient.

A co worker has died and team in USA would like to give money to his family in India. How can we do this?

Hi Charlie,

First, reach out to the family of your deceased co-worker and confirm their willingness to receive financial assistance. After that, Sending money to the family can be done through various methods like international bank transfer and online Money Transfer Services. You can also send a bank check or demand draft.

Can i gift 1cr to my mother. I am NRI

Hi Sneha,

Yes, as an NRI, you are generally allowed to gift money to your mother, and the amount you mentioned, 1 crore, can be gifted without any income tax implications for your mother in India.

I am in US and want to gift $25,000 to my brother in India. Are there any tax consequences for him in India?

Hi Darsh,

your brother generally won’t have to pay any gift tax in India on the amount received. This is because gifts from specified relatives, including gifts from a brother to a brother, are generally not subject to gift tax in India.

Sir, Non resident who is a brother to Indian resident brother gifted $ 100000 dollars, shall Indian resident brother can lending to educational Society with free of interest, after one year he takes back gifted money and he can gives a gift to his Non resident brother. Rambabu Nagalla.

Tax implication on cash gift from Indian grandparents to USA citizen grand daughter

Can mother in law from India gift money to her daughter in law who is pr holder in canada

Hi Padmaja,

Yes, a mother-in-law in India can gift money to her daughter-in-law who is a Permanent Resident holder in Canada. Canada generally does not impose income tax on gifts received by individuals. Therefore, the daughter-in-law should not have to pay income tax on the gifted amount.

If a doctor from london send a gift to an Indian lady then what will be the procedure to receive the gift and how much tax have yo pay.?

Hi Krishna,

India had a gift exemption limit of INR 10,000 for gifts received from abroad. Gifts valued below this limit were typically exempt from customs duties and taxes.

Does NRI have to give gift to blood relatives from account outside India only or the money can be transferred from NRO account as well?

I want to gift my property in India to my mother, so that she can take care of the sales and transactions later point in time. I want to know the tax, while gifting and after that selling

Hi Suma,

In India, there is no gift tax applicable when a property is gifted to specified relatives, including gifts from a son to a mother. When your mother eventually sells the property, she may be liable for capital gains tax in India.

Hi I want to give a gift worth CAD 20000 to my brother in india. Is it taxable

Hi Bino,

If you are a resident of Canada and you want to gift CAD 20,000 to your brother in India, there should generally be no tax implications for you as the donor. Canada does not impose a gift tax on individuals who make gifts to family members or other individuals.

My father based in India wants to cash gift some money in my UK account. Has any rules changed recently which means he needs to pay some tax on this remittance?

Hi Prashant,

If your father, who is based in India, is gifting you money, it should not be subject to income tax for your father.

Want to buy a property in India. How to transfer the money to the seller to minimize tax implications on transfer of money

Hello Aman,

Utilize Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts to receive and hold funds. NRE accounts are tax-free, while NRO accounts have some tax implications.Abide by Reserve Bank of India (RBI) guidelines for property transactions and repatriation of funds.Check Double Taxation Avoidance Agreement (DTAA) provisions between countries to mitigate potential double taxation. Maintain proper documentation for the funds’ source and property transaction to justify the transfer’s purpose.

My uncle( chacha) has gifted me money can i transfer it outside india without any problem?please let me know thank you

Hey Naveed,

As an Indian resident, you can transfer the gifted money from your uncle (chacha) outside India without any problem, subject to certain limits and regulations. Under the Liberalized Remittance Scheme (LRS) of the Reserve Bank of India, individuals can remit up to a specified amount annually for various purposes, including gifts. As of my last update in September 2021, the LRS limit was USD 250,000 per financial year.

Can I gift to my son money in his NRO account in India

Hey Ashok,

Yes, you can gift money to your son’s NRO (Non-Resident Ordinary) account in India. As an NRI (Non-Resident Indian), you are allowed to make gifts to your relatives, including your son, in India.

Property is situated in west bengal kolkata. Sister who is ill living in japan wants to gift her undivided share in the property to his brother who lives in london. How to do it?

Hello Arpit,

To gift the undivided share in the property from the sister in Japan to her brother in London, they must follow the process of executing a Gift Deed. The sister should prepare a Gift Deed with the details of the property and the transfer to her brother. The Deed must be signed and notarized in Japan. The brother in London will then need to have the Gift Deed attested at the Indian Embassy or Consulate in London. Finally, the executed Gift Deed should be registered with the Sub-Registrar of Assurances in Kolkata, West Bengal, to complete the transfer legally.

Any tax on cash from resident father to nri son & nri son wants to send to australia?

Hey Human ,

There is no tax on cash received by an NRI son as a gift from a resident father in India. Gifts from a close relative, like a father, are generally exempt from income tax in India. However, when the NRI son sends the gifted cash to Australia, he may need to consider the tax implications in Australia, including any currency conversion charges or potential taxes on foreign transfers.

I have received gift money from blood relative in Canada. Under what clause should I seek exemption?

Hey Param,

You can seek exemption for the gift money received from a blood relative in Canada under Clause 5 of Section 56 of the Income Tax Act, 1961. This clause provides an exemption for gifts received from specified relatives, which includes blood relatives. Ensure that you maintain proper documentation and comply with any reporting requirements as per income tax regulations.

Ruling on gifts to non resident relatives

Hey Sanjay,

As of my last update in September 2021, gifts to non-resident relatives by Indian residents are generally allowed and exempt from income tax in India. Indian residents can gift money or other assets to their non-resident relatives (as defined under the Income Tax Act) without any tax implications in India.

I recently moved to US, and i want to send funds to my account in India, but i am confused if i can do so

Hey A Sharma ,

Yes, as an NRI (Non-Resident Indian), you can send funds to your account in India from the US. You can use various methods, such as wire transfers, online remittance services, or NRI-specific banking channels to transfer money to your Indian account. Ensure that you comply with all relevant regulations and reporting requirements, and consider using reputable and authorized channels for the transfer.

I have given a gift of Rs.10 lakhs to my child’s spouse,who is an NRI, in last financial year,in his bank account in India.Is this amount taxable for the receiver and the giver?

Hey Rubsin,

The gift of Rs.10 lakhs to your child’s spouse, who is an NRI, is not taxable for the receiver (NRI spouse) in India. Gifts from a relative are generally exempt from tax for the recipient in India. As the giver, you are not liable for any tax on the gift, as gifts given to relatives are not subject to tax in India.

Gift received through cheques/ neft the document can be in plain paper and notarised or in a stamp paper and notarised

Hey Venket,

The document for the gift received through cheques/NEFT can be in plain paper and notarized. It does not necessarily require a stamp paper. The notarization adds an additional layer of authenticity to the document, making it legally valid as evidence of the gift transaction.

I want to send Rupees 2 chrores to my NRI son in USA to buy a house. shall I have to pay tax on it?

Hey Ramesh,

sending Rupees 2 crores to your NRI son as a gift to buy a house should not attract any tax liability for you in India. Gifts from a resident individual to an NRI relative are generally not subject to tax in India. However, it’s crucial to comply with the Foreign Exchange Management Act (FEMA) regulations and report the gift transaction to the appropriate authorities, such as the bank through which the remittance is made.

MY Daughter who is an nri in us wants to purchase agricultural land. Can she and what are the problems

Hello Jethareddytella,

As an NRI, your daughter cannot directly purchase agricultural land in India. NRIs are generally prohibited from acquiring agricultural land, farmhouse properties, or plantation properties in India. However, she may inherit agricultural land through a gift or inheritance, subject to certain conditions and restrictions.

I want to gift some amount to my NRI brother by taking loan on FD. Can he transfer this gifted loan amount to abroad?

Hey Kushal,

Yes, your NRI brother can transfer the gifted loan amount to abroad if it is given as a genuine gift without any expectation of repayment.

Is gift to mydaughtera us citxen will be taxable in usa?

Hello Birendra,

Gifts from a parent to a U.S. citizen child are generally not taxable in the USA.

How much money can I gift my father in law

Hey Suresh,

You can send money upto50000.

I sent money from US to India to my dad to buy land for him but now hes dead and want to bring back the money or whatelse can be done to avaoid paying taxes and unwanted trnasfer fees

Hey Krishn,

If you have already purchased the land and plan to sell it, you will need to pay taxes based on the Indian tax rate framework. The tax liability will be determined by factors such as the holding period, type of asset, and applicable tax laws.

My mother wish to give a gift money worth 15000euro.I live in ireland and she is in India.Do i have to pay tax after rexeiving gift from my mother.how much indian rupees can be transferred to Euro?

Hey Sandeeplal,

Your mother can transfer unlimited amount as gift money

My son in law an NRI sold a site and LTCG tax has to be paid, can he get threshold exemption of 250000

USA citizen gifts his inherident house property to his Indian citizen wife in Andhra Pradesh clarify TDS

Money transfer from my foreign bank account to my brother’s Indian Bank account is taxable or not

Is there a tax amount for withdrawing cash as a gift out of India?

Hey Mohamed,

No, there is no tax amount for withdrawing cash as a gift out of India

Some one send gift, from foreign USA, here they are asking money to pay, why

My sister a US citizen wants gift me US company shares to me. What is the procedure

I am an Indian living in Gurgaon. I have received GBP 10000 in my Bank account in India, under a WILL from my father’s sister a Citizen of UK.I want FIRC from the Bank. They are asking me the purpose code. I want to know the purpose code for the inward transaction of GBP 10000.

Can you tell me if someone has got gift from a foreign country can he do currency exchange

I received shares as gift from my NRI sister .What will be my acquisition cost for calculating Short Term or Long Term Capital Gains Tax

How much money can I non resident alien receive from india to USA without tax

I am an NRI and I want to gift deed 24lakhs money to my mother online

Can a NRI transfer his property to parents

How much amount in US $ can a son gift to his father in India as per US laws. Son has acquired American citizenship.

My son nri with usa passport wants to gift from his nro accounto my ( also nri ) with usa passport. Do we need gift deed for tax purpose

Can mother in India gift 200k AUD to daughter in Australia

It a person send the parecel from another country and Indian person cancel it or have any issue with that person

If a resident Indian wants to give as gift to his son/daughter who is working on visa in USA a gift, what is the maximum amount that can be given without paying tax at both the places

If a Resident Indian becomes NRI and subsequently OCI, then does the Aadhaar card held by Resident Indian need changes

What is the legal way of getting money transferred from a Indian resident relative to Me living in the UK, for the purpose of buying a house

Want to gift Rs5000000/- to my son NRI. What is the procedure?

I have migrated to live with my son after retirement.I am selling a property in India,and I have also received a PPF maturity payment.My son has an NRO account.I wish to transfer the entire amount to his NRO account.Is there a tax liability for either of us??

Suppose a commercial property is given to a bank on rental basis for a period of 9 years and during this period, If i decide to gift this property to my nri daughter, can I do that ?? Can the bank agree to this or one has to first terminate the rent agreement and then re-enter into agreement with the new owner

How much money I can send to my son in Canada from my sb acct

I am holding a commercial shop in Mumbai and wish to transfer the title to my NRI( H1B Holder) daughter, how to go about it.What are the tax implications ?? In India as well as at USA for me and to her.

Upto how much value of a property an NRI can give as a GIFT to Indian Resident Sibling / Relative & its Taxation effect..??

Can my indian resident sibling gift farm land to me (australian citizen)

I am a person of Indian origin but now acquired foreign citizenship, can i purchase land in india

Hello Sidney

Yes, as a Person of Indian Origin (PIO) who has acquired foreign citizenship, you are eligible to purchase immovable property in India, subject to certain conditions and restrictions.

According to the Reserve Bank of India (RBI) guidelines, PIOs can purchase residential and commercial properties in India, subject to the following conditions:

1.The property must be for the PIO’s residential or commercial use.

2.The property must be purchased in Indian Rupees (INR) through funds remitted from abroad or through a Non-Resident External (NRE) or Foreign Currency Non-Resident (FCNR) account.

3.The PIO must file a declaration with the RBI within 90 days of the purchase of the property, giving details of the purchase price, the source of funds, and the purpose of the acquisition.

4.The PIO may not purchase agricultural land, plantation property or farmhouses in India. However, they may be able to inherit such properties.

Is cash gift by bank deposit or cheque from mother (resident account) to a daughter (NRO account) taxable ?

Hello Karan

As per the Indian Income Tax Act, a gift from a relative is generally exempt from income tax, regardless of the amount. For this purpose, a “relative” is defined to include a parent, child, sibling, and spouse, among others.

Therefore, if your mother gifts you cash by depositing it into your NRO account or by issuing a cheque from her resident account, it should generally be exempt from income tax, as long as your mother is a “relative” as defined under the Income Tax Act.

However, it is important to note that if the gift amount is very large, the tax authorities may scrutinize the transaction and require proof that the gift is genuine and not a way to evade taxes.

I am indian resident and my spouse living in USA. I i want to gift money to my wife in india but she lives in USA , what’s the max i can gift her in india account which she is not taking to US

Hello Jignesh

As an Indian resident, you are allowed to gift money to your wife who is a non-resident Indian (NRI), subject to certain limits and conditions.

According to the Reserve Bank of India (RBI) guidelines, an Indian resident can gift up to USD 250,000 per financial year to an NRI spouse who is an Indian citizen or of Indian origin. This gift can be made in any form, including by way of a bank transfer to your wife’s account in India.

It’s important to note that the gift must be made out of your own funds and cannot be sourced from any borrowed or loaned funds. Additionally, the gift must be made under the Gift Tax Act, and you may be required to file a gift tax return if the value of the gift exceeds a certain threshold.

What are the taxation rules in the USA for an NRI with regards to receiving gift from Indian parents , remitting 200k USD

Hello Mohan

As an NRI living in the USA, you may be subject to US tax laws on any income you earn or receive in the US. In general, the US tax system is based on the worldwide income of US citizens and residents, but the rules are different for non-resident aliens, including NRIs.

When it comes to receiving gifts from Indian parents, the tax treatment will depend on the nature of the gift and the amount involved.

If any person from another country wanted to give me a gift worth rs – 200000 how much cost charges to pay the receiver

Hello Chaturvediamulya

If you receive a gift worth Rs. 200,000 from someone in another country, you may be subject to customs duty and other taxes depending on the country you are in.

It is important to check the customs and tax laws of your country to determine the exact charges you may be subject to. You may also want to consult with a tax professional for more specific advice.

I am Indian recident i want to gift to my son rs 10 lacks in Dubai by bank transfer any tax to pay in India ?

My son an NRI. My wife & her sister joint holder of a property selling it and planning to remit to my son’s NRO account which inturn he will make as NRO deposit in the same bank. My question is 1.Hope no gift tax to both as close relatives. 2. TDS of 30% on interest too ok3. IT return and refund upto 3 lacs under new regime – is it correct. 4. Abv 3 lac IT applicable as per citizen limit and std rebate not eligible. Am i ok in my understanding

Hi..My question is can we transfer from NRE account to home loan account….and wha are the tax implications?

I have property in India and I wanted to do gift to my mother

I an an NRI. i have NRO account in india. can i transfer Rs.50000 from my NRO a/c to my friend? is it taxable for me or to him?

Wat gifts are allowed to receive if my friend send it from another country

My Father’ s sister live in Bdesh and want to gift her inherited Indian property to me. she is unable to come to India due to her serious illness. But her daughter can come to India. Please suggest the way that will fruitful me me.

regulation regarding gifting my property to a relative.I am an NRI and OCI cardholder, I live in Kansas, USA

Can recently a green card holder usa send money trough lrs to son for maintenance

I am 74 lady. I am cancer survivor. I want to give my bank fds to my daughter and her children. How to go about it. She is the 2 nd depositor now

Sending money rs 1,00,000/- to sister abroad from India as gift

Can i know how much account can i transfer to nri account

I am NRI and I want to transfer my flat by GIFT DEED to my brother who is Indian? Do I need NOC from RBI?

I want to gift agriculture land to my father

I am selling a property with power of attorney send by my nri sister. Property is inherent and registered on my father name

How much an Indian resident can give as gift to his relative

Hi Karan,

The limit for tax exemption on gifts made by an Indian resident to their relatives is currently Rs. 50,000 per financial year (April-March). This means that an Indian resident can give a total gift of up to Rs. 50,000 to their relatives in a financial year without attracting any tax liability.

Nri gifted to indian parents through account transfer and they bought property on their name so is there any tax?

Hi Sandy,

It’s important to note that the tax laws in India are complex and subject to change, and the exact tax implications of a gift of money used to purchase property will depend on the specific circumstances of the gift. It’s recommended that you consult with a qualified tax professional who can provide you with specific advice based on your unique situation and circumstances.

What is the tax implication in USA , if I (USA citizen) give shares as a gift to my family friend ?

Hi Hiral,

It’s important to note that the tax implications of gifting shares can be complex, and may vary depending on the specific circumstances of the gift. It’s recommended that you consult with a qualified tax professional who can provide you with specific advice based on your unique situation and circumstances.

Does fema permit resident indian to gift his share of joint Australian immovable property with close relatives , to his wife

Hi Vikram,

Yes.

I am NRI maine gift deed ki the apni soninlow ke Nam usne mere bete se tlak le liya hai kiya Mai gift deed vapas le sakta hu

Hi Abdul,

Please consult with your lawyer.

Can resident gift policy to Nri

Hi Karan,

Yes, a resident individual in India can gift a life insurance policy to an NRI (Non-Resident Indian) as long as the gift complies with the Foreign Exchange Management Act (FEMA) guidelines.

What is the best way to gift immovable property to my Mother. I am an AU Citizen and my mother in Indian Citizen. The property is registered on my name.

Hi AD,

As per my knowledge, You can gift the property through Gift Deed.

Can we transfer money to an NRE account and use that to buy property in India? What are the tax implications in US or India for it .?

Hi Pricks,

Yes, money can be transferred to an NRE (Non-Residential External) account in India and used to purchase property. NRE accounts are specifically designed for Indian citizens living abroad to hold and manage their foreign income in India.

As for the tax implications in the US, money transferred to an NRE account is considered as foreign income and is subject to US taxes. However, if the money is being transferred from a foreign bank account that you already own and the money was already taxed in the foreign country, you can claim a foreign tax credit or exclusion to avoid double taxation.

In India, income earned outside India is not taxable in India. However, if the property is rented out, the rental income earned will be taxable in India. Also, the capital gains on sale of property will be taxable in India if the property is sold within three years of purchase.

It is recommended to consult a tax professional in both the US and India to understand all the tax implications and to ensure that you are in compliance with all the tax laws.

I want to gift around 75 Lacs to my nephew in India. I want to get it vested in 4 years. How to do this?

Hi Sanjiv,

You can gift money to your nephew in India by transferring it to his bank account. However, if you want the money to be vested in 4 years, you have a couple of options:

Trust: You can set up a trust in India, with your nephew as the beneficiary, and transfer the money to the trust. The trust can specify that the money will be vested in your nephew after 4 years. This can be done with the help of a lawyer or a professional trust company.

Will: You can also make a will and specify that the money will be transferred to your nephew after 4 years. However, this option may not be as flexible as a trust, and the will takes effect only after your death.

It’s also important to note that there might be certain legal and tax implications in both India and your country of residence. It’s recommended to consult with a lawyer or a tax professional to ensure that the gift is in compliance with all the laws and regulations, and to understand all the tax implications of gifting the money.

I have my brother residing in UAE. If he sends me money 50000 to 70000 rs. per month to me. Is it liable for taxation?

Hi Parkar,

If your brother residing in UAE sends money to you in India, the money is not taxable in India. As per the Indian Income Tax Act, money received as a gift from a relative is not considered as income and therefore is not taxable. A relative is defined as spouse, brother, sister, brother or sister of the spouse, brother or sister of either of the parents, any lineal ascendant or descendant. However, it’s worth noting that your brother might be subject to taxes in the UAE for sending money out of the country. It’s recommended to check with a tax professional in the UAE to understand the tax implications for your brother.

It’s also important to note that if the money is being sent for a specific purpose such as a business venture or for buying property and the money is being sent regularly, the regularity of such transactions could be seen as a business income and might be taxable.

It is always recommended to keep all the transaction records and communication with your brother to establish the nature of the transaction in case of any future inquiry by tax authorities.

can NRI son in law staying in USA give gift to mother in law or father in law staying in India? And what is the limit if any

Hi Minex,

An NRI (Non-Resident Indian) son-in-law living in the USA can give a gift to his mother-in-law or father-in-law who are residing in India. There is no limit on the amount of the gift, but if the gift exceeds INR 50,000 (Indian Rupees Fifty Thousand), the recipient will have to pay taxes on it according to the Indian income tax laws. It is advisable to consult a tax professional for more information on gift tax and compliance with Indian tax laws.

If my daughter in law remits money from the US to her husband’s NRI account will it attract GIFT TAX.

Hi Divya,

If your daughter-in-law remits money from the US to her husband’s NRI (Non-Resident Indian) account in India, it would not be considered a gift and would not attract gift tax. However, the money would be subject to foreign exchange regulations in India and any income earned on that money would be subject to income tax in India. It is advisable to consult a tax professional for more information on foreign exchange regulations and compliance with Indian tax laws.

Can someone wire a gift without tds

Hi Karan

In most cases, TDS (Tax Deducted at Source) is not applicable when someone wires a gift to another person. However, TDS may be applicable if the gift exceeds a certain amount set by the government. It’s best to check with the relevant tax authorities to confirm whether TDS is applicable in your specific case. Additionally, It’s also important to note that, it could vary from country to country.

I am an nri and would like to know if i can gift my used vehicle to my mother in india?

Hi Jerry,

As an NRI, you are allowed to gift a used vehicle to your mother in India. However, there are certain procedures that you will need to follow in order to transfer the ownership of the vehicle to your mother.

First, you will need to obtain a “No Objection Certificate” (NOC) from the regional transport office (RTO) where the vehicle is registered. The NOC is a document that certifies that the vehicle is registered in your name and that there are no outstanding dues or loans on the vehicle.

Next, you will need to transfer the ownership of the vehicle to your mother. This can be done by filling out the appropriate forms at the RTO and paying the necessary fees. You may also be required to provide documents such as the NOC, the vehicle’s registration certificate, and proof of identity for both you and your mother.

It is advisable to consult a lawyer or a professional at the RTO to ensure that the transfer of ownership is done correctly.

I am an NRI, My monther( In INDIA) want to give gift of Rs 60,00000.($74000). Is it tax free or taxable ?

Hi Surajit,

In India, it’s tax-free but it is advisable to consult a tax professional to determine the specific tax implications of this gift and to ensure that you are in compliance with Indian tax laws.

What are Indian gift tax implications when an Indian resident (mother, father) citizen receives AUD 200K from a blood related Australian citizen (child) via an international money transfer for the purpose of property purchase in mother, father and another sibling’s name?

Hi Sanjeev

There are no gift tax implications in India for a resident Indian citizen receiving a gift of AUD 200,000 from a blood-related Australian citizen. However, the Indian resident may be required to pay income tax on any rental income or capital gains earned from the property purchased with the gifted funds. It is advisable for the Indian resident to consult a tax professional to determine their specific tax obligations in this situation.

What is the maximum cash I can receive from my brother from India. I am an NRI in Ireland

Hi Saravan,

There is no limit as you and your brother share a Blood relationship with each other.

Can my nri son in law gift money to me – father in law

Hi Kasthuri,

Yes, but there will be Tax implications. The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver.

As a nri if he buy agriculture land without knowing what should he do immediately

Hi jay,

If a non-resident Indian (NRI) has purchased agricultural land without fully understanding the laws and regulations surrounding the purchase, they should immediately seek the advice of a legal professional with experience in real estate and agricultural land laws in India. They should also consult with any relevant government agencies to ensure that the purchase is in compliance with all laws and regulations. Additionally, they should make sure that the land is properly registered and that all necessary documentation is in order.

How can i send money to my nre account from India. It is the money sent previously by me to my parents

Hi Sathish,

First, deposit your money into NRO A/c and then you can transfer the money from NRO to NRE A/c

I am a.PR of AUSTRALIA. I have Immovable property in India. I wish to make a gift deed to my Children who are australian citizens.

Hi Govindasamy,

It is possible for you as an Australian PR to make a gift deed of your immovable property in India to your children, who are also Australian citizens. However, it is important to note that Indian laws regarding gift deeds may vary from state to state, and you should seek legal advice from an Indian lawyer familiar with the laws in the state where the property is located. Additionally, you should also seek advice from a tax professional to ensure that the gift is in compliance with both Indian and Australian tax laws.

Can the gift deed ( resident indian to NRI(also an OCI holder) be in plain piece of paper

Hi Deepa,

A gift deed is a legal document that transfers ownership of property from one person to another as a gift. The document should be in writing and should be executed in accordance with the laws of the jurisdiction in which the property is located. In India, a gift deed should be executed on a non-judicial stamp paper of the appropriate value and should be registered with the local authorities. It is not recommended to execute a gift deed on plain paper as it may not be legally valid.

Do you help an NRI to file India tax return

Is it possible for NRI to open a FD in name of cousins

Hi Jaydeep,

Yes.

Is there any tax implications if i transfer large amount of money from poland to my parents in India?

Hi Indrajit,

No, There would be no Tax implications.

My Parents are Indian Citizen resident of India and Senior Citizen would likeTo give their son who is NRI in termsOf bank transfer from their acocjnt to son NRO account is there a limit

Hi Rohan,

There are no such limits.

How much we can remittance to NRI in blood relation to US withhout tax liability in either country

Hi Karan,

There is no Tax liability if you do the remittance with your Blood relatives.

My nephew in USa wanted to gift me 1cror rupees as gift, what is my tax liability in India?

Hi Prasanna,

The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver.

Can i gift an immovable property in India to a relative without going to India?

Is there any form for getting the share of the NRI who has a share in the immovable property in India to her/his own brother who is resident Indian?

Can I send iphone to my wife from usa to india? Without custom duty?

How much money can I as Indian resident can gift to my two children that is not taxable in a financial year? Can I send both of them in one financial year?

Hi Harbir,

There will be no Tax Liability, as they are your Child.

If a nri (oci) wants to transfer or gift his share of coownership of property on his sons name, who is already a cowner of indian nationality then what are the formalities

I am an Indian citizen. My son is an NRI. I have sold a property in India and want to transfer funds to him. What is the procedure and taxes involved

Can a converted land be gifted by father to son, where the son is the citizen of USA

If my sister gives me 50 lacs rupees in India via Cheque gift is it taxable

do fcnr and nre deposit interest is taxable for OCI holders who stays beyond for more than 182 days in India

My son is on H1B visa in us . Can I deposit money in his Indian account or by mutual funds in his name . What would be tax implication in India and USA

I am a resident indian.one of my friend who is an NRI and settled in usa wants to bequeath some us immovable property in my favour through his will.pl inform if the value of property when received in India by me will be liable for income tax or not

Hi Mangla,

There would be Tax implications.

Can an NRI give a gift to another NRI property

Hi Anil,

Yes.

While in India I had a adhar card and now my status is NRI. My parents have now shifted their residence and have also got tha address changed in the adhar. Could I also get my permanent address changed

From my NRE account how many USD , i can send to my daughter in U.S. as gift

Hi Ravindra,

There is no such Limit. As you both share the Blood Relationship with each other, the full amount is Tax exempted

How to I make gift deed ? My sister Indian resident is giving me money as a gift so what documents are needed ?

My son staying at Dubai , how he transfer 10 lacs to my account? Is it taxable?

Hi Jeetu,

This is not Taxable.

Thank you Mam..

I want to gift dollars to my granddaughter living in United States. May I? Please guide

Hi Indresh,

Yes, You can

Can nri gift property to resident Indian to save tax

Hi Rastogi,

Yes.

How much money can I receive as a gift from europe

Hello Rahul

Thank you for msg

if the total amount of gift received during the year by an Individual or HUF exceeds (Rs. 50, 000) it will be charged under the Income Tax Act.

I am a NRI and wish to gift cash to my sister (blood relationship) is there a cap on sending amount and whether it’s taxable?

Hello, Rohit

Thank you for msg.

Any amount received as a gift from blood relatives is not taxable in India & Any amount up to $5.6 million given as gift is not taxable for the giver in the US.

A foreign citizen wants to give his property in a foreign land by way of will to an Indian citizen. What laws in India would be applicable?

My father died and if he has any money in USA can I get that money . I live in usa

Hello Dilip

thank you for msg.

yes you can get that money.

Regarding receiving money from Australia to India as gift by blood relative.

Hello Suyash

thank you msg

Any amount received as a gift (money) from blood relatives is not taxable in India.

& The minimum number of AUD to execute a transaction is AUD 250. The maximum amount that can be sent in one transaction Is AUD 10,000.

Seema whether a gift (amt of 50 lk) out of sale proceeds of house given by resident mother in india to non resident son , is taxable in india

actually one of my friend from london send me a gift to india but i dont want to accept it what will happen to that gift

if i receive a gift of 10 lakhs from my daughter have i to report to Tax people even if i do not pay any tax

Hi Abhi,

No.

My husband just died . I did not know he has some lands in India. Now his Nephew would like to sell the land and asking me to sign the paper. So he can sell the land. What Is the law. Is it legal to sign as I live in UK and I am British pP holder I do not have Adher card or Pan card

How to transfer funds from India to Canadian account when the funds are a cash gift from Father to their child?

Hi Swathi,

First, transfer the money from Savings A/c to NROA/c and from NRO A/c to NRE A/c

My mother has gifted rupees 4.5 lakhs as gift to my son who is working in hongkong . The money was given through cheque and has been credited to his nro account. My son has submitted all documents required 15 ca etc through chartered accountant. But still bank is asking for gift deed. Should the gift deed be done? What is the procedure?

What is the maximum gift amount from father to son who is a German resident with out tax

Hi Pushpa,

There is no limit as they share the Blood Relationship with each other.

my wifes father wants to send cash transfer to her as a gift, we are uk residents, are there any tax implications for her or him

Hi Gurjhornbyroad,

No.

I am an NRICan I transfer 1000$ to my brother as a giftIs it taxable to my brother

Hi Lakshmi,

No, it will not be taxable.

can nri relative gift to resident indian in foreign currency and is there a value limit in a financial year as per FEMA

Hi Farida,

NRI/OCI can gift cash to Residents (Sec 9 FEMA) Resident cannot retain currency more than US 2000 or equivalent

Tax implications for sending money from my nre account to father’s resident savings account in order to purchase property in my name

Hi Suhas,

There would be no Tax implications if you show this fund as gift.

If nri sends money to resident Indian father worth more than 50,000 is it taxable income for father

Hi Manish,

No, it is not taxable.

Ian an Indian Residing in Dubai For The last2 Years with my son ,Ian 70 years Old I have a property in Mumbai I want to gift it to my son for all have doing for me

Hi Adrian,

Yes you can

Nri daughter gifts indian immovable property to father is it taxable in India

Hi Ashfaq,

No, it is not taxable.

can fcnr currency be transfered from one indian bank to another?

Hi Ashfaq,

No

Which kind of gift suitable to give Indian family?

What’s the process to get gift from father to NRI son?

Hi Shivendr

Depends On what kind of gift.

If my son who is NRI gifts money from his overseas account to his mother’s overseas account who is a resident Indian does this needs to be reported to IT department and RBI under FEMA. What documents will be required if so.?

Hi Mazher,

No.

Are NRIs aged 75 exempted for filing ITR if they draw pension and interest income from a bank in india

Hi Ramesh,

No.

Hi Ramesh

super senior citizens aged 75 years and above are not required to file ITR if they meet certain criteria defined in the Income Tax Act, 1961.

My PIO daughter has a flat in Ghaziabad. Can she gift it to her mother (an Indian). If so what will be stamp duty in U P. If mother sells flat later on, what would be considered its cost for LTCG?

Hi KV S Jain,

Yes, Shae can gift.

The LTCG will be @20% with Indexation.

If i want to give gift to nri sister what is limit of rupees and how much tax will be paid

Hi Jay,

When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

HI Jay

if the aggregate value of gifts received during the year exceeds Rs. 50,000, then the total value of all such gifts received during the year will be charged to tax (i.e. the total amount of gift and not the amount in excess of Rs. 50,000).

If my usa NRI send 3 crore money to me to India for purchase property house to nri frnd .than in india pay tax by reciver in india

Hi Rana,

The tax will be paid by the Receiver.

Does receiving money (1.2 lakh) from in-laws considered as gift? I am an NRI. Can they deposit to my NRO account directly?

Hi Prajawal,

Yes. They can gift.

Hi Prajwal

Yes.

Buying Property in Mother’s name as NRI

Hi Mahesh

If the mother makes a registered will and she does not change it then NRI gets the property. Nri can purchase but in the future on the demise of the mother legal heirs can claim an equal share, as per Shariah law your mother cannot execute an entire property through will so better execute a relinquishment deed.

Can a mother who is having an NRO account gift money to her resident daughter

Hi Priya,

Yes, She can gift.

Hi Priya

Yes.

My brother’s son wants to send about 25 lacs to my account, is it taxable

Hi Chockanathan,

Yes.

Hi RJ Chockanathan

Any amount received by relatives is not taxable at all, so you will not have to pay any tax on the amount received.

My own brother lives in Saudi Arabia and works ther on contractual basis. He wants to gift me Rs 2000000 as gift for helping me purchase a home in India. Does it have any complications of FRCA.

Hi Madhur,

No.

I want to gift 3 lakhs INR to my elder brother in the form of an FD since am an NRI am not able to transfer funds from my account to directly open an Domestic Term Deposit (FD). What other ways are there to fulfill my requirement, pls advice

Hi Reji,

As per my knowledge, First you need to transfer the amount into his account and then he can open an FD account.

Can an NRI gift to his immovable property which is situated in USA to his mother in Bangalore who is residing in Bangalore

Hi Arun

Yes.

Can a FCNR B be transferred from one bank to another in same currency

Hi Ashfaq,

The funds held in FCNR (B) account are fully repatriable i.e. funds can be transferred to any overseas account.

Im not gettung the specific answer for gift received from abroad will be coynted in national income or not

Hi Neha,

Gift and remittances received by Indian abroad- Not included in national income because they are transfer incomes and payments

How much money a parent can gift to his nri son

Hi Karan,

There is no limit for transferring money as there is blood Relation between the Giver and Receiver.

my son residing in USA would like to gift me from USA amounting to Rs 10 lakhs, what is implication in FEMA

Hi Balasubramanian,

A resident individual can gift his NRI relatives in Indian rupees as well as foreign currency under Liberalized Remittance Scheme (LRS) within the limit of USD 250,000 per resident relative per financial year. Gift received in Indian rupee can be deposited only in NRO Account.

My nri son having a flat want to gift me. What is procedure for gift transfer deed and tax liability thereto???

NRI sister want to gift 5000000 inr to Indian citizen brother, what will be tax implications

Hi Suyash,

There is no Tax implication, if the Receiver and Giver both share the Blood Relationship with each other.

Are there tax implications if my brother transfer £500k from his account in bank of India to my bank account in the uk as a gift?

Hi Shilpa,

There is no Tax implication, if Gift receiver and giver share the Blood relationship with each other.

Kindly advice max amount as loan that can be received in my NRE account in India from a friend in Dubai using western union mode of transfer ?

Hi Ashish,

As per my knowledge there is no such limit.

How much amount to be paid as tax, for convertion of money and transfer of that money to bank account if any Indian received gift from NRI. And how much amount to be paid for gold gift from NRI from

Hi Rajashree,

This is all depend from whom you received the money as gift.

Can mother living in India gift son living overseas Money.If yes what is the maximum limit.Is there any tax implications

Hi Roger,

There is no limit for gift id the receiver and giver has the blood relationship with each other.

Son sent money to mother’s account in India From USA, she bought property with that money and gave gift to others , now son asked to give back that property and mother also want to give back but donee refused to give back that gifted property, is it possible to take back that property by son legally

Indian settled abroad can open new account or not

Hi Pooja,

Please Clear which account you are talking about?

We both are Australian citizen, don’t file tax in India as we have no income coming from there.We have two plots (one in Jaipur and another one in Gurugram). The aim is to sell these both plots and bring the money to AustraliaJaipur Plot:- Puchased in 2007- Size : 300 sq yards- Purchase price INR 5500 per sq yard- selling price INR 13000 per sq yardGugugram Plot: – Purchase in 2010- Size : 200 sq yards- Purhcase price INR 8000 per sq yard- Selling price INR 40000 per sq yardI am thinking about following options1. Option OneWe sell both plots by power of attorney and pay flat tax of 25% on the capital gain. No indexation , just flat tax rate on the difference between selling amount – purchase amount.2. Option TwoGift both plots to my mother who has no other income in India and wo sell the plot, taking advantage of Indexation and paying comparatively less tax. Plus this will save us hassle of filling income tax return in India and getting money out of country will be easier. Or is there any third option ? I am looking for tax advise, do you know who can help ?

Hi Sandeep,

Kindly ask to your CA

Can Indian huf transrer money to member for study in us

Hi Hitesh,

There are no restrictions on the rights of a Karta to gift assets of the HUF to anyone under the tax laws. However, if the gift is made to a family member, the income tax department may treat this as partial partition of the HUF and disregard this for income tax purposes.

Hi Hitesh,

There are no restrictions on the rights of a Karta to gift assets of the HUF to anyone under the tax laws.

My daughter is nriMy question is:- can I purchase flat making her co/owner- how much money she may gift me without gift tax as per usa lawThanks-

Hi Binda,

Any gift received from a blood ‘relative’ is exempt from Tax (‘relative’ in this case is defined as spouse, daughter, brother or sister, spouse’s brother or sister, parents and lineal ascendants of individual or his spouse, siblings of parents of individual or his spouse)

I would like to transfer 5 lakhs rupees to my sister , i am a NRI , is that amount taxable to her?

Hi Bashir,

The amount will not be taxable as she is your relative .

My NRI friend is going to transfer more then 1core to his nephew resident of India ,What are consequences

Hi Shrikant

Consequently, any sum of money gifted to nephew shall not be chargeable to tax in the hands of the nephew. However, reverse shall be taxable since nephew is not a relative of his uncle in terms of the definition contained in Section 56 of the Act.

sibling need to deposit money as a gift in my account nri or nrio

Hi Rakesh,

Sibling can only deposit money in NRO account.

what are consequences if transfer of shares from NRI to NRI as a gifts?

Hi Amala,

You should consult with a CA for this

Bank frozen the savings accountHow do we come out

Hi S Anavarathan,

You need to connect with your bank for this

What are the modes from which a NRI company can transfer shares to a company of India

Hi Antima,

You should consult with a CA for that.

i have just sold a property in India. I want to share the sale money with my two brothers one lives in Canada and the other in India. I have paid the capital gains tax on the money recieved. I want to now transfer 30 lak to my brother in Canada and 30 lak to my brother in India…how can i do this…

Hi Sanjeev,

You can transfer this amount to their NRO account and then they can transfer this amount from NRO to NRE account & then they can repatriate this amount to their overseas bank account.

gift of Rs 20lakh by nri father to indian resident son is taxable or not

Hi Roni,

It is not taxable.

My father an Indian resident wishes to give me a gift exceeding rs. 50,000. I hv an bro and an Nri account in India. What r my best options to minimize tax

hi Jay,

He can gift you the gift more than Rs 50000 & it is not taxable.

I am a US Citizen. A person not related to me (who is a Indian Citizen living wants to “gift” me some money. How much can he gift to me without any tax implications in India either for me or for him?

Hi Ramakrishna,

He can only send you Rs 50000. above that there will be tax implications.

What is the taxation on recieving fund in accounting my by NRI relative?

Hi Ranjan,

You should consult with a CA for taxation.

What gift can I give to my uncle who is a foreign return as a minor

I’m an Indian resident I’m about to receive $ 35000 from usa is it taxable for me.. ?

Hi Shwetha,

If your are receiving this amount from above mention relative then you don’t need to pay the tax on it.

My friend from london wants to help me he want to give me 25lakhs to start my business Is it legal Is it taxable

HI Nikhil,

It will be taxable.

Can An American Husband send money to his Indian wife to buy property

Hi Dips

Yes he can send the money.

Is it possible to receive a gift from a resident indian account to an NRO account in INR by cheque?

Hi Sanjay,

yes it is possible.

how can I engage someone to advise me on rules regarding gift giving by my sister in India to me in the US

Hi Jay,

You should consult with a local tax advisor in US.

I wish to purchase a residential house in kolkata. the vendor is an NRI now. He wishes to execure a GPA in favour of his mother making a declaration of gift of the house in her favour & to transfer the house , on his behalf, to anyone to whom she wishes..?Is it ok ?

Hi Mahesh,

You should consult with a CA for that.

gift recieve from relative in foreign currency (one-half is received in india) and remaining is used for education of son in germany. taxability for ordinary resident

Hi Bhumika,

You should consult with a CA for that.

Can nri gift his immovable property this real brother in india

Hi Rupal,

yes he can.

my father is sending 50000$ us doller to my mother in india as a giftso how much tax my mother will pay

Hi Abhi,

There will be no tax liability.

Hello, I am planning to sell real estate in India and bring the money to the USA. The amount is about Rs. 2,50,000,000. Need suggestions on this.

Hi Balamurugan,

You should consult with a CA for this.

I want to send Rs. 18,00,000 to my own elder brother in Canada, who is a permanent resident of Canada. Is there any income tax hurdle to do that

Hi Rajnish,

There will be no tax liability in India.

I like to send 2000$ To india(for my mothers bank account to purchase gold bangles as gift to her How much tax do I need to pay And what is the process

Hi Jay,

There will be no tax liability.

I am NRI since 1995 i am working in south Africa last 5 years my company having some financial issues to send the my salary my NRI accountthey advised me to provide my wife account to transfer my salary every months.

If my sibling (Indian Citizen) has a property(residential vacant block) in India, possibly worth 3 Crores and wants to gift to me (I am a citizen of another country and also an OCI), would it be better to gift the land or sell the Land and than gift the proceeds ? Question is which is better in terms of Indian Tax liability for me and my sibling. Can the proceeds of this be transferred to an account in an overseas bank ? Appreciate your advise.

Hi Ram,

It would be better if he sell the property and then amount transfer to your account. You can transfer this amount from your NRE account to overseas bank account.

can an NRI gift shares to his brother in India

Hi Ajay,

No he can’t.

Can I give ti gift to son in america

Hi Karan,

Yes you can.

My friend want to send me some money from USA, want to know the taxation and other proceedures

Hi Nagamani,

Amount will be taxable. For the procedure you should consult with a CA.

Hi , my dad want to gift me some money from India . Can you please update me do I have to pay tax in UK on this amount ? It will be aprox. £40k

HI Ankush,

You should consult with a local tax advisor in UK

transfer of farm land sale proceed to US.

Hi Jag,

Yes, you can bring the proceedings to the US. It is recommended that you get the payment of the property through proper banking channels. Documenting proof is required for transferring money on sale of property. The first step is to get a certificate from a Chartered Accountant (CA) in India. Once you have the CA certificate along with ‘Form 15CB’, the next step involves taking the signed undertaking along with the CA certificate on Form 15CB, to the bank where you have your NRO account. Your bank will transfer your money abroad. There is a limit of USD1,25,000 per year that includes sale proceeds of up to two immovable properties held by NRIs

My mother has 3 children. Out of 3 children my mother wants to gift India’s house to my sister. We don’t have any objection for that

Can i gift a property to a same sex partner who is a foreign citizen by birth?

Hi Sam,

Yes.

Can I get Singapore dollars as gift from my sister who is NRI and Singapore citizen

Hi Pramak,

Yes.

Can a OCI Person gift money to brother in law. Will there be tax charged.

Hi Sonali,

Yes.

Is any gift tax involved in gift being given in property to her son from an NRI to her son an Indian Citizen and property is in India

Hi Tirath,

When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

As a PR holder in USA can I receive money (as a gift) from my father-in-law in India? If so, what’s the annual limit without any tax implications in USA?

Hi Abhishek,

When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

I am NRI, I can transfer money to my relatives and if there any tax applicable.

Hi Minish,

When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

Can RNOR gift his Funds from NRE FD to Daughter,s NRE Account. And is there any limit on amount .

Hi Rajesh,

Yes, You can first withdraw that amount from your account and then transfer it to your daughter’s account.

Can a father gift to his son abroad& the limit

Hi Vishan,

When an NRI gives gifts in the form of cash, cheque, items, or property to a Resident Indian who is a relative, both giver and receiver are exempt from tax in India.

If a NRI send us a gift .who have to pay the tax the donor or the donee

Hi Sangeeta,

Tax on Gifts depends on the relationship you share with them.

If the giver is relative then, No Tax will be levied.

But, If he is not your relative and gives the gifts then the Tax will be levied . The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver.

I am an Indian resident. I want to gift my daughter in law in USD who is green card holder in USA how much I can gift without facing any implication

Hi Karan,

The entire gifted money is Exempt from Tax.

Can british citizen residing in spain gift his house in barcelona to niece in india?

Hi Sonia,

Yes, but there will be tax implications.

Sir if a foreigner friend send a luxury items and money through courier and Indian friend deny to accept then is there any consequences

Hi Abhishek,

there is no consequenses.

My son is holding other country passport and if he gets gift of cash money from a local a/c of deceased father can he take it in Nee or nro a/c

Hi Sanjay,

Yes.

I will be recieiving gift money from my father of approximatel 50 lakhs for sale of business which i need to transfer overseas since its a gift i am not willing to pay any taxes. What is the best way to transfer the funds over and what documents will be needed?

Hi Karmjeet,

the Money needs to be transferred in your NRO a/c and then from NRO to NRE A/c and then from NRE to your Foreign Bank Account.

The Documents required for the same are as follows:

1. Indian Passport/ Voters ID/ Aadhar Card or any other Govt. Issued Photo ID Card of the sender

2. PAN Card Copy of the sender

3. Beneficiary Passport Copy

4. Latest Bank Statement (if required, depends on the processing bank)

What tax is levied in india if a us citizen relative gifts them US dollars/INR/immovable property in india

Hi Ganesh,

It depends on the relationship you share with them. If you share a blood relationship with them then no Tax will be levied. But, When an NRI gives gifts in the form of cash, cheque, items, or property that exceeds the value of Rs. 50,000 to a Resident Indian who is a non-relative, the NRI gift taxes India is payable by the receiver. The amount is added to the receiver’s income and taxed as per the income tax slab applicable to the receiver.

can an indian wife receive money from nri u k based husband 30 lakh inr for buying agri land in india with paying gift tax .

Hi Vijay,

Yes, She can but.

I am buying a property in India as a NRI what is the best way , shall I buy just use my arhat and pan card to show am still a resident or buying in dads name and gift to NRI , as it’s agricultural land which we came to know later. For the future selling and transaction, which is the best.

Hi Shalini,

NRIs can not buy agricultural land.

My daughters 2 of them had PPF account extended before becoming NRIs , their PPF matures in 2023 . Can they gift the proceeds to mother or father without having to pay any tax by daughters and parents ,as PPF proceeds are EEE tax exempted .

Hi Shobhna,

Yes, they can gift.

I am a non-resident Indian living in the UK and I wish to make provision through my will to leave a resident Indian a sum of money. We are not relatives, just friends. My belief is that this is free of taxes for both me and the receipient as this is left through my will. Please can you confirm this, and also confirm if there is a limit to the amount in Rs or USD equivalent

Hi Andy Barr,

Yes, you can do the same.

My boyfriend sended me gift which is on the way to India it’s costing is 4000 pounds .. how much tax i have to pay in India

Hi Megha,

Kindly consult with your CA.

If my friend send me gift from abroad my friend told he already paid for courier fees.then after my gift reached india i need to paid for tax again or what

Hi Karan,

No.

Hello Hemant, I looked over your gift deed format and article, and was wondering if it needs to be on a stamp paper or plain paper is fine. If stamp paper is needed is there any denomination that is recommended?

Hi Ravi,

No.

My father is NRI living in UAE for 20yrs, can he gift be 1.25CR INR. Do i need to pay any tax

Hi Sujitra,

No. The whole amount is Tax-Free.

I looked over your gift deed format and article, very helpful. The detail that is left out is if it needs to be on a stamp paper or plain paper is fine? If stamp paper is needed is there any denomination that is recommended?

Hi Ravi,

For Financial assets, even Rs 50 or 100 is good enough. In the case of property – it will depend on value and state govt rules.

Thank you!

So I assume for the financial assets the deed need not be registered with the Registrar while for real property they need to be registered at Registrar’s office. Am I right?

I wish to know how much i can recieve as gift from NRI friend?

Hi Vignesh,

Up to Rs. 50000, there is no Tax.

Sending Gift to NRI

I want to send £ 500000 to Uk as sale proceeds from my property sale in india

Hi Karan,

Only 2.5 Lakh USD can be transferred in a Financial Year.

NRI how much amount transfer to india

I am an NRI in Canada and my parents want to gift me around 35000 CAD in a financial year. What are the tax implications for them in India and for me in Canada.My parents are retired.

Hi Amit,

The whole amount is exempt from Tax as you are receiving gift from your Parents

Can an OCI card holder receive gift from someone residing in India?

Hi Devibharati,

If he is your Relative then there is no Tax. If no there will be Tax.

Can NRI person give gift of Rs 1000000 to his brother in law ? Any tax payable in India on gift received

Hi Vijay,

Gift received from the brother-in-law is exempted from Tax.

What is the maxmium amount an NRI in gulf country can send to his wife’s savings account in India ? Is there any limit after it is taxable ?

Hi MD Taslim,

There is no tax implication for you or for your wife for transferring money from one account to another.

Let me known I can I remit money to Canada as gift

Hi Rudra,

Yes. You can

Can a maternal grand mother gift cash to her grandchild tax free.Is she considered a relative in India

Hi Sadhna,

Yes.

In Gift deed, In case of account transfer, Is it require to give bank account details in the deed ?

Hi Yasho,

No.

I wish to gift a property to my siblings in India. I am an NRI. Can I get the property registered to my siblings without having to travel to India?

Hi Pbak,

As per my view, you have to visit India.