The forties often mark a pivotal decade for many, a time of peak earning potential, growing family responsibilities, and a clearer vision of future aspirations. But for Non-Resident Indians (NRIs), this crucial period comes with its own unique set of financial complexities, from navigating diverse tax regulations to optimizing investments across borders.

If you’re an NRI in your forties, it’s more important than ever to take a strategic look at your finances.

In this post, we’ll explore five key checkpoints that NRIs in their forties should prioritize to ensure a robust and secure financial future.

Must Read – 9 Benefits of Early Financial Planning for NRIs

In the case of NRIs, there could be many situations

- Some may be planning to move back to India.

- Others are unsure if they want to retire in their country of residence or in India.

- Some NRIs may want to return to their homeland and work but are not sure how the second innings will turn out.

- Many might have kids who will be pursuing higher education soon and old-age parents back home.

- Some ex-pats might have lost a job and are forced to return to India. Getting a job at that age and in the same role is not very easy.

NRIs have to make the best decisions keeping in mind their unique conditions.

Financial Planning Moves For NRIs in the 40s

As an NRI, here are 5 financial planning Moves for NRIs that you should focus on so that you will reach the goal of financial security.

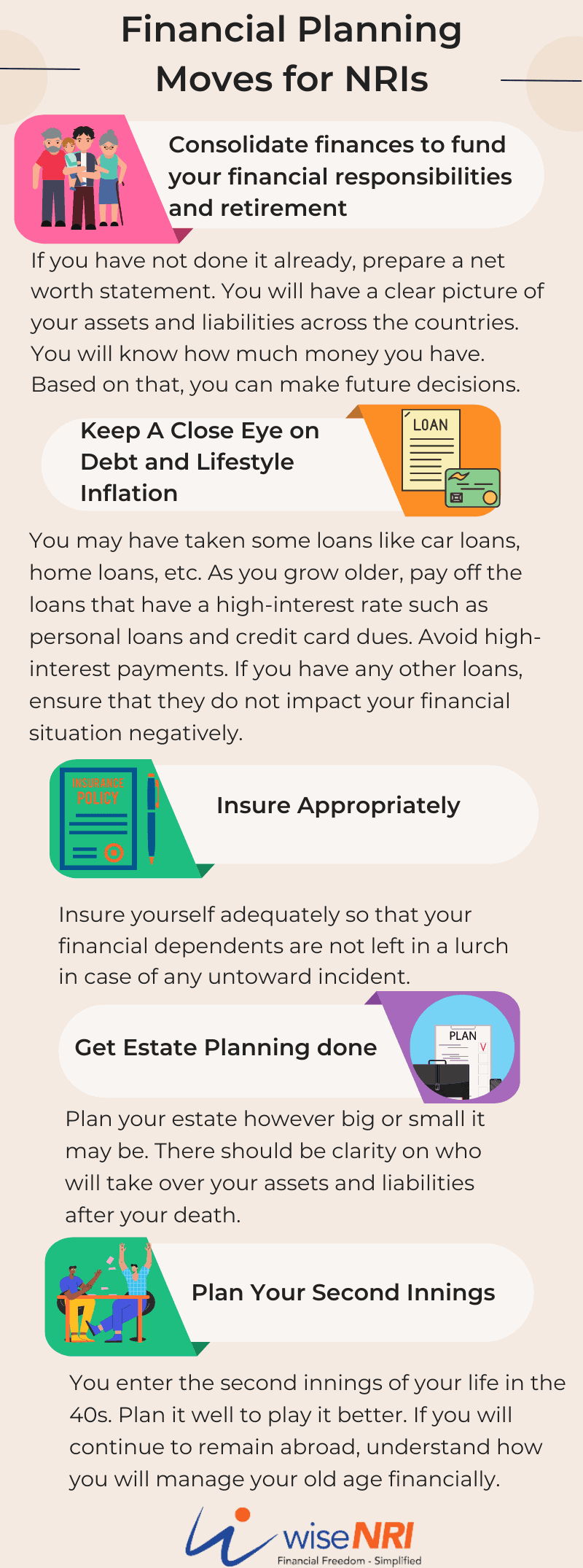

1. Consolidate finances to fund your financial responsibilities and retirement

- If you have not done it already, prepare a net worth statement. You will have a clear picture of your assets and liabilities across the countries. You will know how much money you have. Based on that, you can make future decisions. If you have lost your job, you will know how urgent it is to get a job. Can you wait for the right opportunity or you have to take the first job available?

- Check whether you are on track to achieve your financial goals. If you are on track or ahead of your timeline then it is good, or else you have to make changes to the financial plan. If your child is going to study abroad in a few years, and you have to finance it, you will have to consider if you have enough money or you need to take some specific actions for it.

You have some more years to work and earn an active income, but retirement is in the near future. Work towards having enough funds for a comfortable retirement and for medical emergencies.

- Mishra is a well-to-do businessman. But Mrs. Mishra steers away from his financial matters. She says she is happy as long as she has access to money for her needs and wants. This is immature thinking. Involve your spouse in your Financial Problems. He/She must be aware of your net worth and how you plan to distribute your assets. In case of an emergency, the spouse should have access to manage the wealth.

Check – 5 Financial Must-Haves for NRIs

2. Keep A Close Eye on Debt and Lifestyle Inflation

- You may have taken some loans like car loans, home loans, etc. As you grow older, pay off the loans that have a high-interest rate such as personal loans and credit card dues. Avoid high-interest payments. If you have any other loans, ensure that they do not impact your financial situation negatively.

- Rakesh has 2 cars for a family of three people. Now he wants to buy an expensive sports bike too as it looks good and he can afford it too. When you have a higher disposable income, you tend to spend more. As an expatriate or an NRI, there is an inherent expectation that you should have a flashy lifestyle. It is fine to splurge occasionally but Do not waste money on a fancy lifestyle, spend carefully i.e. only after saving and investing. In the future, your savings and investment matter more than an inflated lifestyle.

3. Insure Appropriately

Insure yourself adequately so that your financial dependents are not left in a lurch in case of any untoward incident.

If you do not have one, buy a term insurance plan. It is valid even if you are abroad provided you inform the insurance company. If you have a term plan, check if its value will be enough to provide a financial cover for your family. If not, increase the sum assured amount.

It might be prudent to take a medical insurance policy so that medical care does not create a dent in your pocket. Take a comprehensive health insurance policy for the entire family. If there is a history of critical illness in your family, it might be a good idea to buy additional insurance against critical illnesses.

Check – Financial Planning For NRI – How it’s Different & Complex

“Please remember Insurance is not an Investment – buy sufficient life & health cover this month.” wiseNRI

4. Get Estate Planning done

Plan your estate however big or small it may be. There should be clarity on who will take over your assets and liabilities after your death. Estate planning includes –

- Will Creation/ Update

- The setting of Power of Attorney for your assets

- Tax Planning

- Management of Philanthropic activities

I have not discussed investments in this post.

Must check –How A Financial Planner Can Help?

5. Plan Your Second Innings

- You enter the second innings of your life in the 40s. Plan it well to play it better. If you will continue to remain abroad, understand how you will manage your old age financially.

- If you had aspirations of being a photographer, learn the requisite skills. Figure out how you can use your skills to earn an income. Go back to college or try out an alternative career provided your financial plan has provisions for the college fees or lower income of the alternate career.

- If you will be moving back to India, have a plan in mind. If you will work in India, start looking for jobs and rekindle professional contacts.

- If you want to start an adventure in India, understand the entrepreneurial landscape, market, and economic conditions. It is different from that of other countries. Build an emergency fund in this case that will help you cover expenses when you are starting out.

- If you plan to give back to the community, research and reach out to genuine organizations that will help you make a difference in people’s lives. Volunteering is noble but plans your finances and the family expectations so that there is no despair in the future.

The 40s is a key decade to plan your finances such that you have enough funds for your retirement and at the same time, are able to fulfill your life goals.

Have you ever made a decision SO important, that it became a real “distinction” in life?

If you are in your 40s please share in the comment section – how you are planning to achieve your key goals?

Difference between financial advisor and financial planner

My own Sister is in UK. I want to gift 15lakh to her. Can I transfer the amount to my brother in law a/ c? What is the procedure & what are the implications?

I want to gift money to my Uk citizen grand daughter, how can I ?

I am an NRI in UK just turned 40 , but never done any investment in India ,

Is it too late to start thinking about it ? Looks like I am 10 to 15 years late in investing.

Hi Manish,

The best time to plant a tree was 10 years ago. The second best time is now. So act NOW.

I want to know taxes for stocks market gains

Hi Jayesh,

Check this https://www.wisenri.com/tax-rates-for-nri-indian-income/

I am on H1B and have completed 40 quarters will I be eligible for SSN benefit after my retirement if I am in India and if I am neither green card holder nor citizen.

Hi Himanshu,

According to me, you will get social security benefits even after returning to India. 2-3 years back US Govt made some changes so Indian NRIs are eligible.

I have seen our clients getting this information from govt. sites that clearly share the amount that you are eligible for.

Dear hemant ji

I am likely to fall in the category of NRI loosing job at the age of 49 in next 4 month fortunately i am also from jaipur, during last 3 years i enriched skills of technical analysis of equities on findamental analysis i could not focus much

I read your blog for nri in 40

My plan is to come back and start carrier in investing company as during 3 years study of financial market this has facinated me

I am not invested even 3 % of my savings in equities

I just want to know can i survive in jaipur being an SIP invester and can get job with a investment agency

Dear Anurag,

My suggestion is you should start a job in any investment company to learn more. After that, you can use that knowledge on your investors or starting something on your own.

Bw I am against equity trading…

I’m also against equity trading as well. I am looking for a service to take care of my Demat account and do retail stock investing using Buffetology in India on my behalf. Why doesn’t Wisenri have a service to do that?

Dear Sreeram,

We focus on Financial Planning. Direct equity requires huge energy with very limited alpha.