Before March 2020, we had planned vacations, big ticket purchases, destination weddings, education abroad, etc. But the pandemic ensured none of them went as per plan. Education abroad became education online, destination weddings became at-home affairs, and vacations became board games at home. While initially shocked and scarred, we lived through it, initially scrambling along but later with a different plan of action – Plan B.

If the dreaded COVID-19 pandemic taught us anything, it is to have a Plan B. We at wiseNRI think it imperative for NRIs to have a plan B for their finances. So many aspects of our lives may not pan out as per our plan, and we have to be ready financially to adapt to the changed circumstances.

Must Read – Financial Planning For NRI – How it’s Different & Complex

NRIs must have Emergency Fund

An emergency fund is a vital financial safety net that provides individuals and families with a buffer against unexpected events or financial crises. It is a designated savings account specifically set aside to cover unforeseen expenses, such as medical emergencies, car repairs, job loss, or unexpected home repairs. The purpose of an emergency fund is to avoid resorting to high-interest debt or depleting long-term savings during times of financial strain.

Having an adequate emergency fund is crucial for financial stability and peace of mind. We recommend saving three to six months’ worth of living expenses in an emergency fund. The exact amount needed may vary based on individual circumstances, such as job stability, family size, and insurance coverage.

By having an emergency fund, individuals can respond promptly to unexpected challenges without disrupting their overall financial plan. It serves as a safety cushion during times of uncertainty, reducing stress and allowing people to focus on resolving the situation.

Building an emergency fund requires consistent savings discipline. Individuals can start small and gradually build the fund over time. It’s essential to keep the emergency fund in a liquid and easily accessible account, such as a savings account or money market fund, to ensure immediate access when needed.

Having a well-funded emergency fund is a critical aspect of overall financial planning. It offers a sense of security and empowers individuals to navigate through life’s uncertainties with greater confidence and financial resilience.

Why NRIs Should Have a Plan B

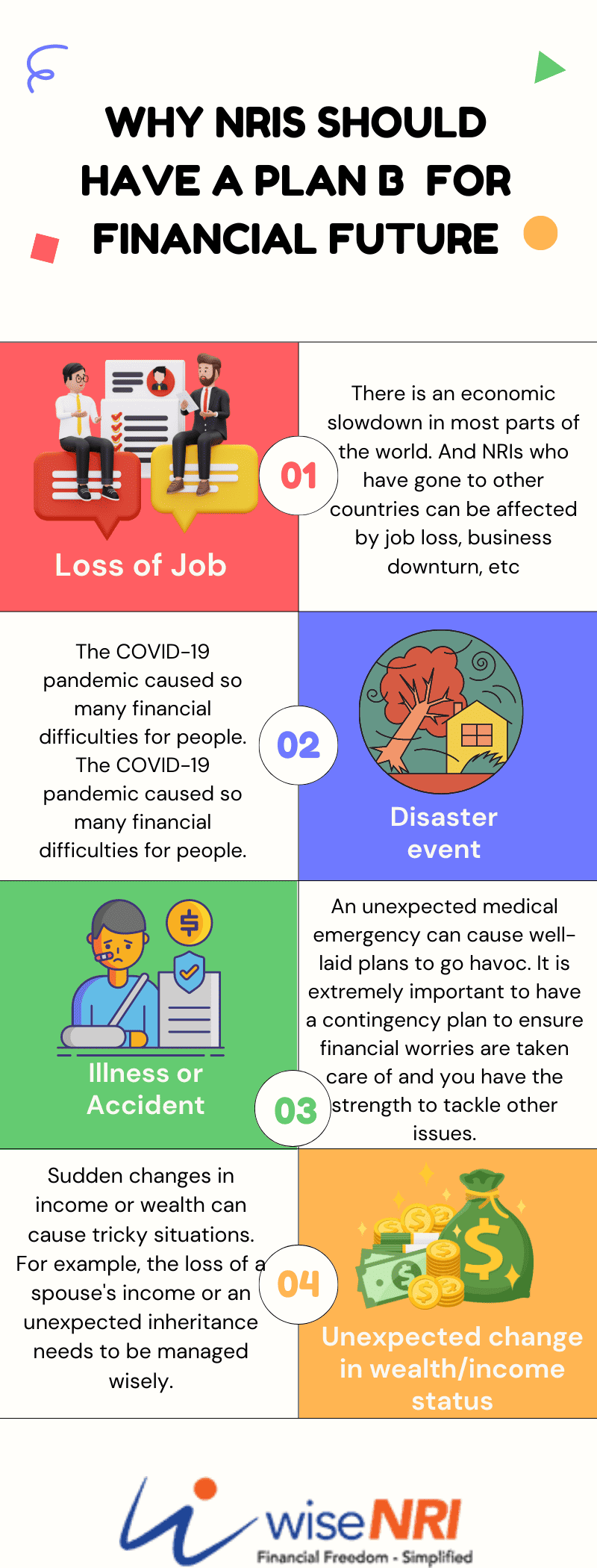

Loss of Job

There is an economic slowdown in most parts of the world. And NRIs who have gone to other countries can be affected by job loss, business downturn, etc. Apart from the loss of income, you may have to look at alternate solutions if your residency is tied to your job or business.

It is difficult to plan something when you are in the midst of a crisis. Therefore, ensure that you have a plan B and put it in execution mode. You can build a good professional network. Invest in learning new skills so that your professional skills will be updated and it will be easier for you to get back to work. Enhance skills in your hobbies and passions to find ways to earn income through them.

Must Check – 9 Benefits of Early Financial Planning for NRIs

Disaster event

So many lives have been uprooted because of the war between Russia and Ukraine. Many Indians living and working in Ukraine had to evacuate to other countries. The COVID-19 pandemic caused so many financial difficulties for people. The COVID-19 pandemic caused so many financial difficulties for people. For example, a person who had to go abroad for a job could not have done so due to the lengthy lockdown, and they would have to look for alternative sources of income.

With so much uncertainty around, you need a Plan B. A good idea will be to set aside an emergency fund that can be easily accessible and usable. Typically, the emergency fund should be equivalent to 3-6 months of your expenses.

Illness or Accident

An unexpected medical emergency can cause well-laid plans to go havoc. It is extremely important to have a contingency plan to ensure financial worries are taken care of and you have the strength to tackle other issues. A health insurance cover that is valid in the country of residence and India is a must. Ensure that you have enough accident cover in both countries. Your nominees should also be aware of how to claim the insurance amount.

Check – Health Insurance for NRI in India

Must Check – Five Financial Tips for NRI

Unexpected change in wealth/income status

Sudden changes in income or wealth can cause tricky situations. For example, the loss of a spouse’s income or an unexpected inheritance needs to be managed wisely.

While working abroad, changes in the job situation can cause issues in your residency, which can lead to increased expenses. Investments in liquid funds can help you tide over such matters.

If you have gained wealth in India unexpectedly, your financial plan must be able to accommodate it. Else one can be tempted to squander away the money, or it will lose value over a period of time if left lying idle. A financial advisor who has the expertise and experience in handling investments for NRIs in India can help you manage these funds such that you grow your wealth and earn optimal returns.

Life is designed such that change is the only constant in it. There can be many unexpected situations. While we may not be able to predict each of them, we can have a broad strategy in our financial plan for managing such events. It will help our overall financial well-being.

We’d love to hear about a time when your Plan B came to the rescue and saved you from a financial disaster. Please Share your story with us in the comment section!

How should i send my funds to India as an NRI so i dont need to pay taxes ??

How can I gift an amt.Rs.60lk to my son at Chicago?