India was well on the verge of the complete digitization of many of its corporate and taxation-related services and regulatory requirements. The pandemic and associated restrictions only hastened the digitization process. Today most of the work requires digital submission of forms, documents, evidence, and vouchers.

Till a few years ago, you had the option to transact with the government and its regulated agencies in physical as well as digital mode. But that has changed as most of the services, especially of the Income Tax department, Central Board of Indirect Taxes (CBIC for GST), and Ministry of Corporate Affairs (MCA) have turned faceless and paperless.

Must Read- NRIs Moving from one Foreign Country to Another – Checklist

This certainly means faster response time, accuracy in processing, and fewer chances of corruption. But it also means that now there is not even an option to submit documents in the physical form.

A digital signature is the only way to ascertain the validity of such electronically submitted documents by certifying the identity of the sender. Routine tasks like e-filing of ITR as well as one-off tasks like the incorporation of a Company or an LLP require a Digital Signature Certificate (DSC).

A digital signature is like your physical signature – unique and establishes that you were the one who prepared, sent, and authorized the document in question. It is used to authenticate the identity of the sender of a digital document/message as well as the integrity of the document/message itself.

The Information Technology Act of 2000 made digital signatures legal, non-repudiable, and valid for all electronic documents and digital communication. The technology for generating and verifying a DSC has evolved and uses the latest security standards in public-private key encryption.

Why do NRIs Need a Digital Signature Certificate?

Just like any other person, Non-resident Indians or NRIs also need to transact their business with the government departments and regulated agencies like banks. Therefore, for transacting with a government agency, NRIs also require a Digital Signature Certificate.

The need for NRIs to adopt DSC is exacerbated by the fact that they live abroad and cannot present themselves every time for authentication and identity verification. This does not mean they cannot conduct business in India or earn here. It simply means that they must have a digitally verifiable identity to do so.

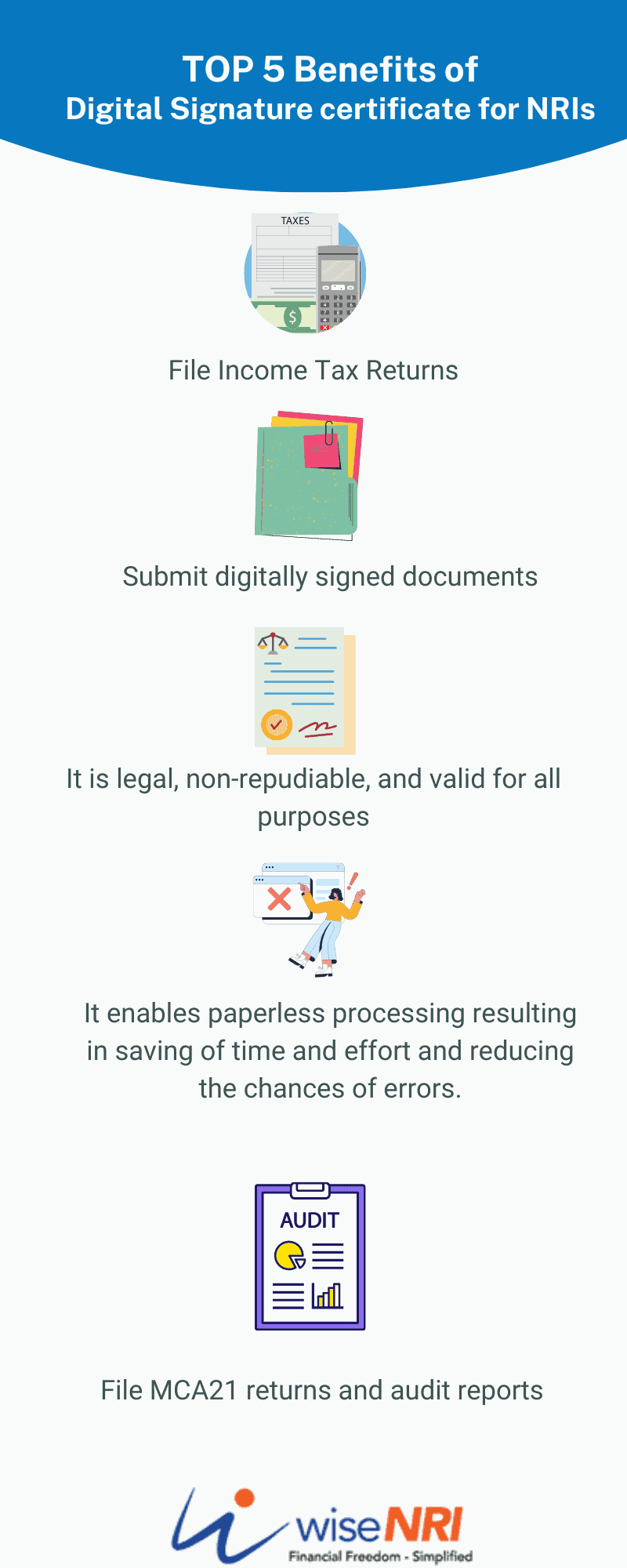

With a valid DSC, an NRI can:

- File IT returns

- Submit digitally signed documents

- Incorporate a company or limited liability partnerships

- File MCA21 returns and audit reports

- Open & operate a corporate bank account

- Participate in the e-tendering process

- Participate in e-auctions

- Secure email communication between you and your business associates, including your lawyers, POA holders, bankers, CAs, and brokers who are in India.

Must Check – NRI Checklist

Advantages of Digital Signature Certificate for NRI

- It enables paperless processing resulting in saving of time and effort and reducing the chances of errors.

- More secure than paper signatures.

- Can be verified independently by any agency as it cannot be altered.

- It is legal, non-repudiable, and valid for all purposes.

Information on a DSC

- Owner’s Legal Name

- Owner’s Public Key

- The expiry date of the Public Key

- Name and details of the issuing Certifying Authority (CA)

- Unique Serial Number

- Digital signature of the CA

Are Digital Signatures Certificate mandatory?

According to the MCA, a Digital Signature is mandatory for the following:

- Directors of a company

- Auditors

- Company Secretaries – in job or practice

- Bank Officials

- Other Authorized Signatories

But as digital signatures are now required for secure email communication as well as for filing ITR, they are virtually required for everyone with those needs. But according to the needs of the users, the DSCs are categorized into different classes.

Digital Signatures mandatory Classes

- Class I: The simplest and cheapest class used for securing email communication.

- Class II: This DSC verifies the identity of the owner from a trusted and pre-verified database. It can be used for all purposes except e-tendering and e-auctions.

- Class III: This highest class of DSC can be used for all purposes, including for e-tendering and e-auctions. The person requesting this class of DSC must undergo in-person verification (IPV). The IPV process can be done by physically submitting applications and identification documents at the offices of a Registration Authority (RA) or now also through video calls on a secure platform.

If you are already into business or plan to foray into one shortly, we recommend that you apply for and get the Class III DSC from the beginning instead of buying different types of DSCs. The Class III DSC can be used for digitally signing the documents as well as protecting them with encryption.

Documents Required for Obtaining DSC

The documents required to apply for a DSC are:

- Copy of Passport (front and back) duly attested by the local Indian Embassy/Consulate

- Attested copy of valid Visa

- Attested copy of the resident permit

- Attested bank statement for past 12 months

- Attested copy of the PAN card

- Apostille copy of the driving license

Process of Obtaining DSC from a CA

The Controller of Certifying Authorities, under the Ministry of Electronics and Information Technology, Government of India has issued detailed guidelines on how to obtain a Digital Signature Certificate. You can directly approach any licensed Certifying Authorities (CAs) with attested copies of the documents with original documents in support.

The new Aadhaar-based eKYC allows you to obtain DSC without you being physically present via IPV done through a secure video call. The process to do so is simple and takes a maximum of two days.

The steps to obtain a DSC for NRI are:

- Visit the website of any licensed CA

- Purchase the appropriate plan

- Upload documents on a secure vault

- Fill up the form or you can take their assistance

- IPV through secure Video-call and Aadhaar-based OTP

- Issuance of the Digital Signature Certificate with the USB token being dispatched

Must check –Estate Laws For NRIs In India

Frequently Asked Questions

Who is a certifying authority?

The Controller of Certifying Authorities, under the Ministry of Electronics and Information Technology, issues licenses to a legal person to issue a digital signature certificate u/s 24 of the Information Technology Act of 2000. All licensed CAs essentially work as the sub-contractors under the Root CA of India.

What is the cost of obtaining a DSC?

The cost of a DSC depends on three factors:

- The DSC class – I, II, or III.

- The DSC validity – can be 1 to 2 years.

- The Certifying Authority.

As the DSC is a commodity, you may be tempted to go for the cheapest one, but the level and quality of service is the differentiating factor. Please take their review from other NRIs who already have a DSC.

Can the DSC and USB token be sent to a foreign address?

Usually, the DSC and the USB token are sent to only Indian addresses and the shipment cost is part of their service charges. But if you want it delivered to a foreign address, then you may have to pay extra for shipping. Some of the CAs may not deliver the DSC to certain jurisdictions, so place your order only after ascertaining for sure.

How do I reduce the size of PDF e-forms after digitally signing them?

Once a PDF document is digitally signed, its file size increases manifold. In the Adobe PDF editor/creator You can take the following steps to limit file size while digitally signing them:

- Open your PDF editor.

- Go to the Preferences or Settings Option.

- Find the Signature option and open it.

- You will find an option that says, “Include signature’s revocation status.” This is by default enabled, so disable/uncheck the option.

Check the preference settings of other PDF editors like Foxit or Nitro in a similar manner.

Hope you got a good idea about Digital Signature for NRIs – please share your experience in the comment section.

What is the cost for nri Dsc signature ?

Pls suggest licensed CA for applying DSC

we want to make a DSC for our NRI client

Can NRI sign inheritance real estate documents electronically from USA and How can you help

I am a NRI and do not have Aadhar. What is the procedure to get DSC

Requirements for DSC for foreign nationals

Is Indian mobile number required for filing of Income tax returns ? If I am staying in foreign country