Financial management takes center stage in the lives of Non-Resident Indians (NRIs), and one critical aspect of this is debt management. As NRIs navigate the intricacies of living and working abroad, understanding how to manage debt effectively becomes paramount.

In this comprehensive guide, we explore strategies and insights on how NRIs can successfully handle their financial obligations, optimize debt, and secure their financial future while residing away from home.

What is Debt Management?

Assets and liabilities are the main components of an individual’s finances. An asset is anything that holds value, like a home, equity shares, jewelry, etc. Liabilities are debts or obligations owed to other people or institutions.

Must Read – Why NRIs Should have a Plan B for Financial Future

You will have a positive net worth if the value of your assets is higher than the value of your liabilities, else a negative net worth. The value of assets must be more than the value of your liabilities to avoid financial problems.

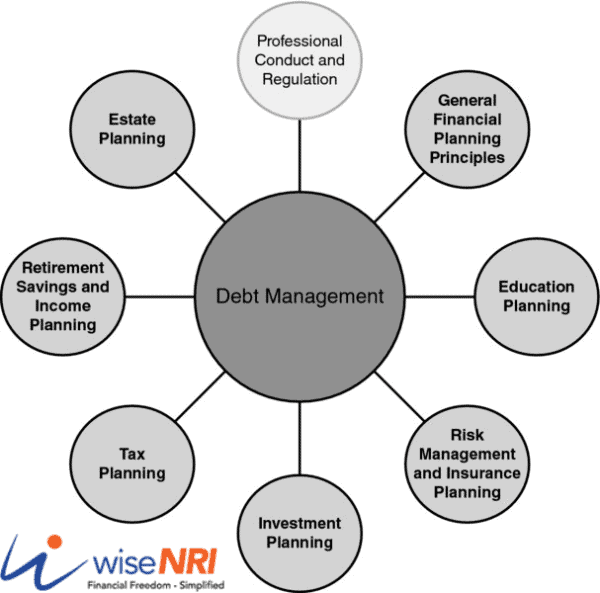

Debt management is a systematic method to get your debt under control through financial planning and budgeting. The aim of a debt management plan is to use these strategies to help you decrease your debt and move toward eliminating it.

Importance of Debt Management:

Why debt management is crucial in an individual’s life and the potential consequences of not managing debt effectively:

1. Financial Stability: Effective debt management ensures that your financial obligations are met consistently, reducing financial stress and creating a stable foundation for your future. It helps in maintaining a healthy balance between income and expenses.

2. Savings and Investment Opportunities: Proper debt management allows you to allocate funds for savings and investments. It enables you to grow your wealth and achieve your financial goals, such as buying a home, funding education, or retiring comfortably.

3. Creditworthiness: Managing debt responsibly positively impacts your credit score. A good credit history opens doors to better borrowing terms, lower interest rates, and improved financial opportunities. It’s an asset when seeking loans for significant life events like purchasing a car or a home.

Consequences of Inadequate Debt Management:

1. Mounting Interest Costs: Failing to manage debt effectively can result in accumulating interest charges. Over time, this can lead to a significant financial burden, making it harder to pay off the debt.

2. Credit Problems: Late payments, defaults, or excessive debt can harm your credit score. A low credit score can limit your access to credit, increase borrowing costs, and negatively affect various aspects of your financial life.

3. Stress and Financial Insecurity: Uncontrolled debt can cause emotional stress and anxiety. It may lead to a cycle of financial insecurity and hinder your ability to plan for the future. Ultimately, it can impact your overall well-being and quality of life.

Effective debt management is essential for achieving financial stability, enabling savings and investments, and maintaining a strong credit profile. Failing to manage debt can lead to mounting interest costs, credit problems, and increased stress, potentially derailing your financial goals and overall financial well-being.

Why will NRIs have debts in India?

As an NRI, you will have financial interests in India. You might be interested in owning a property or require cash to manage some exigencies for which you can take loans in India. NRIs can avail of different kinds of loans in India. For example, they can get home loans, car loans, and even personal loans subject to certain rules and regulations. If you use credit cards associated with your Indian bank accounts and do not pay the dues regularly, the balance will accumulate, leading to credit card debt.

Must Check – Creative Ways for How NRIs Can Save Money

What are the legal and regulatory frameworks for NRI debt management in India?

The loan for buying a vehicle or property is secured, and the bank will keep it as collateral until you repay it. Typically, the payment duration for personal loans is up to 5 years, and for vehicle and home Loans, it can be up to 7 years and 30 years, respectively.

Non-payment of interest and principal can lead to legal action, losing the asset in case of a secured loan, deterioration of credit profile, and a negative impact on CIBIL score.

How can I manage debts better while living abroad?

- Make timely payments on the loans you have in India and abroad to avoid paying more cash in terms of interest and penalties.

- Avoid getting trapped by lifestyle creep. It happens when your lifestyle or standard of living improves as your discretionary income rises. It is hard to resist lifestyle creep when you are abroad. You spend more because you can afford to and start buying things you don’t need. For example, you fly business class, purchase your third car or start using high-luxury brands. It can lead to a spending trap, leading to non-repayment of existing debts and incurring new ones.

- NRIs incur large expenditures for “friends” and “relatives” back home. From funding trips bearing hospitalization costs to paying off loans, NRIs are unable to refuse any of these big expenditure items as they suffer from the guilt of being too far away. It can lead to a mismanagement of personal wealth.

- Devise and execute a debt management strategy. Create a plan to ensure that you become debt free. List down the various outstanding loans, the type, and the interest outgo for each of them. Incorporate full payments in the monthly budget. If that is not possible, either pay off the loans with the highest interest rates and shortest tenure first or allocate a percentage to each loan payment and ensure you never miss any of them.

- Take stock of your financial position in India regularly. You might have a lot of financial interest in India. Review your financial portfolio periodically and take steps to keep it healthy. Banks, financial institutions, and well-wishers will try to sell many products or services that may not be suitable or even detrimental to your financial position. Be wary and do your research thoroughly so that you don’t end up losing money

- Seek professional assistance. A financial advisor can help get debt under control as part of the financial planning exercise. They can analyze the financial position and identify existing and potential problem areas. They can create a debt payback strategy and execute it to reduce debt and improve your overall financial health.

Debt management should be an integral part of financial planning for an NRI. While good debt can help you create wealth, bad debts can cause dents in your financial position. Keep a check on your debts so that they do not become a burden and disrupt your financial progress.