A growing number of NRIs and Indian passport holders living abroad work for Indian employers or serve Indian clients. Many are not sure if NRIs working remotely for Indian companies can legally continue their employment while remaining outside the country. Whether you’re a full-time remote employee of an Indian company, a freelancer billing an Indian business unit, or a digital nomad travelling the world with an Indian passport, you need to understand the tax implications and adhere to the taxation laws. With stricter scrutiny of cross-border workers, evolving DTAA rules, and special provisions aimed at digital nomads and HNIs, it is critical to understand NRI remote work tax rules in India and comply with applicable regulations.

Must Read – Income tax for NRIs

The rise in digital nomadism has made it easier than ever to live abroad while earning from anywhere. Advancements in technology, flexible work cultures, and widespread adoption of remote-first roles have encouraged many NRIs and Indian passport holders to build careers outside India while maintaining professional ties with Indian employers or clients. Countries like Estonia, Croatia, and several Southeast Asian nations offer digital nomad-friendly visas, low-cost residency options, and relaxed tax residency rules. This makes long-term living abroad more attractive. With better quality of life, stable family environments, and spouses settled overseas, returning to India for work is often neither necessary nor feasible for many NRIs working remotely for Indian companies.

Can NRIs Work Remotely for Indian Organizations? Legal Rules Explained

NRIs, digital nomads, and Indian passport holders living abroad are allowed to work remotely for Indian companies or serve Indian clients. What matters is not the permission to work, but the taxation and compliance framework that applies when you earn money from India while living overseas. When you get paid by an Indian employer, or you bill an Indian client and get the proceeds, you fall under tax governance in India. The tax rules applicable to you and the tax payable by you are based on your residential status, where the work is performed, and where the income is received under NRI remote work tax rules in India.

This blog outlines the critical factors you need to understand about taxation, so you can meet all compliance requirements and manage your income and taxes to keep the tax liability as low as possible while working remotely for Indian companies as an NRI.

Residential Status Determines Tax Liability

An individual is considered a tax resident in India if they stay for 182 days or more in a tax year. If an individual stays in India for fewer than 182 days, they will be classified as an NRI.

If an individual stays in India for at least 60 days in a tax year and has spent 365 days in India over the past four years, they would be classified as a tax resident; otherwise, they would be considered an NRI. If an individual’s income is below ₹15,00,000 in India and they visit India, they are exempt from this rule and would be considered an NRI remote work tax rules in India.

If an NRI or PIO earns over ₹15,00,000 in India, they will be classified as RNOR if they stay in India for 120 days or more in a tax year and have stayed in India for more than 365 days in the past four years. As an RNOR, their Indian income is taxable, while their global income remains exempt.

Salary Income Tax Rules for NRIs Working Remotely for Indian Companies

If, as an NRI, you render services in India irrespective of your location, your income is fully taxable. The Indian employer must determine whether TDS applies and, if income is taxable in India, the employer is responsible for TDS at the applicable non-resident rates. When payment is made to an NRO account, the employer has to withhold the requisite TDS and provide Form 16/16A as applicable. The employer should also obtain and retain documents proving the employee’s residency status to justify the TDS treatment.

Read more –RNOR Status

Freelancer Income Tax Rules for NRIs Working Remotely for Indian Clients

If an individual earns freelance income, business income, royalty, or technical/professional fees from Indian sources, the amount received is fully taxable, considering the residency rules and the amount received. It should also be noted that if services are performed abroad but income is received directly into an Indian bank account, the income may be taxable in India. This might apply to digital nomads who use their Indian bank accounts to receive fees or income. GST is applicable to NRIs who supply goods or services from outside India to individuals or businesses in India. GST registration becomes mandatory for NRIs if their annual aggregate turnover exceeds the prescribed threshold limits. For regular businesses, the threshold limit is generally ₹40,00,000 for Goods with some differences in the threshold limits for special category businesses and states and regions in India. A non-resident is required to make an advance tax payment equivalent to the estimated tax liability.

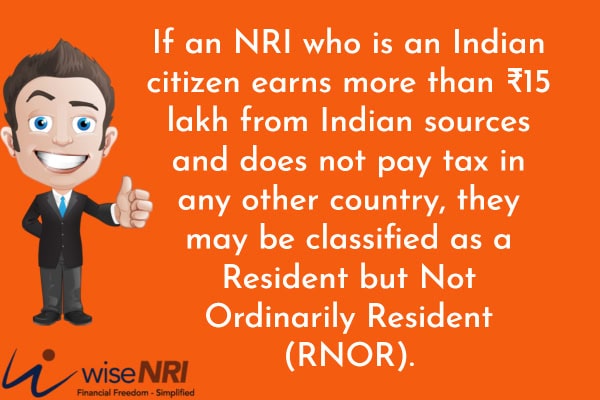

RNOR and Deemed Residency Rules Under NRI Remote Work Tax Rules in India

If an individual NRI is an Indian citizen, earns more than ₹15,00,000 from Indian sources, and is not paying tax in any other country due to their residence or domicile, they can be classified as a Resident but Not Ordinarily Resident (RNOR).

PAN and Income Tax Filing Requirements for NRIs Working Remotely for Indian Companies

If an individual (NRI or digital nomad) has a PAN, it may be better to file an income tax return, even if tax is not payable. It will keep income tax records in order, avoid the PAN from being raised in routine IT department scrutiny, and prevent identity theft and fraudulent tax returns.

Filing taxes as an NRI can be complex due to changing tax regulations and residency status. Proper understanding of the rules, appropriate documentation, and strategic tax planning are essential to minimize tax burden and ensure 100% compliance.