Many NRIs who acquire foreign citizenship worry about their property, bank accounts, and investments in India. This legal implications of renouncing Indian citizenship for NRIs.

What Is Renunciation of Indian Citizenship?

Renunciation of Indian citizenship refers to the voluntary act of giving up one’s Indian nationality, usually after acquiring foreign citizenship.

Under Indian law, once an individual renounces citizenship:

- They are no longer entitled to rights such as voting.

- They cannot hold an Indian passport.

- They lose access to certain government privileges.

- They are legally treated as a foreign national in India.

For NRIs, this change in legal status has direct consequences on property ownership, taxation, investments, and banking arrangements.

Must Read- NRIs Working Remotely for Indian Companies

Key Financial Implications After Renunciation

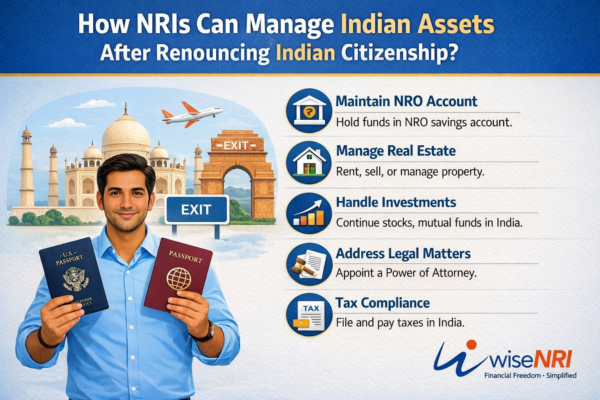

Understanding the financial and regulatory impact is essential for proper NRI asset management after renunciation.

1. Closure of the NPS Account

If you have renounced your Indian citizenship and do not hold an OCI card, the PRAN/NPS Account held will be closed and the entire accumulated corpus or the pension wealth will be transferred to the Non-Resident Ordinary (NRO) account. The key documents that you have to provide are:

- An undertaking that you have renounced your Indian citizenship and do not hold an OCI card.

- Valid certification of renunciation of Indian citizenship/Surrender Certificate/Cancelled Indian passport.

The NPS Trust and the Central Recordkeeping Agencies (CRAs) will vet the documents. On the successful vetting of the documents, they will process the closure of the NPS account and transfer the accumulated corpus to the NRO Account, as per the FEMA guidelines issued by the RBI.

The proceeds will be credited to the NRO account and will be subject to applicable income tax provisions. The credit balances and interest earned on the NRO Account are taxable as per the individual’s tax slab.

2. Agricultural land and other real estate

Once you renounce your Indian citizenship, you would be considered a foreign national. As a foreign national, resident outside India, you cannot purchase any immovable property in India, unless such property is acquired by way of inheritance from a person who was resident in India.

If you have property, that was acquired when you were a resident, you can sell it to a resident in India as long as you comply with the foreign exchange regulations of both countries and have a valid visa to enter India and a proof of your identity and ownership of the property. If coming to India is not possible, then you will have to appoint a Power of Attorney (PoA). You can repatriate sale proceeds to the country you are currently a citizen of. Ensure that you comply with the tax regulations of both countries. Having an OCI card can make the process easier and faster.

If you are an OCI card holder and not a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal, Bhutan, Macau, Hong Kong or Democratic People’s Republic of Korea (DPRK), you can:

- Purchase residential and commercial properties in India. However, you are not allowed to purchase agricultural land, farmland or plantation property.

- Transfer residential or commercial property in India by way of gift to a person resident in India or to a person resident outside India and is a citizen of India or to an OCI card holder resident outside India.

- Retain all kinds of property including agricultural farmland received by way of inheritance. You can also sell it to a resident of India. Proceeds will be credited into your NRO account. Transfer to children who are OCI card holders is permitted subject to FEMA compliance and documentation requirements.

Must Check – Can an NRI buy agricultural land in India?

3.Bank accounts

Once you complete renouncing Indian citizenship for NRIs, you must regularize your banking structure.

- Resident savings accounts must be converted to NRO accounts.

- You may open or maintain an NRE account, if eligible.

- Interest earned in NRO accounts is taxable in India.

Failure to convert accounts appropriately may lead to FEMA non-compliance.

4. Investments (Shares, mutual funds, etc.)

You cannot use your resident Demat account for trading in the Indian stock market. You will need to open a Portfolio Investment Scheme (PIS). You can deal only in delivery-based trades and there are restrictions on intraday trading or trading in currency derivatives and commodities. You can repatriate your investments and gains under the applicable regulations through your NRE/NRO accounts. The income gained from investments in stock markets is taxable subject to the duration and nature of the instrument held. You should check the rules and tax implications regarding investments in a different country that are applicable in the country you live in. For example, residents (not temporary residents) in Australia are taxable on their worldwide income, including gains realized on the sale of capital assets. You must declare income you earn anywhere in the world in Australia.

If tax has already been paid in India, relief may be claimed under the Double Taxation Avoidance Agreement (DTAA), subject to proper documentation.

Understanding cross-border taxation is a critical part of NRI asset management after renunciation.

Giving up your Indian passport can be an emotional decision, but it doesn’t have to mean giving up your connection to India. From real estate to investments, you can manage these assets by staying informed, maintaining proper documentation, and seeking professional advice.