In part two of our reporting on the findings of the survey to gauge “NRI Banking Experience” and to find out the “Best Bank for NRI in India,” we present to you the findings of the survey.

We strongly recommend that you read the first article to understand the methodology – “issues NRIs face with their banks.”

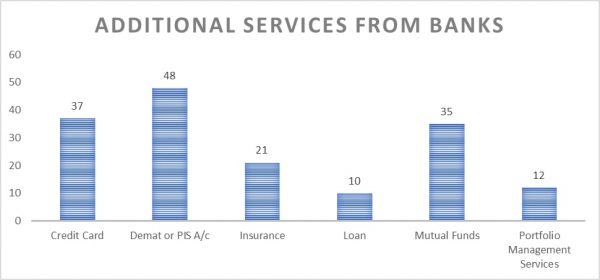

Additional Services from Bank

Must Read- NRE Vs NRO Accounts

- Of the total 86 responses to this question, 7 customers only availed of 1 service from their banks – most of them had “Demat or PIS A/Cs” at 16 followed by “Credit Cards” at 12. 7 customers only had a “Mutual Fund” portfolio with their banks, 6 only had insurance, 2 only had loans, and none had only “PMS” services.

- A higher incidence of the Demat and PIS services along with Mutual Funds shows that NRIs are invested in the India growth story and wish to participate in it.

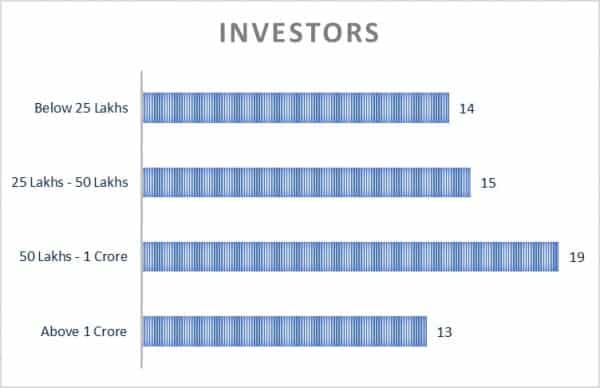

Investment Services

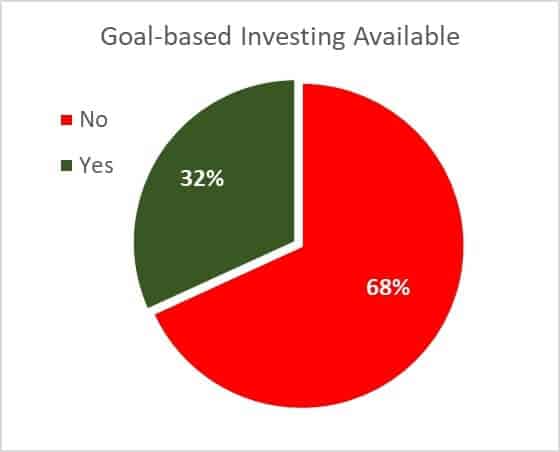

Most investors were from the above 50-lakhs annual income brackets at 52.45%. These are the NRIs with a sizeable investible surplus that their banks can channelize into Indian markets through their Demat/PIS or Mutual Fund services.

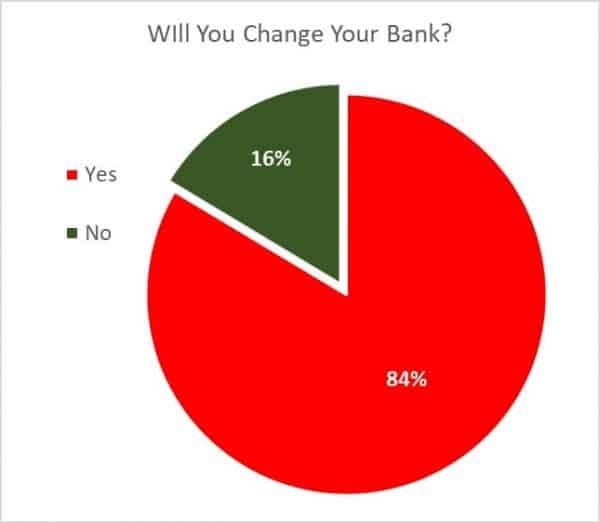

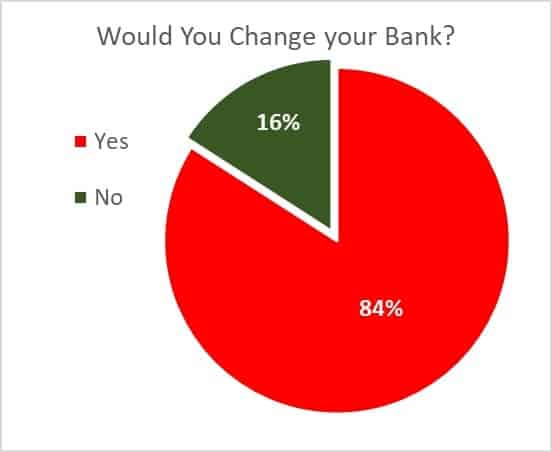

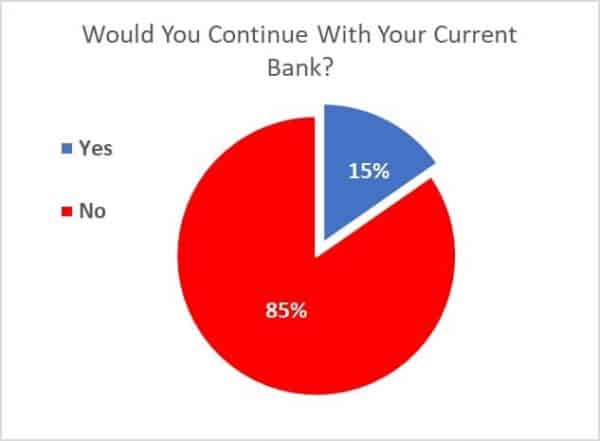

No wonder every 5 out of 6 NRI customers, or 84%, wish to change their banks! This goes on to show that investors have become savvy at least in the sense that they have started recognizing the value and importance of professional advisory.

Check – All About Mandate Holder In Bank Account

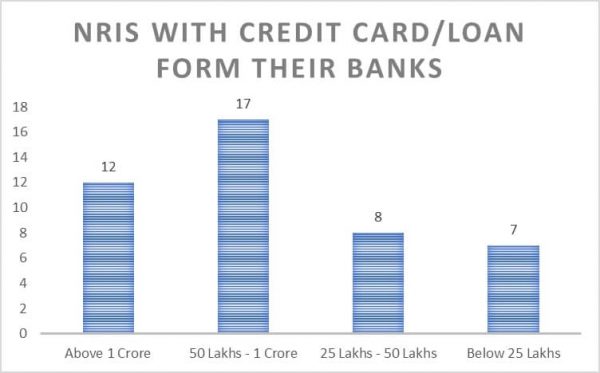

Credit Cards and Loans

Credit planning is an integral part of your financial planning, and its effective management can give you the boost that you need. Taking a loan for business, building a property, or using a credit card for routine expenses is a financially sound decision – provided you are adequately insured, and your financial behavior is prudent.

A similar trend is visible in the credit relationship of banks with their customers.

Must Read – NRI credit cards In India

The people with the most number of credit cards and loans from the banks belonged to the higher annual income levels – 25% earning more than 1 crore annually, and close to 39% earning between 50-lakhs and 1-crore annually. Together they constituted 66%, or two-thirds, of the total respondents with a credit card or a loan.

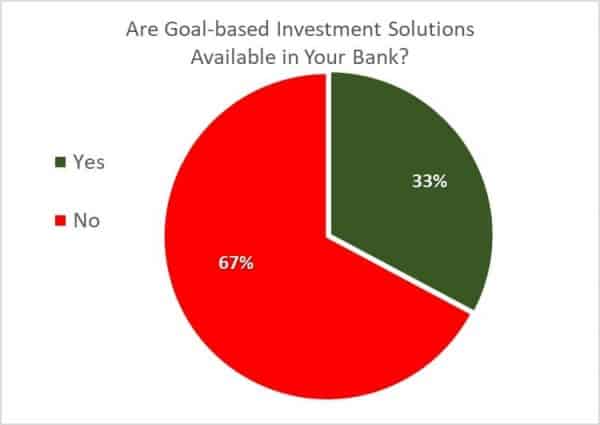

Once again, we see that the users of credit facilities are left wanting personalized goal-based investing services. This is also reflected in the fact that five in every six customers wanted to change their bank. Check – 7 things banker wishes NRIs should not know about Financial Planning

Investors now take financial advice from professionals who are privy to their financial conditions and expect their relationship managers to be on their side. If your relationship managers are acting only as sales agents, or they change frequently, then your customers will always be left high-and-dry.

Read – FCNR account for NRI

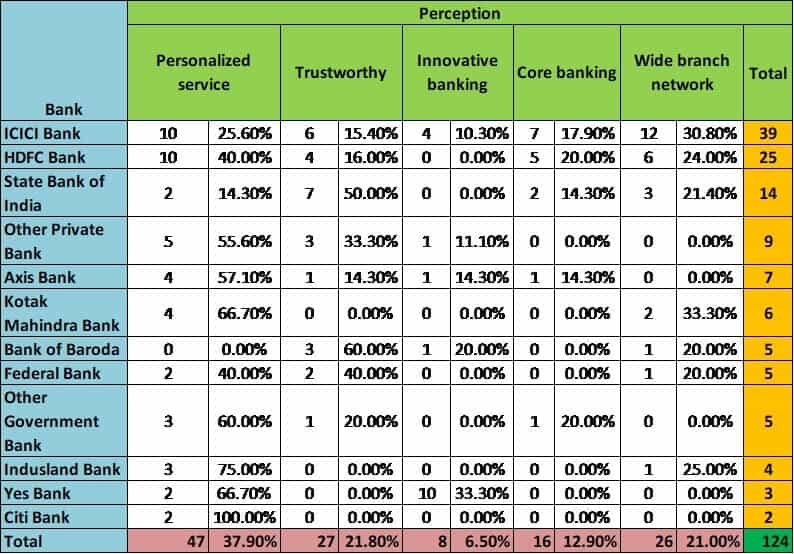

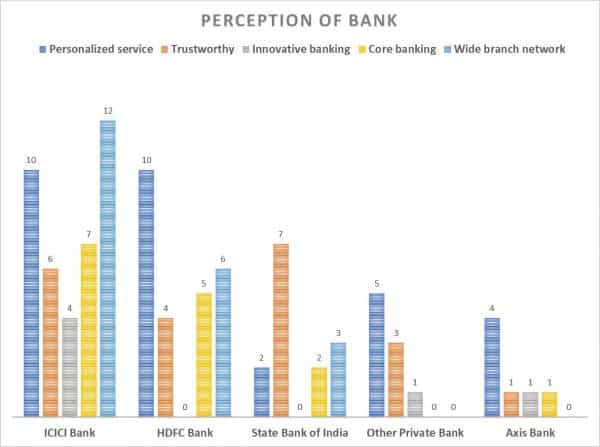

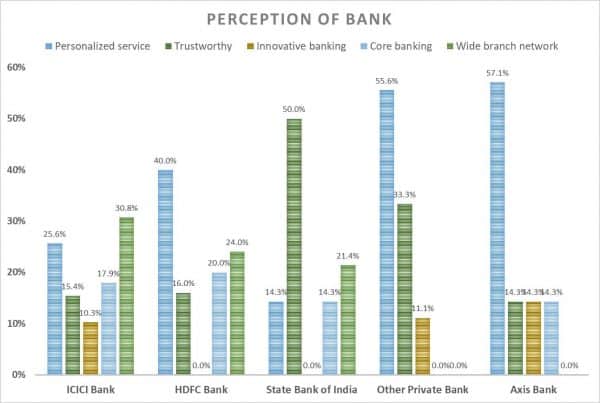

What Comes to Your Mind When You Think Best Bank for NRI in India?

On the perception range, there is usually one specific image or service that stands out for a bank. This one defining service is what anchors a customer to that bank, despite its many flaws and limitations.

We asked our respondents to identify their banks with one of the following defining perceptions that they associate with their banks.

- Personalized service

- Trustworthy

- Innovative banking

- Core banking

- Wide branch network

These are the results that we got.

Read – NRIs Should Read This Before Making a WILL

The figures in percentage represent the proportion of customers who gave first preference to the said attribute for a given bank. For example, in the cell for ICICI Bank, 10 out of 39 customers thought of the bank for its “Personalized banking” services. This was equal to one-fourth or 25.6% of the total respondents for the ICICI bank.

In the two charts below, we present the comparative data only for the top five categories, as they represent 94 or more than 75% of total responses. Other banks’ data is too small to be of any significance and hence left out of this analysis.

The major findings from the above table (for the top-five items only) and these charts are as follows:

- There are four private banks (including the category for other private banks), and only one PSB, the SBI.

- Personalized service ranges from 25% (ICICI bank) to 57% (Axis bank) among the four private banks. It is at an abysmal 14% in the SBI.

- Trustworthiness is highest for the SBI because it is India’s flagship commercial bank with a majority holding with the Government of India. It means it will be the last bank to fail in India – at least that is the popular perception.

- According to the RBI data as of July 14, 2020, there were more branches of PSU banks operating out of India, but still, a very low participation rate indicates people do not rely on their services.

- People give more weight to “Core banking” services as compared to “Innovative banking” services. The reason is simple – first, ensure that necessities are taken care of, then focus on fancy stuff.

- For many NRIs wide branch network – meaning the possibility of having a foreign branch in their city of residence – was the most important criterion. The satisfaction of visiting a branch and conducting business must be very high on their minds.

Must Read –Can NRI Continue With Resident Savings Account In India?

Things You Most Like About NRI Banks India

Out of 124 respondents identified one distinct feature of their bank is its most liked characteristics. The responses ranged from technology (internet and mobile banking) services to the presence of a branch, and from an approachable staff to a large branch network.

As this was a subjective answer, people could write anything. Here we present the most relevant findings:

- For most private banks, technology services – Internet banking, phone banking, mobile app banking – were the key drivers and a distinguishing feature. They compensated lack of branch presence in the vicinity with technological access.

- Most large public sector banks – SBI, Bank of Baroda, and Bank of India – are considered trustworthy by customers because of their government ownership.

- In the smaller public sector and private sector banks, the staff was more approachable and friendly. That is the only way to retain your customers and get a positive reference from them.

- Private banks were ahead of PSBs in introducing innovative features for their customers.

- Smaller private banks were attractive to a few customers for their high-interest rates compared to other banks. In the current scenario of depressed rates (below 5%) on most deposits, who wouldn’t want an extra 1.5 or 2-percent.

- With many PSBs, one of the defining factors was their “Sarkari” attitude of inefficiency and ineptitude.

The Best Indian Bank For NRI

Finally, we are at the juncture to declare the best bank offering NRI banking services. Once again, we wish to state that these results are based on a small sample and are only indicative.

One of the questions that we asked our readers and clients was “Which is the best bank for In India?”

The analysis is for you to see.

Must Read – What Is RFC Account or Resident Foreign Currency Account?

An overwhelmingly large number of people wanted to change their banking service provider. The reasons are many and the top three reasons are:

- Unresponsive RM and staff.

- Lack of financial planning services.

- Inadequate technology solutions.

TOP 10 Best Bank for NRIs – Ranking

The below table indicates the number of customers who wish to opt-in for the services of another bank, versus those who wish to continue with their current bank.

As is evident, HDFC Bank, ICICI Bank, and other private banks are at the top-3 positions where either their customers wish to continue their services or wish to start their banking relationships.

- Most respondents, at 20 or 18.9%, with other banks wish to opt-in the banking services from HDFC Bank. ICICI Bank and “Other private banks” come second with 16 each (15.1% each).

- The only PSB to make it to the top-5 list is the SBI with 10.4% of the respondents wishing to opt-in to its services.

- Citi Bank and Axis Bank are tied at number five with 9 or 8.5% opt-ins for each of them.

- The top-5 banks account could corner 81 or more than 75% of all respondents who wish to opt-out of their current banker’s services.

- ICICI Bank ranks at the top with the most number of customers who wish to continue with their current banks. It has 7 out of 18 or 38.9% such customers. It is followed by the HDFC Bank with 4 or 22.2% of customers willing to continue.

Conclusion

Banking today is no more an evil necessity where the customer had no choice and therefore would continue with the same banks for years. Today banking is about relationships, trust, and effective use of technology.

If your staff, especially relationship managers, can be a little more responsive, well-equipped, and the bank itself starts offering personalized services such as goal-based financial planning, they can attract HNI customers like NRIs.

If they do not, then such customers can take most of their accounts and new business to any other bank of their choice in no time. the customer is the king, especially those who earn in Dollars, Euros, Dinars, and Dirhams.

Most NRIs are not getting Financial Planning advice from their banks. But all successful investing is Goal Focused & Planning Driven.

If you agree – let’s talk about YOUR Goals & Plan

Hope you agree with the survey findings of Best Bank for NRIs in India – please share in the comment section why you prefer your bank over other options.

NRE account in RBL , is it good ?

Hi AVsr,

The suitability of an NRE account with RBL Bank, or any other bank, depends on your specific financial needs and preferences.

I’m moving to India and I need advice as to how to open an account before I leave to go.

Hi Hiten,

It is advisable to approach a bank or a bank manager to get better details of the project.

Hemant ji, namaste.

Thank you for your service to the NRI community.

I need a suggestion for a good bank where I plan to have a max balance of 1,50,000 INR in both NRE and NRO accounts. I need a debit card that would work in Indian petrol bunks and a few other places.

Decent customer service, internet banking, and debit card. I do not care too much for the interest rates for the deposits as much.

thank you

Hi Ravichandra Kaushika,

There are several bank ptions available to cater your needs. However, it depends on your personal preferences regarding opening a bank account. Hence it is recommended to contact a bank/bank manager or refer to you financial planner for the same.

Asha ji,

Thank you for the advice. I was able to talk to the customer support managers at ICICI Plano, TX and was able to open a remote option joint account with them.

I am in uae and i want an nri account which can give credit card alao

Hi,

You can open an NRI account with various Indian banks that offer credit cards like HDFC, ICICI, Axis and Kotak etc.

How can i open account

Hi Seema,

As an NRI, you can open a bank account in India by visiting the nearest branch of the bank you wish to open an account with and submitting the required documents. The documents you will need to submit may vary depending on the bank and the type of account you wish to open.

In general, you will need to provide proof of your identity, such as a passport or Aadhaar card, and proof of your address, such as a utility bill or bank statement. You may also be required to provide proof of your income, such as salary slips or tax returns.

It is important to note that NRIs are not allowed to open certain types of bank accounts, such as a savings account, unless they are able to provide a local contact in India who can act as a reference.

It is advisable to check with the bank you wish to open an account with to determine the specific documents and requirements for opening an account as an NRI.

I want Open nri acc in India

Hi Nandani,

Consult with your bank.

Which bank is good to open NRE account

Hi Raj

Kotak, ICICI, and HDFC are good options.

Which bank is better for nri account for home loan

Hi Vijin

Kotak, ICICI, and HDFC are good options.

Iam an NRI at Scotland looking for renewal of Indian passport within Glasgow Scotland ,how much is the fee n what documents needed n which form to b filled n where to submit ? Can we submit online application by online ?

have recently migrated to Australia ,most of my investments in India through HDFC bank, but no branch here, except for SBI,should I change banks as SBI has local presence??

Hi Bharat,

You don’t need to change your bank. As you can do all the things online.

Which bank has best facilities for NRE acct

Hi Garun,

Kotak, ICICI, and HDFC are good options.

Benefits of nri account in icici

Hi Santhosh,

Please consult with ICICI bank.

Which bank has multi ATM service for money withdraw for NRI customer

Hi Manish,

Every bank has multi ATM service.

Best bank for opening nre and nro account

Hi Subrato,

You can go with ICICI,HDFC or Kotak.

Best bank of nri

Hi Balamurugan,

You can try with Hdfc or ICICI or Kotak.

what is charges for remitance

Hi Kavita,

The taxable value is 1% for transfers up to ₹1 lakh, 0.5% plus ₹1,000 on transfers from ₹1 lakh to ₹10 lakh and 0.1% plus ₹5,500 on transfers above ₹10 lakh, capped at ₹60,000. For example, if you are transferring ₹25 lakh, the taxable value will be ₹5,500+0.1% of ( ₹25 lakh- ₹10 lakh). This comes to ₹7,000. The GST is then levied at 18% on ₹7,000 which comes to ₹1,260. So, let’s assume that the bank charged a commission of ₹500 (with GST of 18%) and spread of ₹1 lakh. Adding up the commission, spread and GST, you will end up paying ₹1,01,850 as charges in your transaction of ₹25 lakh

I live in NZ,and would like to open a bank account in India,as I have inheritance money of 45 lahk due to me.Can I transfer that money to my NZ bank account

Hi Thirglal,

Yes, You can get the money transferred in ti your NRO Account.

Which bank is good for nri account

If I sale my home in india and want to deposit that money in india after paying all my tax obligations can I withdraw money in us currency in USA?

Hi Shashi,

Yes.

I want to know about NRI Account

Hi Nikanth,

An NRI Account refers to the accounts opened by a Non-Resident Indian (NRI) or a Person of Indian Origin (PIO) with a bank to provide various services.

Here are the types of NRI Accounts that you can opt for, to meet your financial requirements:

1.Non-Resident External (NRE) Accounts

2.Non-Resident Ordinary (NRO) Accounts

3.Foreign Currency Non-Resident (FCNR) Accounts

Hi, which Bank have higher interest NRE account

Which is the best bank to open NrE account…???

Can I open a demat account being an NRI staying in Bangladesh ?

Being an NRI you can go for Portfolio Investment Service Account.

Hi Hemant, I do have accounts in some of the banks you’ve mentioned here. I wish to opt in from a bank to another. However, I have an endowment insurance plan purchase through them, and I am waiting till its due date in 2026. Secondly i have some MF funds purchased. Is there a way I could opt-in without selling in advanced (MF and Insurance plan)? E.g. changing broker name (bank details) with AMC’s? Could you please share some light on how I could do this?

Hi Rajiv Ji,

You can change your bank anytime without selling anything.

I am regular reader of your article. my question it is required physically available at your office or in india to start taking your services for financial planning

All statistics will be representative if they are also classified as per type of Countries eg US/Canada or UK or EU as the results would significantly differ ..Would appreciate your tabulting the results as per country types and presenting..