For anyone, retirement planning poses many dilemmas. These exacerbate when it comes to retirement planning for NRIs.

The reasons can be grouped into two categories – one that affects everyone, and the ones that are specific to NRIs. Let us consider both.

Must Check – Retirement planning for NRIs

Common Retirement Dilemmas

What is retirement?

Retirement – in the simplest manner means that you have given close to 30 to 40 years to your work, and now with growing age, you can no longer function as efficiently as you could earlier. This is a natural progression as age catches with you.

For some people – including yours truly – retirement means when one does not have to work for money, but only for pleasure. For such people, retirement may come earlier than most.

When is the right time to retire?

Is it the right time to retire when you cross a specific age barrier or is it when you cannot find a new job? Should one retire at all, or should one continue to work in some capacity till the mind and the body allow?

Where do you retire?

Should you retire in the city where you spent most of your working life, or to your hometown or village? What life adjustments would be required for that?

Check – Best Places To Retire In India

How long would be your retirement?

On the first of a month, you may not leave your home for the office – as you did for last many decades – but do you stop living! Retirement only means a break from work life (for most people it is the 9-5 routine) not from life itself. There are now more people living in their 90s and even 100s – thanks to better healthcare.

What would be your post-retirement lifestyle?

Would you confine yourself to your home or would you meet with friends, relatives, and would like to travel a lot? Given a chance, everyone would like the latter. It means less income but more expenses.

How much is enough to retire?

This question would have different answers for different people. Even for the same person, the answer would be different from time to time – depending on their financial, and more importantly mental, state. For example, a young person in her 30s may say she would need at least Rs. 5 crores to retire at 50. But when she reaches 45, she may change it to 10 or even 15 crores because of changed circumstances.

How do NRIs retire rich In India?

This is something that we all are trying to find. Isn’t it?

Retirement Dilemma of Non-Resident Indians

The dilemma of NRIs is over and above the ones stated above. The most important confusion as to whether to retire in the country of work or India? The lifestyle of most developed economies is far superior compared to that in India, but they lack the support group of family and friends.

The education & career opportunities and healthcare facilities are also ahead of most Indian cities. But so is expenditure and cost of living. A middle-class NRI couple – say in the USA or UAE – can retire as among the top 1% in India simply because the cost of living is low, and you also get the benefit of the exchange rate.

For example, looking from the PPP point of view, the value of 1 USD is not INR 74.31 but only 20.65 according to the PPP (latest data for 2017). It means you can buy almost 4x more stuff in INR than in USD – though the price differential on some luxury and imported goods would be much less due to high duties.

Must Read – How much is enough to retire?

How to Retire Rich and Why Time Is Money When it Comes to Retirement Planning?

Now let us turn our focus on the one question that was left untouched earlier.

Your future depends on your present – state, habits, behavior, and actions. Your future also depends on you treat money and how do you wish to live. Expecting too many things, beyond your means, after retirement can be a perpetual source of resentment – today and then.

But you can change this if you only have one thing on your side – TIME.

No doubt earnings, spending, savings, and investment habits matter. No doubt that asset class and their risk/reward category matter. And no doubt that luck – not losing money, surviving emergencies, and striking gold with some investment – also shapes your financial destiny.

But with time on your side, you can minimize the vagaries and volatility in most of your investments and come out with a decent corpus at the time of retirement.

Must Read – Why Should NRIs Save For Early Retirement

When you have time:

You earn more over time.

If you are not struck by misfortune repeatedly, then over time your income would grow. Salary appraisals, job switch, growth in business income, consultancy work, investment income, heritage, sale of property, and many more reasons would contribute to it. This simply gives you an advantage that no rate of return can beat

You can save more and invest more.

When you are young, you have less income, but also most likely fewer responsibilities. Parents are still earning and healthy, you are unmarried or newly married with no child. You can easily switch jobs and cities and become upwardly mobile. If only you can save first, and spend later, you can save more and invest more over a long period.

With regular investments, you benefit from compounding.

When you regularly invest, you earn income from not only your principals but also from the income from those principals. This is compounding 101. When you let compounding work for you for a long time, it can work wonders. That is why Albert Einstein called it the world’s eighth wonder!

Volatile assets like equity get a long runway and can outperform even your wildest dreams.

Equity is considered the most volatile asset class – we do not consider crypto a reliable asset class, so will not go there. Even with equity, if you remain invested in good quality mutual funds or stocks for the long run, then you can see the volatility disappearing and the curve taking the shape of an upward slope.

Must Read – NRIs should consider before buying a gadget abroad

Data Don’t Lie

Here are some examples that will show you how “Time in the Market” matters more than “Timing the Market” (by the market we mean any financial asset like bank deposits, G-Sec, Bonds, or Equity). We are not considering the impact of taxation and inflation here to keep the examples simple.

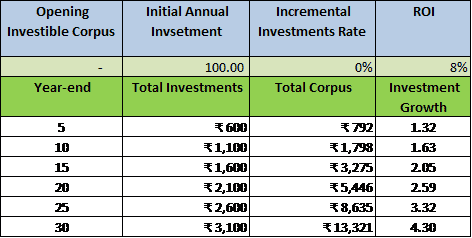

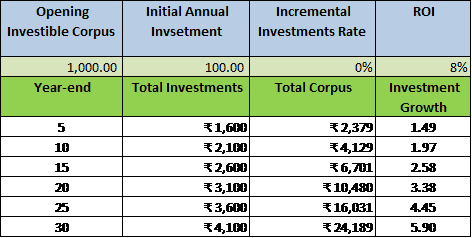

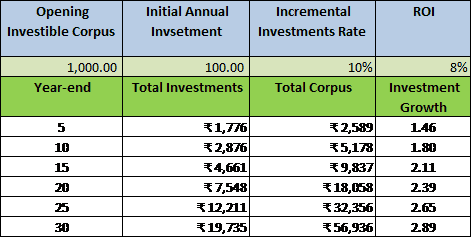

These examples take the long-term Roi at 8% that is a tad above the inflation rate to give you positive returns. If you adjust the expectations to more realistic returns above 10% up to 15% – then the results can be amazing. The examples presented here are categorized into the following classes:

- Starting from Zero vs. Starting with a corpus

- Same regular investments vs. increasing investments

Rs. 100 annual investment @ 8% – No initial Investment, No incremental investment

Rs. 100 annual investment @ 8% – Rs. 1000 initial Investment, No incremental investment

Rs. 100 annual investment @ 8% – Rs. 1000 initial Investment, Incremental investment @ 10% p.a.

As it is apparent from the above examples, with long-term investments, the real gains are reaped at the tail-end of the investment period.

As the world’s most famous investor Warren Buffet says, “Our Favorite Holding Period Is Forever.” There is a pot of gold waiting for you to reveal, only if you have the tenacity to continue the journey through its ups and downs.

If you are looking for proper retirement planning to live the life you deserve – TALK TO US

Hope now you have a good idea of why TIME is important for Retirement Planning by NRI. If you have any questions – add them in the comment section.

how many years i can keep the NRI Deposit under RNOR status