India today is one of the world’s fastest-growing economies. Financial services, IT, pharmaceuticals, auto, FMCG, engineering, and many more sectors have attracted investors – foreign and Indian alike.

A growing industry is supported by competent and affordable human capital, a conducive policy environment, and increasing connectivity in the country. The country’s consumption demand is the cherry on top!

Must Read- NRI Checklist

NRI (non-resident Indians) and foreign investors can invest and start their businesses under FEMA regulations (Foreign Exchange Management Act Regulations, 1999). The government is continuously working to make India a preferred investment destination for NRIs and foreign nationals.

Due to our improved “Ease of Doing Business” rankings, we are one of the top countries in the world to attract FDI investments.

A large part of these investments come from NRIs who have linkages here. The foreign nationals and companies who are amazed by the entrepreneurial skills of the NRIs also wish to tap into this talent pool early.

So, here are a few important things you must remember if you are about to register a company in India.

Identify the Right Sector

We have come a long way since the heydays of License-Permit Raj. After the 1991 economic liberalization reforms, today most of the sectors are open for NRIs and foreign nationals to invest in.

However, there are certain sectors where the share of the foreign capital is capped or they need prior approval from the RBI and/or Concerned Ministry for investing. Also, there are some sectors where investment by NRIs and foreign nationals is restricted.

Check the Invest India website for a comprehensive list of sectoral caps and restrictions.

Types of Companies NRIs and Foreign Nationals can Register in India

Sole proprietorship, partnership, and one-person company structures are not allowed for NRI and foreign investors. However, The Companies Act 2013 provides for the setting of the following types of companies:

- Limited Liability Partnership (LLP)

- Private limited Company

- Public Limited Company

Must Read- NRI Investment Options in India

Prerequisites to Establish a Company in India for NRI

The NRIs and foreign nationals should make sure that the following requirements are met before they proceed with registering their business:

- Partners, Shareholders, and Directors

The LLP structure allows for a minimum of two partners and one of them must be a Resident Indian (RI). There must be at least two Designated Partners (same as a company director).

In the case of a Private limited company, the minimum number of shareholders is two, while the maximum is 200. They are required to have at least two boards of directors.

Finally, a public limited company can be formed with at least seven shareholders with no upper limit. It must have at least seven directors on its board.

As Incorporated bodies can also invest as partners or shareholders, they can nominate a person as their representative as either a designated partner or director on the board.

- Workplace Address

Before applying for incorporation, the proposed company/LLP must have a physical address and presence in India. While submitting the incorporation application, the office address proof must be provided, such as a sale deed or rental agreement.

In the case of a leased office space, the NOC (No Objection Certificate) from the owner of the premises must be submitted.

- Investment approvals

FDI in an LLP requires prior approval from the Reserve Bank of India. for a private limited or a public limited company, the approvals are required only in cases where it is specifically required. In most sectors and up to certain limits the FDI into companies is via the automatic route.

Required Documents for Indian Company Registration for NRIs

The following documents must be submitted by NRIs or foreign nationals while applying for registering their company in India:

- Tax Identificati0on Number

- For foreign nationals as per their country

- PAN card of Indian citizen partners/shareholders – NRIs and RIs, all

- Passport

- Valid Visa:

- From the country of residence for NRIs

- From Indian Embassy for foreign nationals (if they would visit here)

- A certificate stating your NRI status.

- Indian Address Proof (for NRIs and RIs):

- Utility bill or bank statement (not older than two months), driver’s license, Aadhaar card, Voter ID

- Foreign Address Proof (for NRIs and foreign nationals):

- Utility bill, employer’s certificate, or bank statement (not older than two months), driver’s license – duly attested by the local Indian High Commission and notarized by a public notary.

- For nominees of incorporated bodies:

- Certificate of incorporation

- Tax information number

- Certificate nominating the member as a director/designated partner

- Shareholding pattern or partnership agreement:

- Authorized and Paid-up capital

- Shareholding percentage

- Bank statements of partners or shareholders/directors.

In case of documents being submitted by foreign nationals or nominees of foreign incorporated bodies, the Consulate of the Foreign Embassy in India must attest the documents.

Must Read – NRIs Contribution to The Indian Economy

Process of NRIs Starting a Business in India

The process for NRIs and foreign nationals to register an Indian company is comparable to the process for Indian shareholders/partners, and directors. Here is how it works:

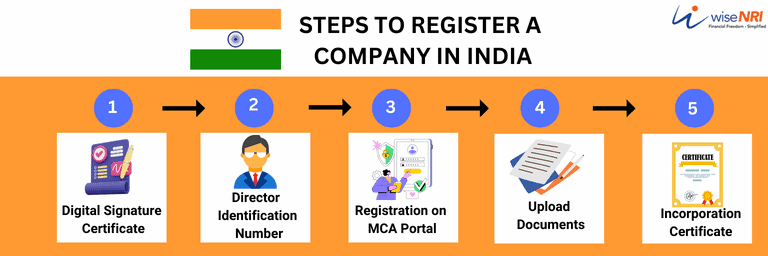

- Apply and obtain for Digital Signature Certificate (DSC) for all directors and designated partners on the Ministry of Corporate Affairs (MCA) website.

- Obtain a Director Identification Number (DIN) or Designated Partner Identification Number from MCA. The DIN and DPIN have similar roles and similar application processes.

- Fill necessary applications and forms on the MCA website for registering your Indian company.

- Upload all the necessary documents, including the e-MoA (Memorandum of Association) and e-AoA (Articles of Association) for a company or Registered Partnership Deed for an LLP.

After reviewing the application and supporting documentation, the Registrar of Companies will issue the incorporation certificate.

Role of Advisor and Associated Costs to Register a Company in India

The role of an advisor cannot be underrated in the situation when you are in a different country and possibly at a different timezone. The advisor and their team can obtain many of the documents on your behalf, file applications for DSC, DIN/DPIN, and incorporation open a bank account for the business, and even help you hire the staff to kickstart the operations.

The cost of registration for a company or an LLP by NRIs or foreign nationals in India is dependent on multiple factors:

- Number of shareholders and partners

- The number of documents that need to be applied for and obtained.

- The complexity of business and organizational structure

- Additional services required – like leasing an office, opening a business bank account, etc.

- The reputation and experience of the advisors also have an impact on overall charges.

The fee, charges, and taxes applicable are to be borne by the investors and can be capitalized in the books of the newly incorporated business.

In any case, if you hire a consultant located in your country of residence, then their charges would be much higher (sometimes up to 5x) compared to the price charged by an India-based advisor.

In Conclusion,

India is a fantastic destination to launch a new business as the coming decades belong to her. The size and scale of opportunities that one can today find and create here with high returns are enviable. There has never been a better time for NRIs and foreign nationals to register their company in India.

I am an NRI; can I open a company in India?

Need guidance for setting up company by NRI !!!!

Provide advisory regarding setup a new company in India as an NRI.

I am working outside India and want to start small startup in India. What are the options.

As a nri can i open the company in India?

If an NRI want to inverst in india what are the tax they have to bear, how much they can invest initially, how long is the government processing time on these formalities.

As a foreigner can I own export import company in india

I want to know the process of opening a private limited company in INdia as NRI. I have got virtual office but the address they have mentioned is my India’s address. Is that fine?

I need more details on NRI investment in real estate as fractional investment, crowd pool or AIF

NRI India me Company kholne ka prosis

I need to start a trading company online, what should I do?

Can a NrI start a sole proprietorship in India

I read that “In the case of a Private limited company, the minimum number of shareholders is two, while the maximum is 200. ” so question is is it necessary that in this case one of share holders must be a resident Indian ?

Can i submit my nro bank statement as a proof while registering pvt. Ltd. Co.

we are four friends – two resident Indians and two NRIs. Four of us together wish to start up something in partnership (consultancy firm). Is it possible?