Public Provident Fund (PPF) is a savings and investment scheme. It is offered by the Government of India. It is considered a safe investment avenue as it is guaranteed by the Government and the interest rate is reasonable.

Must Check – NRI Investment Options in India

Features Of PPF account

The key features are –

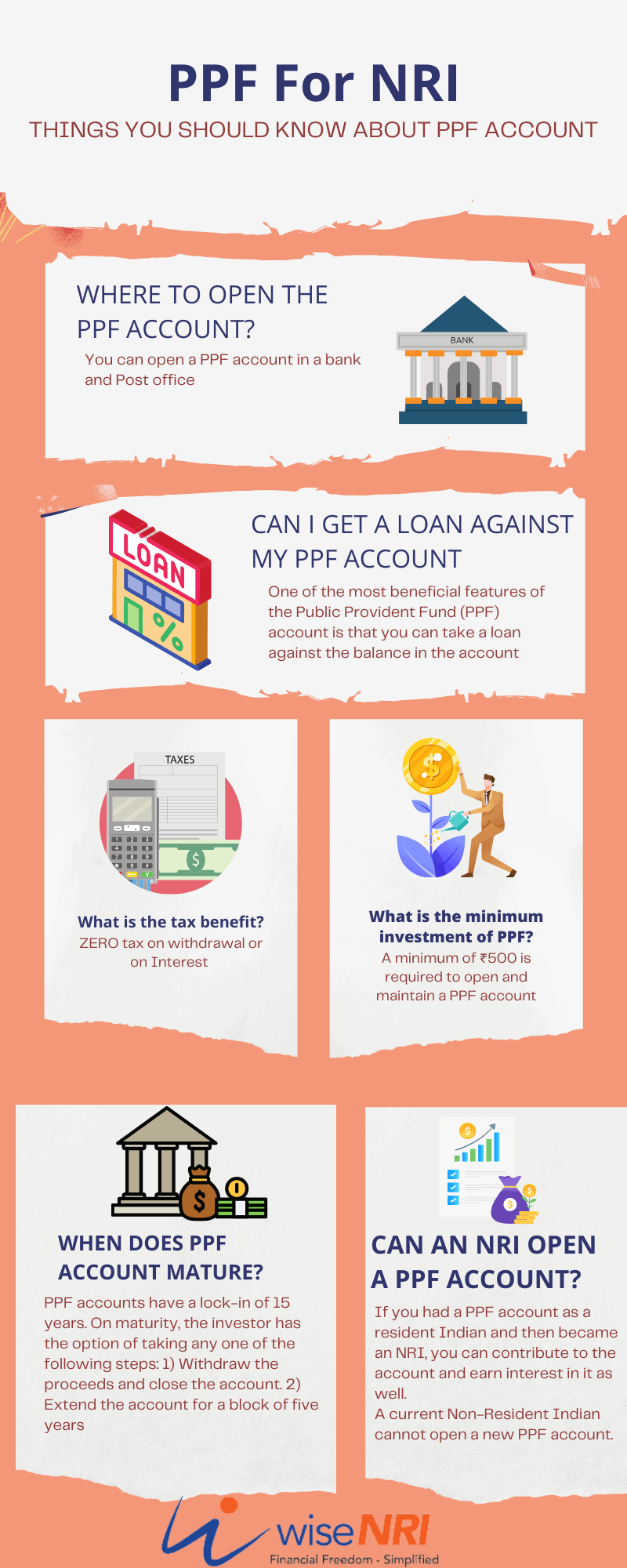

- A minimum of ₹500 is required to open and maintain a PPF account

- A maximum of ₹ 1,50,000 can be deposited per financial year

- The amount can deposit as a lump sum amount or in 12 installments (need not be once a month)

The interest rate is decided by the Government of India. Here is a look at the interest for the last 4 quarters

| Time Period | Interest Rate |

| October – December 2021 | 7.1 % |

| July – September 2021 | 7.1 % |

| April – June 2021 | 7.1 % |

| January – March 2021 | 7.1 % |

Must Read – NRI Investments in Commercial Property

Advantages of PPF investments

- It offers reasonable returns.

- It is a good instrument for long-term savings.

- It is easy to open and maintain an account.

- Annual PPF contributions qualify for tax deduction under Section 80C of income tax. You can avail of the deduction for investment up to ₹ 1,50,000. You can contribute to the PPF accounts of your spouse and your children to avail of tax deductions.

- You can avail of a loan facility subject to certain conditions. It is available from the 3rd financial year up to the 6th financial year from the date of account opening. For example, if you opened a PPF account in January 2018, you can avail of a loan from April 2019 onwards. You can take a loan till the financial year -> 2023-24. Only one loan can be taken at one time.

- Withdrawal of money is tax-free.

- You have the facility of partial withdrawal after 6 years of opening the account.

Must Read – Investment Restrictions for NRIs In India

Disadvantages of PPF investments

- Interest rate is fixed so returns are fixed, unlike equity-based products.

- If the minimum contribution is not made, the account is made inactive. You will have to give a written request and pay a fine.

- It is not the best option if you want liquidity in your investments.

- There is a limit on the maximum amount that you can invest so the corpus is limited to that extent.

- You cannot have joint accounts in PPF unless you open an account in the name of a minor.

PPF FOR NRI

The rules regarding PPF accounts for NRIs have changed multiple times. Here are the current rules applicable –

- If you had a PPF account as a resident Indian and then became an NRI, you can contribute to the account and earn interest in it as well.

- A current Non-Resident Indian cannot open a new PPF account.

- The amount invested qualifies for deduction up to under Section 80C.

- The interest earned is tax-free.

- Renewal of the PPF account is possible within 1 year of the full maturity date in case the account is not kept active be making deposits yearly. (unfortunately, NRIs cannot extend PPF)

- NRIs can also take loans and make partial withdrawals.

Evaluate your investment goals, your risk capacity, and risk tolerance levels before determining if you want to invest in PPF and the extent of investment.

Updated Regulations on PPFs and NSCs for NRIs

The rules regarding investments are different in some cases for NRIs and Resident Indians. Let us look at the regulations on PPFs and NSCs which are widely used as investment tools.

Opening of Account

If you are an NRI –

- You cannot open a PPF account.

- You cannot invest in National Savings Certificates

Residency Status Change

Rules Regarding PPF Account For NRI

If you become an NRI after opening a PPF account, the rules are different. They have also changed.

On October 3, 2017, the notification from the DEA mentioned that if a resident who has a PPF account becomes an NRI before the maturity of the account, the account shall be deemed to be closed from the day he becomes a non-resident.

But this has been CHANGED now which is a relief. As per a notice on Feb 23, 2018, the earlier notice is in abeyance. NRIs who currently hold a PPF account can continue with it until maturity. They will get the interest rate applicable to PPF accounts. They cannot extend the accounts post maturity, unlike residents who can extend the account for blocks of 5 years infinitely.

Rules Regarding NSC for NRI

If you become an NRI and you have existing investments in National Saving Certificates (NSC), you will not earn the same rate. Under the new rules issued by the government in the notification issued in 2017, these investments will be deemed to be closed on the day the investor becomes an NRI. The investor will be paid interest at the much lower post office savings account rate at 4% p.a and will not be eligible for the prevalent interest rate for NSCs

Must Read – A Few Hatke NRI Investment Rules in India

Effect on NRI investments

PPF and NSC are popular investment avenues. They offer good interest rates and are low-risk investments. They are ideal for growing your investment corpus as you get the benefit of regular investments, safe investment, and compounding effects.

It is good that the 2017 notice on PPF has been revoked and NRIs can continue to earn the regular interest rate on it.

The closure of NSCs for NRIs and the low-interest rate applicable now is detrimental to their investment plans.

If you are an NRI and an existing investor, you should consider alternatives to NSCs. You should also consider alternative instruments for growing your investments as you cannot extend your PPF account.

If you do not have investments in NSCs and PPFs, but think you will go abroad for earning income for a long time, it is better to invest some amount now in PPF. It should not be a large amount as there are many amendments in this investment avenue and the government might change the rules again that might be detrimental to your financial plans. You should obviously not invest in NSCs.Alternatives that can be considered.

Alternatives to NSCs and PPFs.

You cannot stop investments. You need to make your wealth grow and make your money work for you. Therefore you can consider other investment avenues such as –

- FDs in NRE accounts – Low-risk investment with tax-free interest earnings. The interest rate ranges from 4.90% -to 7.75%

- FDs in FCNR Accounts – Low-risk investment with interest earnings that is exempt from tax (except for RNOR)

- Mutual Funds – You can invest in a range of mutual funds that invest in different asset classes. You get the potential benefits of diversification, professional management, and good returns.

- NPS – You can invest in National Pension Scheme (NPS). You have the option to choose how your investment has to be distributed across asset classes. But there are rules regarding withdrawal and taxation. So invest only if you are okay with these rules.

How to Close a PPF account –

- Complete the PPF withdrawal form (Form C)

- Keep your KYC Documents (like a copy of ID & address proof, canceled cheque, etc.,) ready.

- Draft an authorization letter stating that you are allowing a person to submit the withdrawal forms on your behalf in case you are not able to close it in person.

- Visit the bank where you have an NRE/NRO account. Get all the documents attested by the bank official or by a gazette officer.

- Visit the PSU bank where your account is present for PPF withdrawal. You can get the money transferred to your NRE/NRO account as well.

How to Close an NSC Account –

Submit the NSC Certificates, NSC form (for withdrawal), identity slips issued during the issue of NSC, and other ID proofs to the post office. If you submit these at the post office where you purchased them, it is easier. Else, there will be some verification process which will take some time. If the issuing post office and post office from where you are withdrawing are connected via the CBS network, the verification process is smooth. If not, then you will have to wait for the post offices to communicate and clarify the same. This takes between one and three months. Moreover, if the identity slip is not there, it will take even longer as they will first verify the genuineness of the claim.

As an NRI, do make sure that you are updated on the latest changes in regulations related to personal finance so that you do not get into any legal or tax issues.

Hope this post answers many common queries… If you still have any specific questions regarding PPF for NRIs – add them in the comment section.

Hello Hemant, Hope you are well I am Sachin and currently live in London. I seek your advice to deal with ICICI Bank. The bank manager misinformed me and based on that I closed my PPF account and the bank deducted my money and not returning it. The bank has not provided reference of the policy or the calculations of how the bank reached to the amount. I am talking to them since April 2023 but no resolution. Could you advise me on this matter? I want to understand where to escalate and what option I have? Thanks!

Do you help with PF withdrawal?

What happens to my PF amount when I become nri?

I’m resident Indian as of now with investment in SCSS account (Senior Citizens Savings Scheme).Soon I’m going abroad for work for a period 3-4 years.Can I continue with my SCSS investment after my resident status changes to NRI?Kindly advise. Thanks.

Interest on EPF after a person becomes an NRI and stops contributing

We have three PPF accounts when our kids were studding in India and now all are NRI and un able to visit. We approached concern Post Office and submitted Authority letters, but they insists to present owner of account. After 15 years of tenure we have closed account. How to proceed and which notification is available to show the authority. Pl. guide us.

In case of change of his residency status, an account holder shall also be allowed to close his ppf a/c with provisos that five years must should have elapsed from the end of the year in which the a/c was opened and also that in the event of such premature closure, interest in the a/c shall be allowed at a rate which shall be lower by one per cent than the rate at which interest has been credited in the a/c from time to time since the date of opening of the a/c,or the date of extension of the a/c, as the case may be.

Could you please explain tax for NRE FD Interest. Is there any cap for total interest to be exempt from tax? In case, if the total NRE FD interest exceeds 2,50,000 in a year, do I need to file ITR?