You are living the NRI life, making your mark abroad and earning money in a strong foreign currency. But are you unknowingly leaving money on the table?

While the benefits of being an NRI are often discussed, it is equally important to be aware of the potential hidden financial costs involved that could silently erode your hard-earned wealth. Read on to uncover these hidden costs and, more importantly, how to avoid them:

Must Check – Five Financial Tips for NRI

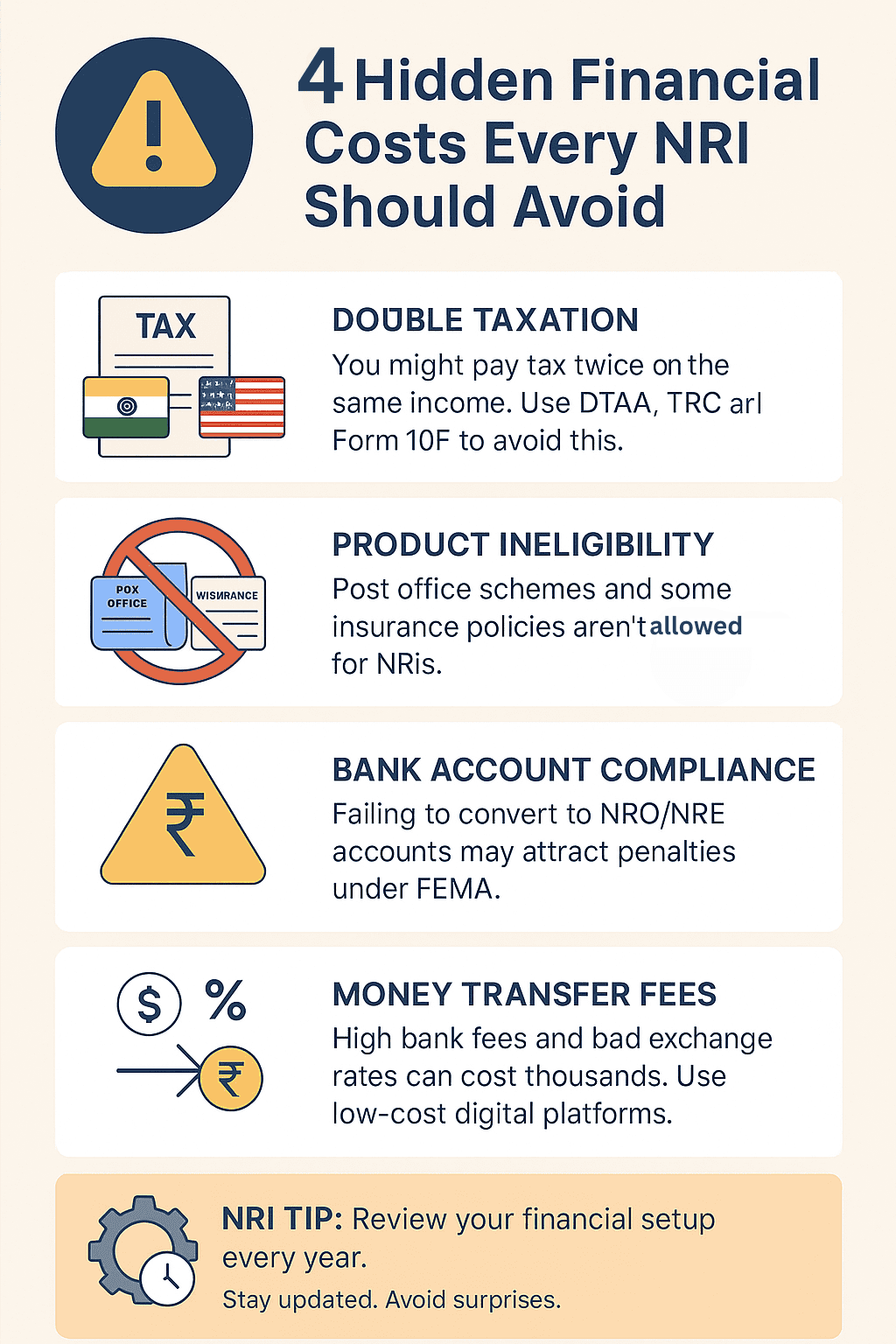

Double Taxation: Are You Paying More Than You Should?

NRI can Claim credit against taxes paid in the USA. For instance, if she has paid US$ 200 in taxes in India on her rental income, she can use this amount to reduce her US tax liability. Furthermore, she can claim depreciation as a deduction on the US tax return, even if it is not available in India. She can further reduce her taxable income in the USA if the interest paid on the housing is more than the rent. She can show it as a loss that can be offset against other sources of income. This loss can even be carried forward to offset future rental income or even other income in the future. The tax paid on dividends and interest received in India can also be used to claim a tax credit in the country of residence, provided DTAA has been signed between India and the country of residence.

To avoid paying more tax, check if DTAA exists between India and your country of residence and get documentation such as a Tax Residency Certificate (TRC) from the country in which you are a resident. Submit Form 10F to the Indian tax authorities, specifying eligibility for DTAA benefits, and other self-declaration and supporting documents to banks or financial institutions for reduced TDS rates. If you are claiming exemption in the country of residence, check and comply with regulations and documentation requirements.

Product Eligibility: Are You Investing in the Wrong Places?

Not all investment avenues in India remain open to you once your residency status changes to that of an NRI. Holding onto products designed for Resident Indians can lead to penalties or other strict actions due to non-compliance with FEMA regulations or RBI (Reserve Bank of India) guidelines.

Before investing in any product in India, verify if its allowed for NRIs. Always ask for the product documentation from the salesperson, bank relationship manager, agent, etc. to confirm its NRI eligibility For instance, NRIs are typically restricted from investing in Post Office Savings Schemes and opening new Sukanya Samriddhi Yojana accounts for their daughters. Certain insurance policies may be designed for Resident Indians only. If you invested in certain products as a Resident Indian and then became an NRI, it is your duty to inform the relevant institutions. Work with a financial advisor on restructuring your investment portfolio when your residency status changes.

Must Read – NRI Checklist

Bank Account Residency Rules: Avoid These Penalties

FEMA regulations mandate that Non-Resident Indians to close all their resident savings/current accounts or convert them to NRO accounts. Failing to do so can result in

- A fine of up to three times the amount in your bank account

- A fine of ₹2,00,000 if the amount is not quantifiable

- A penalty of ₹5,000 per day from the first day of non-compliance till the penalty is paid

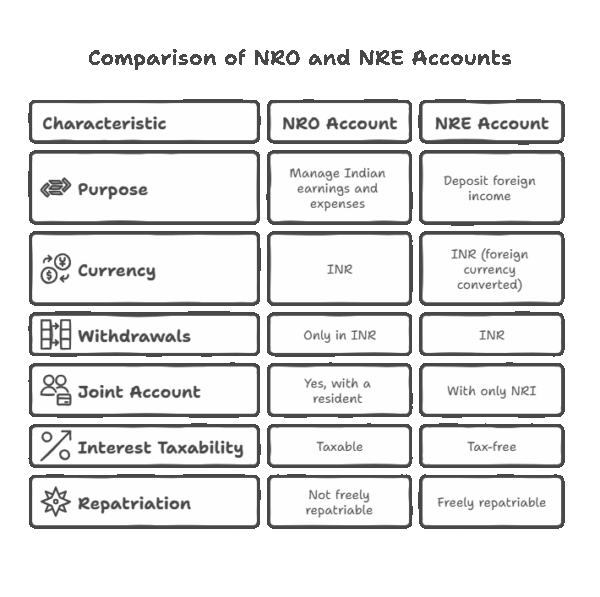

You can open an NRO account to manage earnings and expenses in India and deposit foreign income. However, note that withdrawals are possible only in INR. It can also be opened as a joint account with a resident. For instance, if your loved ones have a medical emergency, they can access this account for expenses, which will save you from the hassles of sending money from abroad, converting funds, etc.

You can open an NRE account which is an Indian rupee-denominated account. It can be used for foreign currency deposits (converted to INR) as long as the money is earned outside India. It will come with an international debit card allowing you to transact and withdraw money 24×7. Interest earned on an NRE account is tax-free and the amount is freely repatriable (transferable to foreign country).

Money Transfers: The Hidden Charges NRIs Forget

When Rishabh, a new NRI working in the Netherlands, urgently needed to send money to his parents in India due to a medical emergency, he learned the hard way that international money transfers are neither straightforward nor cheap. He had to transfer money from abroad because he did not have enough money in his NRO account in India. This came at a price, and the transfer was not as quick as he had wanted.

Sending money from abroad comes with a range of hidden fees and complexities. Traditional banking channels like telegraphic transfers and foreign currency demand drafts take up to 72 hours to process. Banks charge wire transfer fees ranging from US$20 to US$75 per transaction. Add to that service charges, GST, and other transaction costs, and the expenses start stacking up quickly.

Must Check – How can NRIs manage debt?

Then there’s the exchange rate. Banks may not offer favorable exchange rates. While the market rate was ₹96 per Euro, Rishabh’s bank offered ₹95. While the difference is just one rupee, it amounts to ₹1 difference means that on a €5,000 transfer, he lost ₹5,000. If he had planned his finances better, the money would have gone to his family.

To avoid such losses, NRIs should keep funds in the NRO account in India that loved ones can access. They should compare services, check the exchange rate, avoid frequent small transfers, and negotiate with their bank for favourable exchange rates. Digital platforms are becoming increasingly popular for their transparency and competitive rates. Take time to research these platforms, compare fees and rates, and try a few test transfers to ensure that you can transfer as needed when it matters most.

In some cases, instant UPI transfers linked to international mobile numbers—though availability is still limited to select countries and banks are also possible. Check if it is available for your bank and your country of residence. If available, set up the feature in advance and perform a few trial transfers to familiarise yourself with the process and avoid delays during urgent situations.

As an NRI, your focus would be on building a life abroad. At the same time, wisely managing your financial ties in India is equally important. Hidden costs, regulatory oversights, and outdated financial products can quietly chip away at your wealth. Stay informed, review your financial setup regularly, and don’t hesitate to seek professional advice when needed. With awareness, careful planning, and timely action, you can avoid costly mistakes and make the best use of your hard-earned money.

I know this list of Hidden costs for NRIs can be longer – please add few more in the comment section.