Some people might benefit from relocating abroad. When residing and working in some of the world’s most developed countries, an NRI may make their living in foreign currency. A sizable amount is invested in Indian stock due to the sizeable NRI community that exists throughout the world.

To invest in Indian companies that are listed on the stock market, NRIs must have a trading account. As per the current regulations, NRIs trades are permissible only in the F&O segment and for delivery settlement in equities. Therefore, NRIs cannot do intraday trading, STBT trading, BTST trading, and even short selling. Also, NRIs are prohibited from trading in commodities and currency derivatives.

Must Read- Can NRIs Invest in Indian Stocks Market?

The trading services provided by Indian brokers have been made appealing and trustworthy. Despite the market’s volatility, the long-term prosperity of the country is drawing a lot of investors.

Indian stockbrokers are also courting NRIs with alluring options like Zero AMC NRI Demat Account, 2-in-1 NRI Trading Account, and NRI Discount Brokerage Plans. For example, an NRI 2-in-1 account combines a trading account with an NRI Demat account.

Note: we don’t suggest trading to any of our clients.. according to me “trading is the most expensive hobby a man can have”.

Need for NRI Trading Account in India

In India, unlike in the USA and many other countries, the SEBI follows a Depository model and not a Custodian model. In the latter, the broker acts as the custodian for the shares of the clients directly and is responsible for their safety. Whereas, in India, the responsibility is borne by a Depository (either CDSL or NSDL) who is appointed by the broker for the safekeeping of the shares.

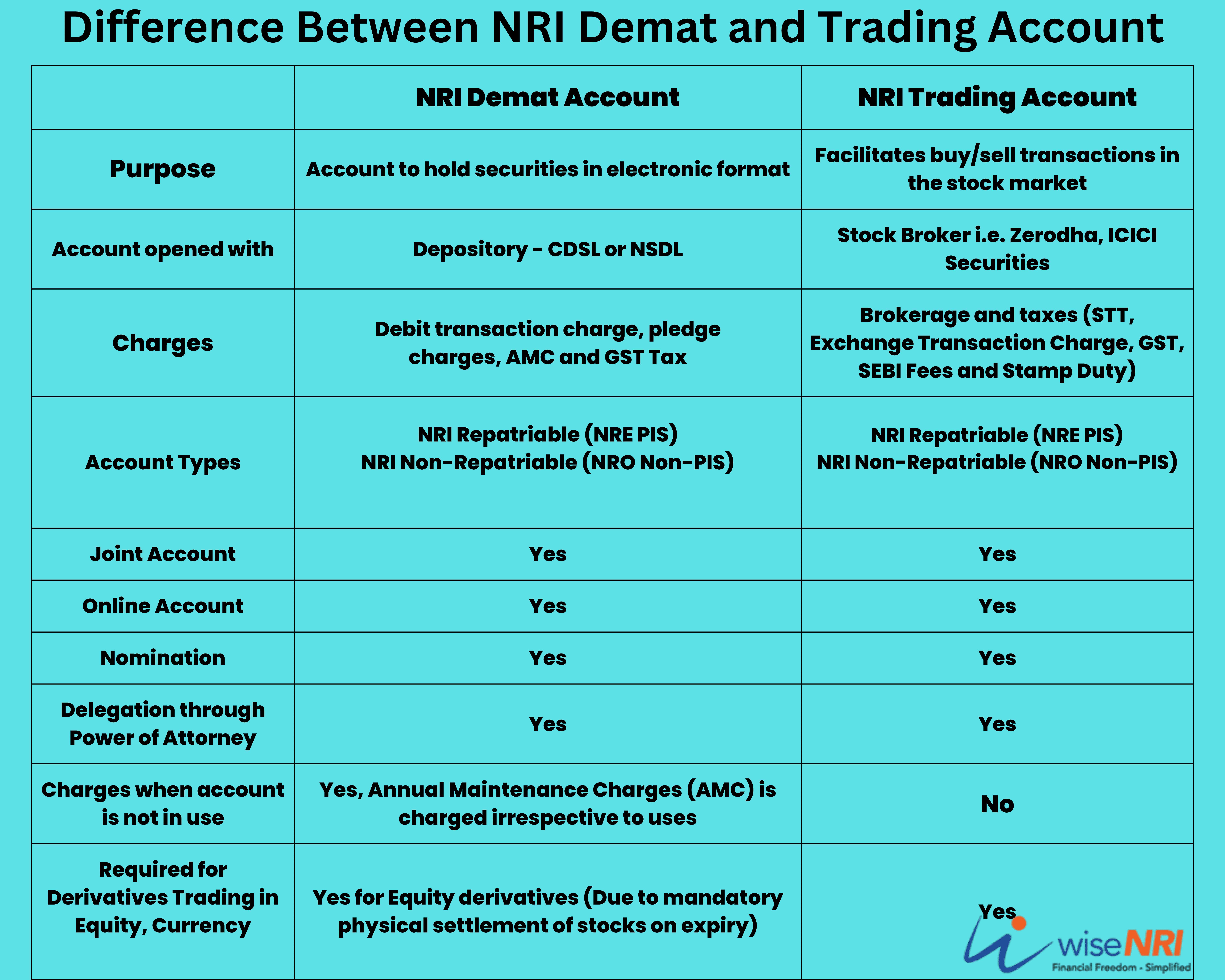

Therefore, in the case of share trading and investing through secondary markets, one must have an NRI trading account in addition to a Demat account for NRI. A Demat account is one maintained by the Depository where the securities are held in dematerialized form. A trading account, on the other hand, allows the account holder to trade listed shares, ETFs, bonds, and other securities.

An NRI trading account, therefore, is a type of investment account that enables Non-Resident Indians to trade and invest in mutual funds, ETFs, IPOs, bonds, and direct stocks listed on Indian stock exchanges.

This trading account serves as the pivot or the hub for all stock market-related transactions that take place between an NRI bank account, a Demat account, stock exchanges, and the NRI investor. It also makes it possible to trade in stocks and futures & options (F&O) online [Though, although we are strictly against participating in the speculative nature of the trading in general and the F&O segment in particular].

Before applying for an NRI Demat account and NRI trading account (or a 2-in-1 account), NRIs must first open an NRE or NRO savings account with an Indian bank.

Must Read- NRE vs NRO Accounts

NRI Bank Account

The monies to fund your trading account must come from a bank account opened with a commercial bank in India. you can open a new account or use your older account converted into an NRI bank account.

Based upon the repatriation of the funds in the account they can be either an NRE [Non-Resident External or repatriable] or an NRO [Non-Resident Ordinary or non-repatriable] account. Both these accounts are denominated in INR and do not allow transactions in foreign currency.

The difference is that in the case of an NRE account they can deposit their incomes earned abroad and can take them out at any time without any limits. While, in the case of an NRO account, they can deposit the income earned in India and cannot directly take out the funds to a foreign country without prior permission from the RBI.

Why NRI should have an NRI Demat Account and NRI Trading Accounts?

To invest in Indian stocks, you must have a Demat account. Through this Demat account, one can also invest in mutual funds, ETFs, and convertible debentures. The securities are kept in electronic form in the NRI Demat account and are maintained by one of the depositories.

NRIs – and now PIO (Persons of Indian Origin) & OCI (Overseas Citizens of India) cardholders – can open a Demat account with any of the SEBI registered stockbrokers. As these Demat accounts are linked to the respective NRE or NRO bank accounts they are popularly known as NRI Demat accounts.

Demat account for NRI is comparable to the regular Demat accounts held by Resident Indians (RIs) when it comes to opening an account, transacting using them, and the fees. However, in the case of the NRE accounts (repatriable), there are some additional requirements that we discuss shortly.

There is a third category of trading accounts called the Portfolio Investment Scheme or the PIS accounts that require permission from the RBI through the banking channel partners of the stockbroker.

Let’s look at all the accounts briefly.

Must Check – Portfolio Investment Scheme for NRI in India

NRO Demat and Trading Accounts

A Demat account linked to an NRO bank account is known as an NRO Demat account. You can invest the money earned in India (through business operations, interest, dividends, and rental income) in the Indian stock markets through this account. An NRO Demat account is linked to the NRO trading account and is used to transact in securities on the stock exchanges.

The funds in the NRO bank account are not fully repatriable and only up to one million USD can be sent overseas every fiscal. This too can be sent after paying taxes to the Indian Government on the income earned in India.

NRE Demat and Trading Accounts

When an NRE bank account is linked to a Demat and a trading account, they are called NRE Demat and NRE Trading accounts, respectively. You can deposit your income earned abroad in the NRE bank account and use that trade in securities on the Indian stock exchanges. The funds earned after receiving the dividend/income or sale of securities are fully repatriable and can be transferred outside in entirety.

Portfolio Investment Scheme (PIS) Accounts

The PIS accounts require explicit permission from the Reserve Bank of India through one of the partner banks of the stockbroker. Most of the SEBI registered brokers allow the facility of opening a PIS account for their NRI clients. A PIS account allows you to use the funds from both the NRO and NRE bank accounts for investing in Indian securities.

The following are some of the salient features of the PIS account:

- A separate NRE PIS savings bank account is required for repatriable investments. The operations in this account are exclusively for stock market operations and hence no chequebook is issued.

- Any transfer and withdrawal from a PIS account are done with the prior approval of DPS.

- The permitted transactions under the PIS are:

- Trading in equity shares and convertible debentures on secondary markets.

- Receiving and trading in shares acquired due to a split in the equity shares.

- The list of excluded transactions is much longer. A PIS account holder cannot:

- Apply in IPOs

- Receive bonus shares

- Participate in Rights issues

- Do intraday trading, BTST (Buy Today Sell Tomorrow), or short selling

- Become eligible for and trade in ESOPs

- Acquire shares by converting ADRs/GDRs

- Acquire shares under Direct Investment Schemes

- Purchase shares outside India from other NRIs

- Invest in Mutual Funds

- Participate in Insurance liked investment products

- The NRI account holder must give exclusive trade orders to the broker, which will in turn present the contract note to the bank. The bank will then make/receive payment for the transactions based on the authorization received.

- The banks must issue a daily statement of transactions to their NRI customers for which extra charges are applicable. They must also mandatorily report to the RBI about the transactions in each PIS account daily.

- On the sale of investments, capital gains tax, if applicable, is deducted by the bank for which they charge a fee and issue a TDS certificate. The effective TDS rate (including the surcharge) is as follows:

- On Short Term Capital Gains (STCG) @ 15.6% for securities held less than 1 year.

- On Long Term Capital Gain (LTCG) @ 10.4% for other securities.

- The global RBI restrictions related to the maximum foreign and NRI shareholding in a company are applicable and the banks must ensure their compliance. If a share has hit the upper limit of maximum foreign shareholding, then no new purchases from the NRI PIS accounts will be allowed in that stock.

- If your status changes from NRI to RI, then you must inform your bank and open a separate Demat and trading account. You cannot operate the PIS account as an RI.

Differences between a PIS and non-PIS accounts for NRIs

| Points of Difference | PIS Account | Non-PIS Account |

| Purpose of the Account | Only to trade in (buy or sell) equity shares through secondary markets. Cannot participate in primary markets (IPOs) and other forms of investments. | Can be used to buy/ sell equities, mutual funds, and F&O in secondary as well as primary markets. |

| Compliance Burden | All secondary market transactions are reported to the RBI by the bank on a daily basis. | Only flagged transactions and transactions beyond permissible limits need to be reported to the RBI. |

| Charges | Because of increased compliance, the charges are usually higher. | The charges and fees are much lower. |

| Repatriation of Funds | All funds are fully repatriable. | Funds in the NRO bank account are non-repatriable, while those in the NRE account are fully repatriable. |

| Joint Holding | Not allowed. | Allowed. |

| Restrictions on investments | RBI’s global restrictions on maximum foreign and NRI shareholding in a company are applicable. If the stock you wish to invest in has already hit this ceiling, no new NRI PIS purchases would be allowed in that stock. | No such restrictions are applicable. |

| Linked Bank Account Type | Only NRE savings account. | Could be either an NRE or an NRO savings account. |

| Other Uses of the Linked Bank Account | PIS accounts cannot be used for any other purposes – like making bill payments or local purchases. | Non-PIS accounts can be used by the NRI client for any purpose they wish like a regular bank account for investments, insurance, bill payments, funds transfer, property investments, and much more. |

Conclusion

In comparison to a PIS account, a non-PIS account offers much more benefits with significantly lower charges. They have fewer restrictions, lesser compliance, and most importantly a more convenient investing experience.

Please leave your questions regarding the NRI trading account or PIS in the comment section. You can also share the best trading account that you are aware of.

I like to open a nri account for trading in icici

can nri trade on questrade

Best trading platform for NRI

Pis account is must for NRIs to buy Mutual Funds in India

Can NRI close Trading Account and keep Demat account for for BONDS and securities for long term investment made before becoming NRI. No trading on stock exchange.

Can NRIs based in North America now do direct trading online, as it wasn’t permitted until few years ago

Can I open non pis Demat account ?