NRIs are not very familiar with Portfolio Investment Scheme or What is PIS account? So we have tried to reply to all possible questions regarding the PIS scheme in this post…

Check – Best investment options for NRIs in India

When an Indian becomes an NRI, this domestic bank, Demat, and trading accounts are to be closed or status to be changed if allowed.

So how do NRIs participate in the Indian market? How do they invest in stocks and bonds?

NRIs can use the Portfolio Investment Scheme by RBI. Read on to know everything about PIS –

What is Portfolio Investment Scheme For NRI In India?

Portfolio Investment Scheme (PIS) is an account that can be opened by NRIs to buy and sell shares, debentures, and bonds issued by PSUs in the Indian stock market. NRIs can apply for IPOs through the PIS as well. It is a scheme initiated by RBI.

Is a Portfolio investment account mandatory for NRI?

Yes, NRIs can invest in equity by opening a PIS account that is associated with an NRE or NRO account. In the case of NRE where funds come from outside India & can easily be repatriated – RBI wants banks to track & report all these transactions.

Why Do NRIs Need a PIS Account?

NRIs who want to earn good returns from investments in the Indian stock market are advised to open a PIS account offered by the RBI. The only catch for buying and selling Indian company stocks and convertible debentures is that you must operate through a registered broker in the recognized stock exchange. NRIs are authorized to trade freely, barring intra-day transactions.

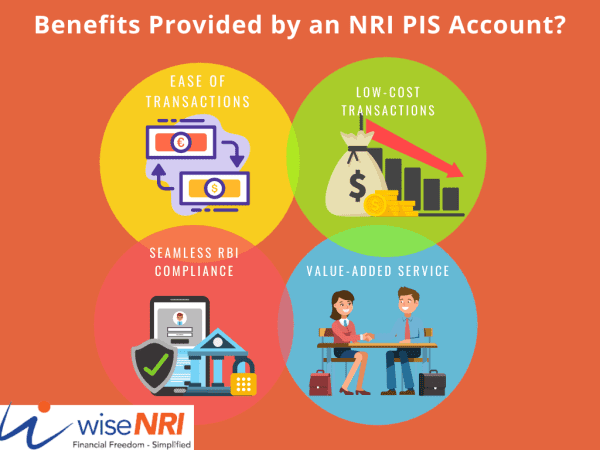

NRIs get the following benefits with an NRI PIS account:

- Invest in Indian stock

- Freely buy and sell stock and repatriate

- Easy transaction

- User-Friendly operations

Must Read: Investment restrictions for NRIs In India

What are the Eligibility Criteria to Open a PIS Account?

NRI and PIO are eligible to avail of the PIS scheme according to the RBI guidelines.

NRIs cannot open a PIS account, if

-

A resident is traveling abroad for medical treatment

-

Residents traveling abroad on short trips

-

Bangladesh and Pakistan residents without prior RBI permission

-

Nepal and Bhutan residents

- Mariners employed by Indian shipping companies

What are the documents required for a PIS account?

Usually, the requirements for a PIS are :

- Identity Proof documentation.

- Overseas Address Proof documentation.

- Valid Visa.

- PAN Card.

- Photographs of the investor.

- PIS Permission letter.

- Form for the opening of an account.

- Approval letter from the designated bank where the PIS is opened.

- Some banks require a minimum amount to be in the PIS account.

There are some changes that have to be paid to open a PIS like account maintenance charges and Approval fees.

How Do I Open a PIS account for NRI?

The NRI has to apply to a designated branch of a bank, that deals in Portfolio Investment. All transactions will be routed through this branch.

The NRI will need an NRO or NRE savings and an NRI PIS account to manage his transactions.

The NRE Savings Account is for investments made out of money repatriated. The NRO account is for investments to be made on a non-repatriation basis.

Submit the PIS application form to the bank with the requisite information and documentation to open the PIS and Demat account.

How do I use the PIS account?

Once the account is set up and connected to the NRE/NRO savings accounts, you will get your login credentials. You can buy and sell shares, debentures, and bonds. Payment can be made through inward remittance of foreign exchange/funds in the NRE account for purchase on a repatriation basis or through the NRO account for purchase on a non-repatriable basis. On sale, the amount can be credited to the NRE/NRO accounts if the sale is on a repatriable basis. If the sale is on a non-repatriable basis, the sale proceeds can be only credited to the NRO account.

Also Read: HSBC Report Review

Can NRI open Multiple Portfolio Investment accounts?

No, RBI allows only one PIS account for NRI. If you want to open a new account, you have to close the existing one.

Permitted Credits/ Debits in NRE Portfolio Investment account?

Credits

- Inward remittances in foreign exchange though normal banking channels;

- Transfer from the NRI’s other NRE or FCNR (B) accounts maintained with Authorised Dealer in India;

- Net sale proceeds (after payment of applicable taxes) of shares / convertible preference shares /convertible debentures /warrants/ units acquired on repatriation basis under the Scheme and sold on stock exchange through registered broker; and

- Dividend or income earned on investment made on repatriation basis under the Scheme

Debits

- Outward remittances of dividend or income earned;

- Amounts paid on account of purchase of shares /convertible preference shares/ convertible debentures /warrants/ units on repatriation basis on stock exchanges through registered broker under the Scheme; and

- Any charges on account of sale / purchase of securities or units under the Scheme.

- Remittances outside India or transfer to NRE / FCNR (B) accounts of the accounts holder of the NRI or any other person eligible to maintain such account.

Source RBI

Are there any restrictions for the PIS account?

It is important to know the rules of operating the PIS. There are certain restrictions:

- It cannot be used for day trading. Delivery of instruments is compulsory.

- Short selling is not allowed in the PIS account for NRI.

- For both repatriation and non-repatriation stocks, an NRI can invest only up to 5% of the paid-up capital/paid-up value. The ceiling can be extended to 24% with special permission is acquired wherein t, if the General Body of the Indian company passes a special resolution to that effect.

- RBI regularly monitors the data and can put an embargo on your bank account if you exceed prescribed limits.

- NRIs can invest in futures and options of stocks based on certain conditions.

Can it be a joint account?

No, the joint holder is not allowed in the case of PIS.

Can NRI do intraday trading?

No, NRIs are not allowed trading. They can buy stocks & sell only after they got delivery in their accounts.

Must Check – NRI Real Estate Investments Outside India – Pros & Cons

Do I require a PIS account for Mutual Funds?

No, you don’t need it for mutual funds. Many people think that a Demat account is required for Mutual Fund investments – actually, even in the case of online purchase, it’s not required.

A PIS investment account is not required if NRI is selling the stocks which he purchased when he was resident in India.

Some List of Banks in India who offer PIS account for NRI

- ICICI Bank.

- SBI Bank.

- Deutsche Bank.

- Bank of Baroda.

- Federal Bank.

- South Indian Bank.

- HDFC Bank.

- Kotak Mahindra Bank.

It is important to have a diversified portfolio of investments. India’s growth story is intact and it might be in your interest to make wise investment decisions.

Investment matters are more so if you are an NRI. But managing them is not impossible.

If you have any questions on the portfolio investment scheme for NRIs – please add them in the comment section.

NRI can sell/ buy thru BSE/NSE using your DMat service provider..

Can nri sell there shares themselves as they do in residence account

Hello Rajiv,

No NRIs cannot sell shares like resident Indians, they must use a Portfolio Investment Scheme account for stock trading sales of shares bought as a resident can be done through a normal Demat account but taxation rules differ.

Can an NRI Day trade?

Hi Sreejan,

No NRIs cannot do day trading in India under RBI’s Portfolio Investment Scheme they can only trade in delivery-based transactions means they must take actual ownership of shares instead of buying and selling on the same day.

I am an NRI in Dubai and have hdfc pis account and HDFC NRE account. should I first transfer the money to HDFC NRE account and then from hdfc nre account to hddfc nre pis account. Can i not directly transfer from any of the exchange house in Dubai directly to hdfc nre pis account

I am a NRI, a US citizen, holding physical shares. I want to sell these shares. I want to bring the proceeds from sale to USA. What type of accounts (NRE, NRO, Demat, PINS) i need to open

Hi Bhagwat,

To sell your physical shares, you would need to convert them into electronic form by opening a Demat account in India. This account will hold your shares in electronic format.

Me and my mrs havr jt nre Rs checking Ac in city bank and demate ac is link iam trying to get pis letter as i want to sale the share through broker india iam not getting any response

Hey Sureshchandra,

If you are not receiving a response for the PIS letter from Citibank, try reaching out to their customer service or NRI banking support through phone or email. Alternatively, visit your local Citibank branch in person to inquire about the status of your request and expedite the process.

How to invest in mutual funds without PIS account?

Hey Jay,

As an NRI, you can invest in mutual funds in India without a PIS (Portfolio Investment Scheme) account by using the NRE (Non-Resident External) or NRO (Non-Resident Ordinary) bank accounts. You can choose direct plans or invest through an authorized mutual fund distributor. Ensure that the chosen mutual fund is eligible for NRI investment, and comply with all the necessary regulatory requirements.

Sir/Madame, I have been investing in ELSS, Flexicap, Multicap funds etc using Kuvera.in and a NRO Bank account. Apart from Kuvera there are many others who provide services to NRIs. I have also invested in Mutual Funds thru ICICI bank using my Non-PINS account. To invest with Kuvera, I had to open an account with KYC details. For ICICI Bank Mutual Fund investments, I have used Non-Pins account and relevant DMat account.

Hi Sir, I would like to use NRO account to invest in Indian stock markets. then in the future when I sell those stocks, Can I repatriate both the capital investment amount and gains from sold Stocks to My foreign bank account?

Hey Mohsmed,

Yes, as an NRI, you can repatriate both the capital investment amount and gains from selling stocks in India to your foreign bank account. However, you have to check out the guidelines given by RBI.

I am working in Qatar. Is it mandatory to open PIS account for investing in Mutual funds?

Hey Rajil Raja,

No, it is not mandatory to open PIS account for investing in Mutual funds.

Hi, I am an NRI who had bought shares in Reliance Ind. from UK in 1988 with RBI permission and are repatriable. They are in paper form. I have recently opened a PIS account with HDFC bank. Can I Demat them in PIS trading account?

Sir, If you have paid the money from NRE account, You can credit the shares to PIS Trading account. You need to complete DRF and give it to HDFC Bank Securities division.

How to get pis extension letter from Axis bank?

What the bank do when they issue pis extension letter?

Hi, I am an NRI who had bought shares in Reliance Ind. from UK in 1988 with RBI permission and are repatriable. They are in paper form. I have recently opened a PIS account with HDFC bank. Can I Demat them in PIS trading account?

If you have evidence of buying from foreign currency, you should be able to DMat in NRE PIS account.

Hi I have some shares which I purchased while I was living in India. I want to sell the shares for which I have to get them dematerialized. The problem is in opening a Demat account. Do I need PIS Registration number? Thanks

Hello Hemlata,

No.

For the shares you have bought when you were in India, you need to open a Non-PIS DMat account and get them Dematerialised.

If I want to buy Sec 54 EC bond issued by REC, will I need to use my PIS demat account or non PIS demat account?

Hi Ranz,

You can use the Non-PIS Demat account.

I am and NRI living in US. I want to invest in smallcase. How can i open a bank account and demat account for that

hello Kishna

Firstly, you select the account type as ‘repatriable Demat account’ or ‘non-repatriable Demat account’ based on their choice. They can open a Demat account either online or offline.

What is the income tax implication on NRI PIS account transactions?

Hi Jatin,

For credit on NRE PIS account, the TDS will be 0%. However, your transaction will be recorded by the PIS cell.

Thanks, but my question was about the income tax application, not the TDS obligation.

Whether there will be a capital gains tax on PIS profits? And, what will be a capital gains tax on Non-PIS profits & losses? How is this being calculated? As I presume there is the separate treatment for NRIs and that too for PIS and Non-PIS investments.

Can there be LOA from more than one broker for a PIS account

Hi Durga,

No. As per the RBI guidelines, an NRI can have one and only one Portfolio Investment Scheme (PIS) linked bank account.

hi Hemant, how long does it take for the PIS account approval to come ?

Do we get ready access to all shares on the exchange OR do we get blocked while purchasing online as the RBI caps per company has been reached?

Hi NJLF,

It will take a maximum of 1 month to get the approval.

I’m with HDFC and I applied in person in April’22 and got the PIS letter only now, in Oct’22.

Can a NR customer with PIS account do a BTST transaction

It takes a day to get the share listed in your account.

I have 2 pis nre account what should i do as i was informed lately that i can have only 1 pis account

If these two accounts are with the same service provider, you can ask them to merge the two accounts.

If me an nri wants to do a gift deed of an immovable property, do i need to be physically present in india to do the gift deed.

Hi Raghu,

As per my knowledge yes.

I have shares in NRO PINS account. Can i transfer that to my NRE PINS account

Hi Karthik

No

Can a NRI, NRO non PIS Account be joint?

Can I invest in the stock market with an NRE account?

Hi Ranjeet, You can invest in Indian Stocks with NRE as well as NRO account with the help of a DMat trading account linked to NRE or NRO account. Please approach a service provider to open DMAT account.

I am an NRI and want to open a Demat account, I have NRO/NRE account in India. I have OCI and am canadian citizen.

Hi Rahul,

You can open a PMS account but not a DMAT account

Hi Rahul, You can open a DMat account linked to NRO or NRE account. Investments made under NRO -linked DMat account cannot be repatriated. Investments made in NRE-Linked DMat account can be repatriated. Please contact Bank which provide DMAT account service for this. There are few service providers in India who provide banking services for NRI and few also provide ShareBroking services.

We have an NRO DMAT account. My broker is trying to link to a Non PIS NRO account. Is that possible. There is no repatriation needed.

As per my knowledge you cannot do so.

Hi, It is possible to link Non-PINS account and PINS account to same trading account. All shares bought before becoming NRI are in Non-PINS account. All shares bought after becoming NRI will be stored in PINS account.

Hi Vishwanath, The DMat account you have opened when you have invested being a Resident Indian are in Non PIS NRO account. If you want to Buy shares when you are an NRI, you need to open a PIS DMat account.

Tax liabilities of NRI in portfolio investment schemes

Hii Mr. Anand

Tax liabilities depend on your holding in portfolio investment scheme account whether direct equity,bonds,etc

I’m having some MF holdings with two fund houses which was opened when i was working in India, but now I’m working in abroad & I wish to change my tax status to NRI, what should I do for that?

Hi Chandraprasath,

You have to inform the fund houses regarding the status via email and so.

You will need to inform the status change to CAMS or Karvy with proper evidences.

I am a NRI. I have shares through NRE account. What happens to my holding when return back to india?

You have to convert your PIS account as resident account within a reasonable time, say 3 months after your return back. If you want to convert the balance in foreign currency account, you plan to sell all shares in PIS account and convert the balance in Resident Foreign Currency Account in US Dollar or any other admissible foreign currency if you intend to go abroad again aftger few years or want to finance to your children studies abroad. Consult a CA.

Hi and thanks in advance. I’m an NRI for the past >10 years. I have stocks purchased when I was Resident Indian. These stocks still exist as they were in demat (not closed or sold). I don’t wish to sell the equities I possess in the RI account. Now, I want to open a new PIS account as NRI. That will mean that I could possess an old RI account and a new NRI concurrently. Is that ok ? What options do I have for the RI portfolio… what’s the best way to open PIS demat account if I could let the RI account be dormant as long as I have not returned back to the country.

Hi Tejas,

You can open a PIS account online with Axis bank or HDFC securities or any other broker as per your convinent & after that you can transfer your current holding from RI demat account to new account.

Wrong advice. You cannot transfer your holding in Resident Accout to PIS accout. It is not permitted. As per the latest instructions you can continue your existing resident account and do the transactions as hitherto provided your fund this account out of your NRE or NRO account on non-repatriation basis and inform the Service Provider accordingy.

Additional Info: You can transfer from PINS DMat account to Non-PINS DMat account. But you cannot transfer from Non-PINS DMat account to PINS account.

My parents hold demat accounts and they plan to gift the shares to me. I am a NRi/NRE account holder , how will this process be undertaken, i am in the midst of opening a PIS account.

Hi Fareed,

You just need to transfer the shares in your account but when you will tax show it as a gift. For better understanding consult a CA.

For nri person PIS account is compulsory kindly reply

Hi Sandeep,

No, but if you want to buy shares then it is compulsory.

I have shares of Indian company that I bought from my NRE account. Every year the dividend declared by company was credited directly into my NRE account except in 2020 dividend declared by the company is not credited into my NRE account. My question is do I have to open PIS account to credit that dividend into my NRE account

Hi Thakor

As per Law point, you have to open a PIS account for investment in equities. I would recommend you to talk to your bank or stock broker but you should definitely open a PIS account.

You write to them to credit the dividend to your NRO account giving details.

what is a PIS extension? Zerodha has asked me to get a PIS extension for opening Demat and trading account with them as I already have Demat and trading account with HDFC securities.

Hi Bharat

May be they are asking for a PIS letter which you will receive from HDFC and that you need to submit in Zerodha.

No. They are asking for PIS EXTENSION as I already have one PIS account linked to HDFC securities.

Hi Bharat

As per information provided by Sharekhan, PIS extension is kind of application that you will get from your bank and then need to submit.

Hi.Bharat, I am in same situation. Would like to know if you managed to get the ‘PIS extension letter’ from HDFC bank or HDFC Securities. I wrote to bank guys, they seems to have no clue. Thanks in advance

The PIS extension will be issued by the HDFC Bank and not HDFC securities.

I got the extension from HDFC BANK and mapped the account with Zerodha.

Its a long process but gets done eventually.

Thank you chief. HDFC bank guys are either ignorant OR acting ignorant. The only conclusion I can draw is that they are desperately trying not to loose customers moving to discount brokers.

It is somewhat no objection letter from the existing broker. If you want to transfer the PIS account from HDFC Bank, they HDFC bank will have to issue no objection letter along with all information about submission made to RBI.

How can I use one NRE pis account with two NRE trading accounts with different brokers?

Hi Anthony

Sorry but you can’t use that.

I was told that you can ask the bank with whom you have the PIS account to split the account so it can be used for two trading accounts with different brokers.

The need of two brokers may not be necessary. IN PIS account, deliveryof shares is compulsory. You cannot do trading in shares. Find out from the concerned bank if it is allowed.

Can I have one NRE PIS account and two trading accounts?

Hi Adwin

No, you can’t. Only one is allowed.

Do I have file tax since I am OCI and only rs 70000 long-term gain, Rs 60000 dividends, and Rs 20000 interest income? 20 % TDS is already deducted. I also paid donations of Rs33000 in 2020-21.

Hi Amit

Yes, you must file the Income Tax for the year because your income is below the threshold limit thus you are eligible for the refund.

Long term capital gains you have to pay 10% tax. As a NRI tax deduction on dividend would have been 20.8%. Since your total income is less than Rs.2.5 lakh, if you file incometax return [ITR2)you will get refund of tax paid.

I have an NRE trading account it has been opened for more than 30 years I want to sell all my holdings, do I have to do any special procedure?

Hi Frank

As per my knowledge no special procedure is required.

You can talk to your broker for more clarification.

It is not clear what type of account you are holding. PSI scheme came little later I think. Whatever may be, there is no special procedure to be followed exept that you have to file ITR2 and pay long term/short term capital gain tax. If it is under PIS, the concerned Bank will deduct the tax and issue tax deduction statement showing capital gain tax deducted, etc. Since it is PIS account, the balance in the account is fully repatriable.

Is interest earned on NRE PIS Account taxable or is it Exempt u/s 10(34)?

Hi Visakan

Yes it is taxable as dividend is taxable in the hands of receiver.

Hi Amit

It is not dividend. It is interest earned on the balance lying in NRE PIS a/c. It is similar to the interedt earned on NRE A/c which is tax exempt income.

Since it is NRE account, interest eared in that account is tax free.

Is Interest earned on NRE PIS account taxable or is it exempt u/s 10(34)

Hi Visakan

There is no Interest earned on PIS account.

What he perhaps means that the secondary account maintained with the bank for buying and selling of shares. Since this is Non-Resident External account, the interest earned in the Bank account is tax free.

Can ipo allocated shares in pis nre account be sold on day of listing

Hi Akshay

As per my knowledge Yes as it is already there is your PIS account.

Ensure that the shares are aready credited to your demat account. Once shares are available in demat account, there should not be any restriction for sale of shares. Bank will deduct short term capital gain tax at 15% on the sale proceeds.

I need to open a trading account in Zerodha. For that, they are asking a PIS letter. how to get it…I am having an NRI account with HDFC bank.

Hi Subramaniam,

You should consult with your bank officer regarding this.

You mean you want to transfer your PIS account from HDFC Bank to Zerodha. HDFC Bank has to issue PIS extension letter so that you can transfer your account from HDFC Bank to Zerodha. My advise to you to retain the account with HDFC Securities evethough the brokerage charged by them is slightly high. You yourselves can see how once famous Karvy Broking cheated its client by mortgaging or selling clients share.

How can I transfer my pis account from one broker to another broker? I understand we can hold a pis account with one broker only for NRI?

Hi Kiran,

You should consult with your broker for this.

How NRO non PIS account works?

Can I close PIS NRE account but keep PIS NRO account?

Hi Kanika,

As per my knowledge,There is no need to hold NRO PIS account. You can invest through NRO account as well.

If you remain NRI, you can only buy shares thru NRO PIS account.

If changing Demat account broker, do I need to close PIS account or it can be transferred? If yes, then how?

Hi Kanika,

As per my knowledge you can transfer it to another broker. You can consult with your broker for the procedure.

What is the difference between a NRE PIS account and a NRO PIS account?

Hi Mathew,

As per knowledge the basic difference between NRE And NRO PIS account is the secondary market transaction executed in NRE status will be reported to RBI and hence routed through PIS while the secondary market transactions executed in NRO mode will not be reported to RBI.

Yes. The balance in PIS account is freely repatriable . The balnce in NRO account is repatriable after completing some formalities and payment of tax etc.

How to obtain Permission for PIS extension?

Hi Nandakumar,

For permission, you have to apply for it at your respective bank to that the RBI has authorized to administer the PIS.

When an NRI buys a bond through NRE PIS scheme is the princinpal repaid back in NRE PIS or NRO account?

Hey Manish,

I guess it would be from NRE PIS.

Im an NRI from Singapore and I was able to open my demat account in upstox while I was in India for an 1 month vacation during Jan/Feb this year using my India number that is linked to my Aadhar. My KYC states I am a NRI and my upstox account is liked with my NRO account. I am able to buy stocks via the app and I dont intend to do intraday as I am more towards purchasing and holding my stocks for long term. Am I supposed to realign any of this arrangement, as I later found out that NRI has different restrictions for investment in Indian stock market? Or is it fine to continue with the current arrangement?

How is your experience with Upstox? Is there service good? Trading platform reliable?

If an NRI buys a bond through NRE PIS account …is the principal and interest paid back in NRE or NRO…Also,how can you find which are NRI eligible bonds.

Which banks allow to open PIS now, tried calling Icici and Axis and both are not taking applications to open account.

Hi Pramod,

Try Kotak & HDFC.

You can check with IDFC First bank and open it online. They will issue PIS cert instantly.

Just wondering how long it will take to open pis account.

Hey Kiran,

As per the current situation maybe 20-25 days.

Instant with IDFC First Bank

If the portfolio value of the NRI PIS account is 1 crore or above then does the NRI need to get the same audited?

What is RBI Approval charges for PIS?

Hi.

Under LRS, it is allowed to remit upto USD 2.5lks PA abroad to children by parents for many purposes one on which is As Gift/Donation also.

If children are NRIs n are

already holding NRE account in India, can the same amount of USD 2.50 lks PA as allowed under LRS be transferred directly by parents from their local account into their children’s NRE account through any authorised dealers/banks in India?

Hi Hari,

I don’t think there’s any issue in this.

If I convert my existing NRE account to NRE PIS account, will there be any issues for me to do personal transactions with the account or I should only use the account for Shares purchase/sell??

Hi DJ

As far as I know, you can it can only be use for Shares buy and sell.

Q:Why NRO PIS accounts are prohibited from applying for IPO by a reputed private bank. Any known bank which allows me to invest in IPO with my NRO PIS account?

Thanks

Hi Shripad

IPO can’t be apply from PIS account rather you can use your NRE/NRO account for the same.

Thanks Mr.Kishan. I have started using other NRO account from another bank.