Like any individual, a Non-Resident Indian may need quick access to cash to meet urgent and unforeseen expenses. They may have adequate assets, but not sufficient cash to foot the bill. For example, property, ELSS Mutual Funds, Gold, or their businesses have great valuation but are illiquid.

Must-Read – Home Loan For NRI In India

Common Reasons for taking a personal loan

This need for sudden cash may arise anywhere in India, in your country of residence or work, or when you are travelling. The reasons (some rational, some not so much) may be:

- A health emergency.

- Stolen or lost luggage.

- Children’s educational expenses. (Check – Education Loan for NRI kids)

- A lucrative business opportunity.

- An accident resulting in property loss.

- A dream destination wedding or vacation.

- An impulsive purchase to indulge yourselves or loved ones.

A personal loan is one of the best ways (people think) to fulfill such urgent financial needs. For an expat, it is quite difficult to obtain a loan or an advance in a foreign country. Most banks catering to NRI banking needs, also offer personal loans. Many Non-banking Finance Companies (or NBFCs) also give personal loans to NRIs because of their higher incomes.

NRI Personal Loan Features and Benefits

The personal loan is a “no-strings-attached” credit that you can use anywhere, on anything – to pay bills, pay off another credit, medical expenses, and home renovation.

High Loan Amount

NRI applicants can get personal loans ranging from Rs. 2 lakhs to Rs. 20 lakhs. Some lenders may increase it up to Rs. 25 lakhs depending on your relationship.

Read- Car Loan For NRI In India

Flexible EMIs

You can set up the repayment schedule from 6 months to 60 months according to your convenience.

Attractive Interest Rates

Compared to cash advances from Credit Cards, NRI personal loans offer attractive interest rates. The rate offered is again dependent on the profile and relationship of the applicant.

Quick and Easy Processing

Some innovative banks and NBFCs can process, approve, and disburse loans from their websites or app in just a few hours! Documentation requirements for personal loans have come down to the minimum.

Flexibility in End-Use

NRIs can use personal loans to meet any financial requirements – no questions asked. However, speculating, gambling or other illegal activities are not allowed.

May need a Resident Indian as Co-borrower

NRI personal loans can be taken jointly by an NRI and a Resident Indian (RI) as co-borrowers. In the case of a joint personal loan, both (or all) borrowers need not have separate accounts with the bank and even good individual credit scores. The primary borrower must fulfill all the eligibility conditions.

Complete, Simple, and Easy Communication

The most common pain point in NRI relationships has been a lack of or incomplete communication. (Read our Best NRI Banking Services Survey Report Part 1 here). Many services like EMI alerts, availing moratorium, statements, updating credit limit, and even loan restructuring can be done online in a few taps.

Loan in Currency of Choice

The NRI personal loan can be sanctioned and disbursed in either INR or a foreign currency of your choice. Most lenders offer loans in major currencies including USD, GBP, EUR, AED, HKD, SGD, and SAR. The payment of the loan EMIs and any lump-sum payments would be in the currency of your loan. Some lenders may, however, allow repayment in INR, with or without a fee.

No Collateral

Your credit history, represented by a credit score (like the CIBIL or CRIF score) depends on your past loan repayment behaviour. Additionally, a well-paying job or a business with substantial cashflows are all that you need for loan approval. Some banks or lenders may also approve your loan if you have a substantial term deposit with their banks. In that case, you need not break the deposit but can get a loan against it.

Secured vs. Unsecured NRI Personal Loans

Personal loans are mostly capped at Rs. 20 lakhs. If you need a loan for a higher sum, then you can use your term deposits or other assets as collateral to get a loan beyond this limit. A reputed guarantor can also do the trick.

Must-Read – Issues NRIs Face With Their Banks

Interest Rates

The interest rates and other terms of some of the top lenders are as follows:

| Lender | Minimum Rate | Maximum loan amount (In Rs. Lakhs) | Maximum loan tenure (Months) | Processing Fee | Pre-Closure Charges |

| SBI | 9.60% | 20 | 60 | – | NIL |

| Citibank | 9.99% | 25 | 60 | – | – |

| ICICI Bank | 10.50% | 10 | 36 | Up to 2.25% of the loan amount | 5% of the o/s principal amount |

| Tata Capital | 10.99% | – | 60 | – | – |

| PNB | 11.25% | 20 | 60 | – | NIL |

| South Indian Bank | 11.70% | 25 | 60 | Up to 2% of the loan amount | 4% of the o/s principal (if paid within 12 months) 2% otherwise |

| Bajaj FinServ | 13% | – | 60 | – | – |

| HDFC Bank NRI Overdraft Loan against Deposit | 2% above the Deposit rate | NRE/NRO Deposit – 90% of the deposit amount

FCNR Deposit – 70% of the deposit amount |

Deposit Tenure or 60 months (whichever is less) | – | – |

Eligibility for NRI Personal Loan in India

- You must be a salaried or self-employed applicant with active NRI status.

- For salaried applicants, a minimum employment tenure in the current organization of 6 to 12 months.

- Self-employed applicants need to submit income proof for the past 2 to 3 years with proof of the active status of their business/practice.

- Some lenders insist that the primary borrower be an RI and the NRI can only be a co-applicant.

- The minimum age is 21 years, and the maximum age is 60 (for salaried) or 70 (for self-employed) years.

The above eligibility criteria are generic and not exact. The criteria may differ from lender to lender and case to case.

Check – NRI Credit Card in India

Checklist Before You Apply for NRI Personal loan in India

- Use personal loans for emergency financial requirements and not to splurge.

- The interest rate is higher than secured loans. Therefore, for requirements like home extension or improvement, use a home loan instead.

- Always explore other options – like an advance from your employer or assistance from family.

- The bank with which you have an established relationship generally processes your loan faster.

- If you are taking a loan in the currency of the country you live in, you may save on forex conversion charges but may have to pay an additional processing fee. It may also put you at a disadvantage vis a vis INR loan while paying it back.

- Most lenders require an RI co-applicant who must be a close relative.

- Read the fine print – processing charges, late payment charges, pre-payment charges, and forex conversion charges may apply.

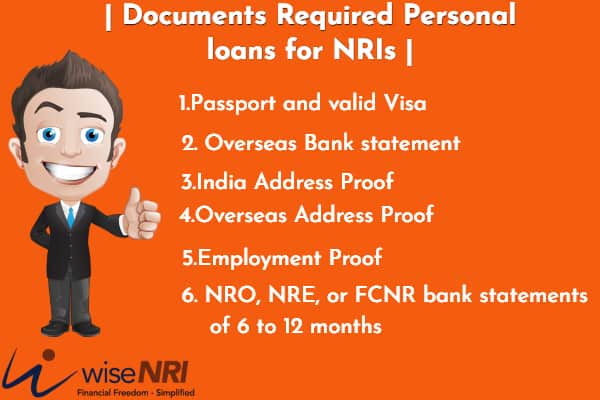

Documents Required

You must keep the following documents (and their soft copies) ready before applying:

- Passport and valid Visa.

- Overseas Bank statement of 6 to 12 months.

- India Address Proof – for both the applicant and the co-applicant) – Aadhaar, Voter ID, Passport.

- Overseas Address Proof – for NRI applicant – Residence Permit, Address Proof Verified by from Indian Consulate/Embassy.

- Employment Proof – Appointment Letter, Your official and HR’s Email ID, Official ID, Current Salary Slips, Active Work Permit.

- NRO, NRE, or FCNR bank statements of 6 to 12 months.

- Valid Power of Attorney in favour of the RI co-applicant.

How to Apply for Personal loans for NRI in India?

To apply for an NRI you can approach the lender through multiple channels:

- Visit the nearest branch of the bank or the NBFC if you are in India. or you can ask a relative to do so.

- If the lender has a branch or business associate in your residence city overseas, you can visit them.

- If you already have a relationship with the lender, ask your relationship manager.

- Visit the lender’s website or app and enter your details in the NRI personal loan application form.

You may also contact your financial advisor in India, who can not only guide you through the need, risks, and benefits of a personal loan, and function as your agent to get you that loan. If you plan to use deposits or other assets as collateral, then your advisor may help you in thinking through the decisions.

Hope this gives you a good idea about NRI personal loans – if you still have any questions feel free to add them in the comment section.

I want to know about the personal loans for NRI.

How do I get NRI loan in Malaysia?

Hello Vinesh,

To get an NRI loan in Malaysia, you must be between 21-60 years, have a stable income, valid employment, and a good credit score. Banks require proof of identity, employment, income, and residence in Malaysia, along with a solid financial history.

I am looking for NRI personal loan in India so please guide me about this.

Nri personal loan process, please

NRIs can get personal loans in India by meeting eligibility criteria, providing required documents and those required documents for NRIs include passport, visa, income proof, employment details, address proof, and photographs, and applying through a bank.

How to apply personal loan for NRI?

Hello Mohammad Naseh Shaikh,

To apply for a personal loan as an NRI, check eligibility criteria such as income, age, and employment status. Gather documents like passport, visa, income proof, bank statements, and credit report. Apply online or through the bank’s NRI branch. Compare offers and ensure timely repayments from your NRE/NRO account.

I need NRi personal loan

I am nri and need personal loan upto 3 lacs

Hi Roshan,

For personal loans, Many banks will require you to have a stable source of income. This can be in the form of a job abroad or any other source of income. You may need to provide proof of your income, such as salary slips, and tax returns. Some banks may require you to have an NRE or NRO account with them.

I am looking for nri loan

Hi Arvinda,

Can you please explain, which type of loan you looking for?

I would like to avail personal loan is there any process to get loan for NRI. I dont have any NRE account

Hi Surya,

Yes, NRI can avail personal loans in India, even if they don’t have an NRE account. However, the process and requirements might differ slightly from those for residents, which depends on the lender.

Hi Surya,

Getting a personal loan as an NRI can be possible, even if you don’t have an NRE account. However, the process may vary depending on the bank or financial institution you choose.

How to get nri personal loan

Hi Ramnas,

As per my knowledge To get an NRI personal loan, you can follow these general steps:

Research and select a bank: Research various banks in India that offer NRI personal loans. Consider factors such as interest rates, loan terms, processing fees, and customer reviews to choose the one that best suits your needs.

Check eligibility criteria: Review the eligibility criteria set by the bank for NRI personal loans. This may include factors such as age, income, employment status, and credit history.

Gather necessary documents: Collect the required documents typically requested for NRI personal loan applications. These may include:

a. Passport: Copy of the passport with a valid visa page.

b. Employment details: Proof of employment, such as employment contract, appointment letter, or work permit.

c. Income proof: Bank statements, salary slips, income tax returns, or any other documents that show a stable source of income.

d. Address proof: Proof of address in the home country and overseas, such as utility bills, rental agreement, or bank statements.

e. Credit history: Credit reports and scores from the country of residence.

f. Other documents: Additional documents as requested by the bank, such as power of attorney, references, or collateral details (if applicable).

Contact the bank: Reach out to the bank of your choice through their customer service channels or visit their website to get detailed information about their NRI personal loan offerings. Inquire about the specific application process, documentation requirements, and any other information you need.

Submit the loan application: Complete the loan application form provided by the bank. Attach the necessary documents as per their requirements. Ensure that all information provided is accurate and complete.

Wait for approval and verification: After submitting the application, the bank will review your documents and assess your eligibility. They may also conduct additional verification procedures.

Loan disbursement: If your loan application is approved, the bank will provide you with the loan agreement and terms. Review the terms and conditions before signing the agreement. Once the agreement is signed, the loan amount will be disbursed to your designated account.

It’s important to note that the specific requirements and processes may vary between banks. It’s advisable to contact the bank directly or visit their website to obtain accurate and up-to-date information on applying for an NRI personal loan.

My self Rakesh I am working in france is there any chance to get personal loan in india I don’t have any account in india currently

Hello Rakesh

Yes, it is possible for you to get a personal loan in India even if you are working in France and do not have an account in India currently. However, there are certain requirements and procedures that you will need to follow to avail of a personal loan in India. Here are a few things to keep in mind:

1.Eligibility Criteria

2.Documents Required

3.Loan Application

4.Loan Disbursement

Do you provide car loan for nri people

Hello Madhav

Yes, banks in India do provide car loans for Non-Resident Indians (NRIs) who wish to purchase a car in India. However, the eligibility criteria, loan amount, and interest rates may vary from bank to bank.

How to get nri loan

Hello Jamshad

If you are an NRI (Non-Resident Indian) looking to get a loan in India, here are some steps you can follow:

1.Check your eligibility

2.Choose the type of loan

3.Gather the required documents

4.Apply for the loan

5.Get the loan approved

It is important to note that the interest rates and other terms and conditions for NRI loans may be different from those for resident Indians. Therefore, it is advisable to compare the different loan options available and choose the one that suits your needs and budget.

I want to apply for NRI personal loan Can i know the full proccess and details

Hello Jagdish

If you are an NRI (Non-Resident Indian) looking to get a loan in India, here are some steps you can follow:

1.Check your eligibility

2.Choose the type of loan

3.Gather the required documents

4.Apply for the loan

5.Get the loan approved

It is important to note that the interest rates and other terms and conditions for NRI loans may be different from those for resident Indians. Therefore, it is advisable to compare the different loan options available and choose the one that suits your needs and budget.

i need a nri personal loan…can you help me with this plz

Is NRI personal loan possible in India ?

Hi Satish,

Yes NRI can avail personal loans in India, subject to the banks policies and eligibility criteria

Hi im working in Australia currently have got working rights and does have salary slips bank statements and wish to apply for loan of at least 50 lakh rupees can i get it

Hi Karan,

Consult with your bank.

sir i want persnol lone in nri account

I do not have a NRI account. Can I get a personal loan?

I want to open NRI account in India?

I want to know more about personal lone because I am NRI

Would like to avail NRI personal loan

IS nri eligible personal loan

Iam Canara bank nri account holder so how much personal loan I’ll get

Hi Manoj,

Please contact your bank for related information.

I would like to know NRI personal loan

I am nri how to get personnel loan

I want nri personal loan

Can nri gift money to nri to an account in india if yes what is the limit

As per my knowledge, you can gift and receive money to nri account in India. Limit and taxation are same as per resident Indians.

I have taken uti mutual fund thru nro 10 years back.10 days back i redeemed they have send the cheque for nro account.but bank people not accepting the cheque to deposit

As per our opinion, bank should accept it but please ask the reason to your bank for the same.

I am from Chennai and an NRI in Dubai for almost 25 years – I have a business for 17 years. Would like to know if I can get a personal loan from any bank in India

Yes, you can opt for personal loan from any bank in India. Please, contact your bank for further information.

Hi I Am Kannan.. I Am Working In Dubai… I Need Personal Loan

Any personal loan for nri

I am working in oman .can i take personal loan

Hi Mahender,

Yes, you can.

I am NRI and like to take a personal loan to pay children education expenses

I have a wise account in india and still use to transfer money to spain for my daughter who lives there and study. I request you to provide me with a fund of 3000 pound as a loan from nri indian

Hi Sheeba,

Kindly contact your Bank.

I am working in dubai since last 9 years. Can i get personal loan here in india?

Hello Bhaumikkumar,

Yes you can, Kindly approach your relationship manager in India or visit bank site.

am a indian.now am working abroad in Europe malta.so how can get a personal loan

Hello Arun,

Please approach your overseas bank or visit your Indian bank website/Personal banker.

I need nri personal loan… How to apply

Hi Abdu,

Please contact your Indian bank/overseas bank/ Financial Advisor/Relatives.

I’m at oman ,i eligibility for apply personal loan from oman?

Please, visit your nearby branch.

I want to apply for personal loan in india for nri what is the process and what documents I need to submit how long it will take to get loan

Hi Farheen,

The criteria may vary from bank to bank and customer to customer. Kindly, contact your RM.

Need personal loan for NRIs

I want personal loan from India.Currently I am residing and working in UAE. How i can avail personal loan?

I need personal loan and i am a NRI

I am looking for personal loan

I would like take 2.5 lakh INR on 18 months tenure from financial institutions from india and I am residing in saudi arabia right now

About Personal loan in India from Singapore

To take a personalLoan

I am working in Bahrain and am looking for a personal loan in India without collateral .I don’t have a mobile number in India.Is there any chance that I can get a loan ?

Hi Sooraj,

According to my knowledge you can take personal loan. Please contact your branch manager for further related queries.

I need parsonal loan fon nri

Personal loam for NRI

nri persoanl loan i wanna apply

NRI personal loan

I need NRI personal loan

Personal Loan

i am looking for personal loan

i am looking for a nri personal loan to receive amount in usd

I am looking for nri personal loan

My son is NRI wants to have a personal loan in india what is needed for tht?

Can I pay the nri personal loan emi by cash?

No, it will be debited in dematerialized form.

I need a personal loan, Currently I am staying in UK , is it possible

yes, you can take personal loan.

nri personal loan

Personal Lone

I’m an NRi and want a personal loan.

Personal loan for NRI